Understanding Bitcoin Basics 🧐

Bitcoin operates on a decentralized digital ledger known as the blockchain, allowing for peer-to-peer transactions without the need for intermediaries like banks. Transactions are verified by network nodes through cryptography, ensuring security and transparency. Each transaction is recorded on a public ledger, visible to all users while maintaining the anonymity of the parties involved. The finite supply of 21 million bitcoins ensures scarcity and value, with each divisible into smaller units called satoshis.

Impact of Aml Regulations on Bitcoin 💼

With the introduction of AML regulations, the Bitcoin landscape in Congo is experiencing a significant shift. Businesses dealing with Bitcoin are now required to adhere to strict Anti-Money Laundering rules, impacting their operational procedures and customer interactions. These regulations serve as a crucial checkpoint in ensuring transparency and accountability within the Bitcoin ecosystem. As businesses navigate through the complexities of compliance, they face challenges in balancing regulatory requirements with the innovative nature of Bitcoin transactions. The impact of AML regulations extends beyond mere compliance; it shapes the future of Bitcoin interactions in Congo and sets the tone for a more secure and regulated environment.

Compliance Challenges for Businesses 🏦

Navigating the Legal Landscape: Bitcoin Aml in Congo

Compliance Challenges for Businesses 🏦

Navigating through the complex web of Anti-Money Laundering (AML) regulations poses a significant challenge for businesses venturing into the world of Bitcoin. The ever-evolving nature of compliance requirements, coupled with the anonymity aspect of cryptocurrency transactions, makes it essential for businesses to stay informed and updated to ensure full adherence to regulatory frameworks.

Legal Implications of Non-compliance ⚖️

Non-compliance with Anti-Money Laundering (AML) regulations regarding Bitcoin transactions can have significant legal consequences. Failure to adhere to these regulatory requirements may result in penalties, fines, and even legal action against businesses or individuals involved. The implications of non-compliance extend beyond financial loss, potentially damaging the reputation and credibility of those violating AML laws. Regulatory authorities are vigilant in enforcing these regulations to maintain the integrity of the financial system and prevent illicit activities. Staying informed and implementing robust AML measures is crucial to avoid the legal pitfalls associated with non-compliance. Stay updated on the latest developments in Bitcoin AML practices to ensure adherence to regulatory standards and mitigate legal risks. You can explore more about how AML regulations impact Bitcoin transactions in Congo on [bitcoin anti-money laundering (aml) regulations in Colombia](https://wikicrypto.news/exploring-the-impact-of-chinas-aml-regulations-on-bitcoin-transactions).

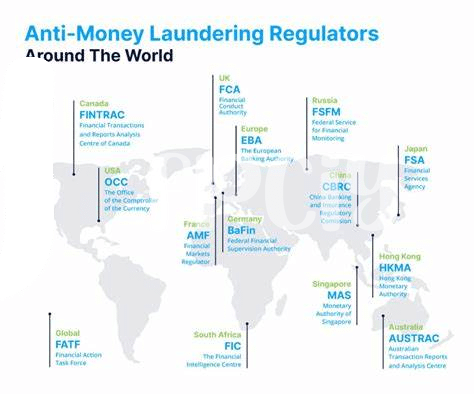

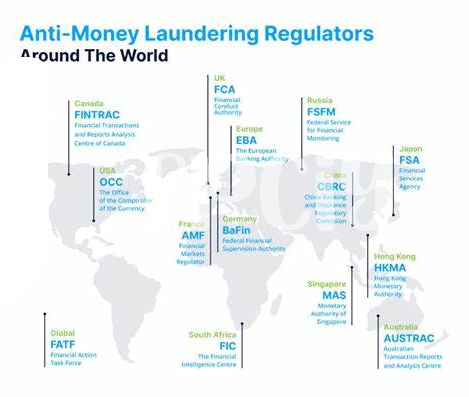

Role of Regulatory Authorities 🕵️♂️

Regulatory authorities play a vital role in overseeing the compliance of businesses with AML regulations in the Bitcoin landscape. They are responsible for setting guidelines, conducting inspections, and imposing penalties in cases of non-compliance. These authorities collaborate with other organizations to ensure a secure and transparent environment for Bitcoin transactions, aiming to prevent illegal activities such as money laundering and terrorist financing. By actively monitoring and regulating the use of Bitcoin, regulatory authorities contribute to the overall integrity and stability of the financial system.

Future Trends in Bitcoin Aml Practices 🚀

In the rapidly evolving landscape of Bitcoin Aml practices, staying ahead of emerging trends is key to successful compliance. As technology advances, the integration of artificial intelligence and blockchain analysis tools will likely play a crucial role in enhancing Aml efforts and detecting suspicious activities more effectively. Moreover, increased cooperation and information sharing among regulatory authorities globally are anticipated to shape future Aml practices, improving transparency and accountability in the crypto space. Embracing these developments proactively is essential for businesses navigating the complex regulatory environment of Bitcoin Aml.