Understanding Aml Regulations in Canada 🇨🇦

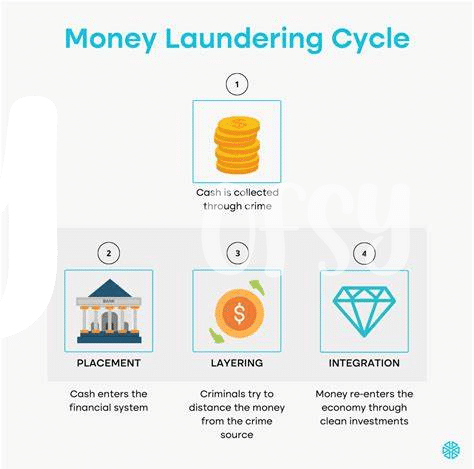

AML regulations in Canada aim to prevent money laundering and terrorist financing within the cryptocurrency sector. These regulations require Bitcoin investors to adhere to specific rules and guidelines set forth by the government. Understanding the intricacies of these regulations is crucial for investors to ensure compliance and avoid potential legal repercussions. By staying informed and following the established AML protocols, investors can contribute to maintaining the integrity of the financial system while safeguarding their own investments.

Identifying Red Flags in Bitcoin Transactions 🔍

Red flags in Bitcoin transactions can come in various forms, serving as warning signs for potential illicit activities. Unusually large transactions without a clear explanation, frequent transfers to anonymous wallets, and patterns of erratic trading behavior are all indicators that warrant further scrutiny. Additionally, the use of mixers or tumblers to obscure the transaction trail and transactions involving countries known for high levels of financial crime should raise concerns.

As a responsible investor, staying vigilant and being able to recognize these red flags is crucial in maintaining compliance and safeguarding against potential legal risks. By actively monitoring transactions for these warning signs and conducting thorough due diligence, investors can help ensure the integrity and security of the cryptocurrency ecosystem.

Importance of Kyc Procedures for Investors 📑

Know Your Customer (KYC) procedures are crucial for investors in the cryptocurrency space. By verifying the identities of individuals engaging in transactions, KYC processes provide a layer of security against potential money laundering activities. This verification not only helps safeguard investors but also contributes to overall regulatory compliance within the industry. Furthermore, adherence to KYC protocols fosters a sense of trust and transparency, ultimately enhancing the integrity of the digital asset market.

Best Practices for Reporting Suspicious Activities 🚨

When reporting suspicious activities in the realm of Bitcoin investments, it is crucial to follow best practices to maintain the integrity and security of the market. This involves timely and accurate documentation of any questionable transactions or behaviors to the appropriate authorities. By adopting a proactive approach and staying vigilant, investors can play a vital role in safeguarding the cryptocurrency ecosystem from illicit activities. For more insights on Bitcoin AML frameworks, check out this informative piece on bitcoin anti-money laundering (AML) regulations in Brunei.

Utilizing Blockchain Analysis Tools Effectively 🔗

Blockchain analysis tools are essential for Canadian Bitcoin investors to ensure compliance with AML regulations. By effectively utilizing these tools, investors can track and analyze transactions on the blockchain, helping to identify any suspicious activities. These tools provide insights into the flow of funds, connections between addresses, and patterns of behavior, enabling investors to mitigate risks and stay ahead of potential regulatory issues. Understanding how to interpret the data generated by these tools is crucial for implementing a robust AML compliance program. With the rapid evolution of blockchain technology, staying informed about the latest tools and techniques is key to safeguarding investments and maintaining regulatory compliance in the dynamic realm of cryptocurrency transactions.

Staying Updated on Evolving Aml Requirements 📈

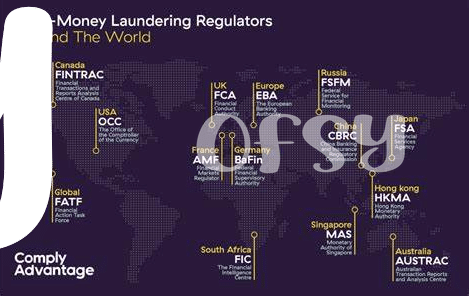

Staying updated on evolving AML requirements is crucial for Canadian Bitcoin investors to navigate the ever-changing landscape of compliance. With regulations constantly being refined and new guidelines emerging, staying informed is integral to maintaining a proactive approach in safeguarding investments and ensuring adherence to legal frameworks. By actively seeking out the latest updates, engaging in relevant discussions, and participating in industry events, investors can stay ahead of the curve and adapt their practices accordingly. This ongoing commitment to staying informed not only fosters a culture of compliance but also demonstrates a dedication to ethical and responsible participation in the cryptocurrency market.

bitcoin anti-money laundering (AML) regulations in Botswana with anchor bitcoin anti-money laundering (AML) regulations in Burundi.