Understanding Bitcoin: 📈 Potential and Pitfalls

Bitcoin, with its soaring potential for growth and opportunities, is also accompanied by potential pitfalls that users should be aware of. Its decentralized nature offers financial freedom, yet volatile market conditions can lead to significant losses for investors. Understanding the nuances of Bitcoin, from its unique technology to market trends, is essential for navigating the digital currency space effectively. By being informed about both the potential and pitfalls, users can make better-informed decisions regarding their involvement in the Bitcoin ecosystem.

Aml Regulations: 💸 Impact on Bitcoin Transactions

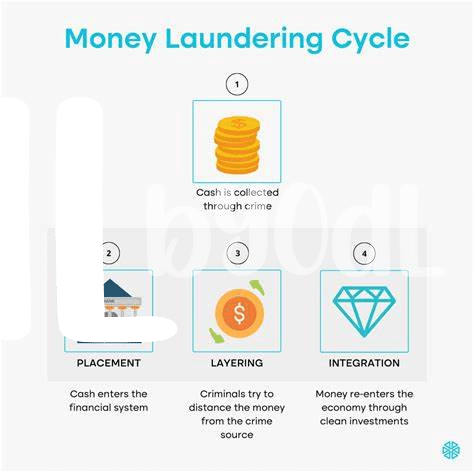

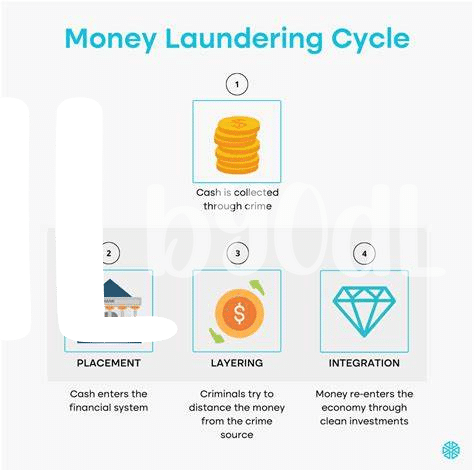

Navigating through the complex world of AML regulations in Cabo Verde involves a delicate balance between safeguarding against financial crimes and fostering innovation within the Bitcoin ecosystem. The stringent guidelines set forth by regulatory authorities not only impact the way Bitcoin transactions are conducted but also shape the overall perception and adoption of digital currencies in the region. Compliance with these rules is paramount to ensure the legitimacy and security of transactions, yet poses challenges for users and businesses operating in this evolving landscape. Amidst these regulations, the need for education and awareness becomes crucial to empower individuals with the knowledge needed to navigate the complexities of AML guidelines in the context of Bitcoin transactions.

The evolving regulatory framework in Cabo Verde underscores the importance of finding a harmonious relationship between AML requirements and the intrinsic decentralized nature of Bitcoin. Striking this balance is not only vital for fostering trust and legitimacy within the cryptocurrency space but is also instrumental in unlocking the full potential of blockchain technology for economic growth and financial inclusion. As the landscape continues to evolve, staying informed and compliant with AML regulations will be key to shaping the future of Bitcoin transactions in Cabo Verde and navigating the opportunities and challenges that lie ahead.

Cabo Verde’s Crypto Landscape: 🌍 Opportunities and Challenges

N/A

Compliance Struggles: ⚖️ Finding the Balance

Compliance in the realm of Bitcoin transactions can be a delicate balancing act. Struggling to adhere to Anti-Money Laundering (AML) regulations while also fostering innovation and financial inclusion presents a significant challenge. Finding the equilibrium between regulatory requirements and the fundamental principles of decentralized cryptocurrencies is a complex task that requires constant adaptation and vigilance. However, by promoting transparency and accountability within the crypto space, stakeholders can work towards establishing a secure environment that satisfies both regulatory expectations and the needs of the community.

For further insights on navigating Bitcoin AML regulations in different regions, especially in Central African Republic, refer to the comprehensive guide on bitcoin anti-money laundering (AML) regulations. This resource offers valuable information for Canadian Bitcoin investors and serves as a valuable reference for those operating in diverse regulatory landscapes.

The Role of Education: 📚 Empowering Users

Education plays a critical role in empowering Bitcoin users to navigate the complexities of AML guidelines effectively. By providing comprehensive knowledge and tools, users can make informed decisions, mitigate risks, and contribute to a more secure crypto landscape. Educational initiatives should focus on practical understanding, compliance best practices, and real-world examples to bridge the gap between regulations and user behavior. By investing in education, Cabo Verde can foster a culture of responsibility and transparency within the Bitcoin community, ultimately enhancing the credibility and sustainability of digital currency transactions.

Future Outlook: 🔮 Trends in Bitcoin Aml Guidelines

As the world of cryptocurrency continues to evolve, the future outlook for Bitcoin Aml guidelines is filled with dynamic trends and advancements. Regulatory bodies are increasingly focusing on enhancing measures to combat money laundering and ensure the legitimacy of transactions in the digital currency space. Embracing technological innovations such as blockchain analysis tools and identity verification solutions is expected to play a pivotal role in shaping the landscape of Aml regulations for Bitcoin. The integration of robust compliance mechanisms coupled with ongoing education initiatives will be crucial in fostering trust and transparency within the cryptocurrency ecosystem. Adapting to emerging trends and regulatory frameworks will be essential for both businesses and users to navigate the evolving landscape of Bitcoin Aml guidelines effectively.