Overview 🌐

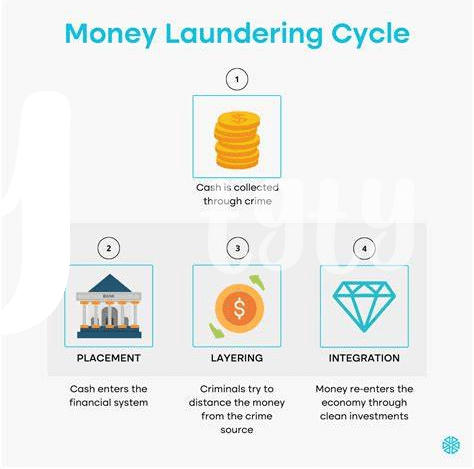

Bitcoin transactions in Cameroon are subject to Anti-Money Laundering (AML) requirements, aimed at combating illicit financial activities. Understanding and adhering to these regulations is crucial for individuals and businesses engaging in cryptocurrency exchanges. Compliance with AML regulations is essential to ensure transparency and security in financial transactions, safeguarding against potential risks. As the digital landscape evolves, the enforcement of AML regulations plays a pivotal role in shaping the future of Bitcoin transactions in Cameroon and the broader financial ecosystem.

Aml Regulations in Cameroon 🇨🇲

Cameroon has implemented Anti-Money Laundering (AML) regulations to monitor and regulate Bitcoin transactions within its borders. These regulations aim to combat illicit financial activities and ensure transparency in cryptocurrency transactions. By adhering to these guidelines, individuals and businesses involved in Bitcoin transactions can help prevent money laundering and terrorist financing. Understanding and complying with the AML regulations in Cameroon is crucial for fostering a secure and trustworthy cryptocurrency ecosystem in the country.

Importance of Compliance 📜

Compliance with AML requirements is crucial for ensuring the security and integrity of Bitcoin transactions in Cameroon. By adhering to these regulations, individuals and businesses can play a key role in preventing illegal activities such as money laundering and terrorist financing. Compliance also helps to build trust within the cryptocurrency community and with financial institutions, ultimately fostering a more transparent and secure environment.

Furthermore, embracing AML regulations demonstrates a commitment to upholding legal standards and ethical practices in the cryptocurrency space. It not only safeguards against potential financial risks but also paves the way for broader adoption of Bitcoin and other digital assets. Ultimately, the importance of compliance cannot be overstated, serving as a foundation for a sustainable and thriving ecosystem for transactions in Cameroon.

Challenges Facing Bitcoin Transactions 💼

Bitcoin transactions in Cameroon face various challenges that need to be addressed. One key issue is the lack of clear regulatory guidelines, resulting in uncertainty for individuals and businesses engaging in cryptocurrency transactions. Additionally, the anonymity of Bitcoin transactions can make it difficult to trace and monitor potential illicit activities, raising concerns around compliance with Anti-Money Laundering (AML) regulations. As a result, there is a growing need for enhanced regulatory oversight and collaboration between government entities, financial institutions, and cryptocurrency service providers to ensure the integrity of the financial system.

If you want to delve deeper into the AML regulations surrounding Bitcoin transactions, you can learn more about it in this insightful article on bitcoin anti-money laundering (aml) regulations in cabo verde.

Impact on Financial Institutions 💰

Financial institutions in Cameroon are experiencing a shift in their operations due to the increasing popularity of Bitcoin transactions. While this digital currency offers potential benefits, it also brings about challenges for traditional financial entities. The integration of Bitcoin into the financial landscape requires institutions to adapt their regulatory frameworks and enhance their monitoring capabilities to ensure compliance with Anti-Money Laundering (AML) regulations. This shift not only impacts how financial institutions operate but also highlights the need for robust measures to mitigate risks associated with virtual currencies.

Future Outlook and Recommendations 🔮

In looking ahead, it is vital for the regulatory landscape surrounding Bitcoin transactions in Cameroon to evolve in tandem with technological advancements. A forward-looking approach that balances innovation with robust AML measures is essential. Moreover, fostering collaboration between financial institutions, regulators, and cryptocurrency stakeholders will be key to ensuring a sustainable and secure ecosystem for Bitcoin transactions in the country.

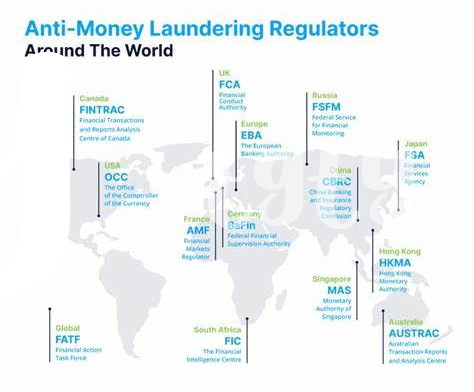

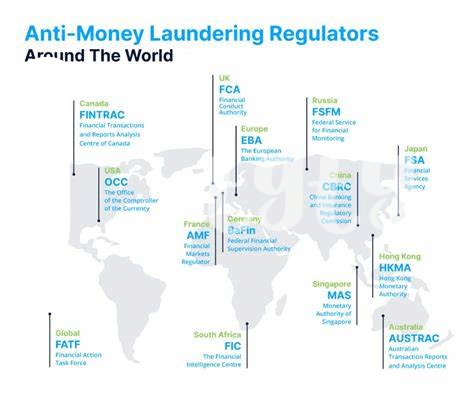

Considering the dynamic nature of cryptocurrency markets, continuous monitoring and updates to AML regulations will be imperative. Embracing emerging technologies for enhanced transaction monitoring and implementing proactive measures to combat illicit activities will be crucial for the successful integration of Bitcoin into the financial system. Collaboration with international organizations and adopting best practices from jurisdictions with established AML frameworks can further strengthen the regulatory environment. Additionally, investing in educational initiatives to raise awareness about AML requirements and promoting compliance culture among all stakeholders will be instrumental in shaping a resilient future for Bitcoin transactions in Cameroon.

Bitcoin anti-money laundering (AML) regulations in Cambodia