Understanding Aml Regulations in Bitcoin Transactions 📜

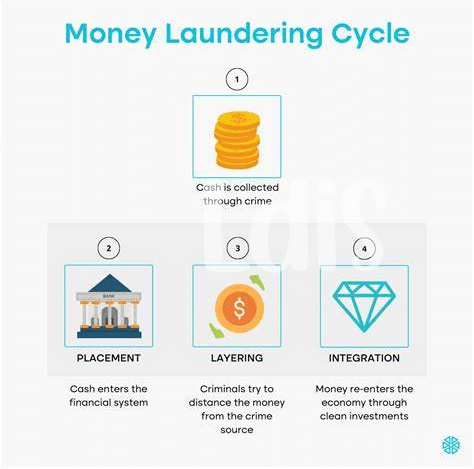

Navigating the legal landscape of Bitcoin transactions involves understanding and adhering to Anti-Money Laundering (AML) regulations. These rules are designed to prevent financial crimes and ensure transparency in cryptocurrency transactions. By familiarizing yourself with AML regulations, you can operate within the legal framework and mitigate the risks associated with non-compliance. It is essential to stay informed about the evolving regulatory environment surrounding Bitcoin transactions to navigate this complex landscape effectively.

Implementing Compliance Measures in Your Business 📊

Implementing compliance measures in your business is crucial in the evolving landscape of Bitcoin transactions. By integrating robust verification processes, monitoring suspicious activities, and conducting regular audits, your business can strengthen its defenses against potential money laundering risks. Educating employees on AML regulations and fostering a culture of compliance are integral steps towards safeguarding your operations and reputation. Collaborating with industry experts and utilizing advanced compliance tools can streamline your efforts and ensure adherence to regulatory requirements. Proactively adapting to changing AML rules and investing in comprehensive training programs will not only protect your business from financial penalties but also uphold integrity in the burgeoning world of digital currencies.

Risks of Non-compliance and Potential Repercussions ⚖️

Non-compliance with AML regulations in Bitcoin transactions can expose businesses to significant risks and potential repercussions. Failing to adhere to these regulations may result in severe financial penalties, legal actions, and reputational damage. Furthermore, non-compliance can also lead to the suspension of business operations, loss of customer trust, and negative impacts on long-term sustainability. It is essential for businesses to prioritize compliance with AML rules to mitigate these risks and ensure a secure and transparent environment for conducting Bitcoin transactions. The potential repercussions of non-compliance underscore the importance of implementing robust compliance measures and staying informed about regulatory developments in the evolving landscape of digital currency transactions.

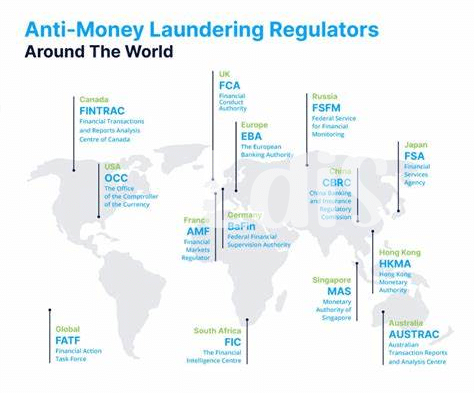

Role of Regulatory Bodies in Enforcing Aml Rules 🏛️

When it comes to the enforcement of AML rules in the realm of Bitcoin transactions, regulatory bodies play a crucial role in ensuring compliance and deterring illicit activities. These bodies are tasked with overseeing the implementation of AML regulations, investigating potential breaches, and imposing sanctions when necessary. By monitoring and regulating the conduct of businesses operating in the cryptocurrency space, regulatory bodies aim to maintain the integrity of the financial system and protect users from the risks associated with money laundering and terrorist financing. To learn more about the specifics of AML requirements for Bitcoin transactions in Canada, visit bitcoin anti-money laundering (AML) regulations in Canada.

Best Practices for Navigating the Legal Landscape ⭐

Navigating the legal landscape in the world of Bitcoin transactions requires a proactive approach. One key practice is staying updated on evolving AML regulations to ensure compliance. Conducting regular risk assessments to identify potential vulnerabilities and implementing robust internal controls are also essential steps. Additionally, fostering a culture of compliance within your organization by providing training and resources to employees can help mitigate risks. Engaging with industry peers and experts to share insights and best practices can further enhance your compliance efforts. Finally, maintaining open communication with regulatory bodies and promptly addressing any issues or concerns demonstrates a commitment to upholding AML standards in the Bitcoin space.

Looking Ahead: Future Trends in Aml for Bitcoin 💡

In the rapidly evolving landscape of AML regulations for Bitcoin, staying ahead of future trends is crucial for businesses to adapt and comply effectively. As technology advances and risks evolve, the role of regulatory bodies will likely expand, necessitating continuous updates to compliance measures. Collaboration between industry stakeholders and regulators will be essential to address emerging challenges and ensure the integrity of Bitcoin transactions. Moreover, with the global nature of cryptocurrencies, harmonizing AML standards across jurisdictions will be a key focus to enhance transparency and mitigate risks effectively. Embracing innovative solutions and proactive approaches will be vital to navigating the evolving AML landscape for Bitcoin successfully. Bitcoin Anti-Money Laundering (AML) regulations in Brunei will serve as a reference point for understanding regional variations and compliance requirements, while Bitcoin Anti-Money Laundering (AML) regulations in Botswana will provide insights into diverse regulatory frameworks.