Understanding Tax Implications 📊

Cryptocurrency holders in Brazil need to be aware of the tax implications involved. Understanding how Bitcoin and other digital assets are taxed can help individuals stay compliant with the law and avoid any potential penalties. Being informed about tax regulations ensures that you can accurately report your cryptocurrency holdings to the authorities and fulfill your financial obligations. By considering the tax implications upfront, you can navigate the complex landscape of digital currency taxation and make informed decisions about managing your assets effectively.

Reporting Requirements and Deadlines 🗓️

When it comes to complying with regulations, individuals holding Bitcoin in Brazil must stay informed about the reporting requirements and deadlines set forth by the authorities. These guidelines are essential for ensuring transparency and accountability in cryptocurrency transactions. By adhering to these timelines and submitting accurate reports as per the regulatory framework, individuals can demonstrate their commitment to operating within the legal boundaries. Familiarizing oneself with these obligations is crucial to avoid penalties or legal repercussions and foster a trustworthy environment within the cryptocurrency space. Be proactive in staying up-to-date on the reporting requirements and deadlines to navigate the regulatory landscape effectively.

Secure Storage Practices and Tips 🔐

When it comes to safeguarding your Bitcoin holdings, ensuring secure storage practices is paramount. By utilizing hardware wallets or encrypted storage solutions, you add layers of protection against potential cyber threats. Additionally, setting up multi-signature wallets or leveraging secure offline storage can further enhance the security of your digital assets. Regularly updating your antivirus software and being cautious of phishing attempts are also crucial measures to prevent unauthorized access to your Bitcoin. By staying vigilant and proactive in implementing these security measures, you can mitigate the risks associated with storing your Bitcoin and safeguard your investment for the long term.

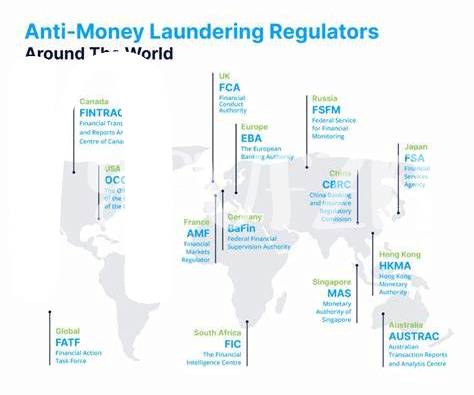

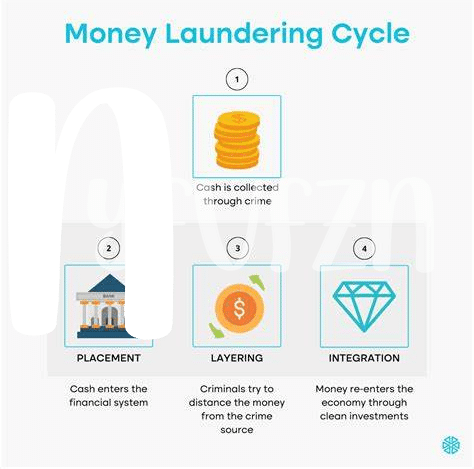

Compliance with Anti-money Laundering Laws 💸

Bitcoin transactions are increasingly under the radar of Anti-money Laundering Laws worldwide. Understanding and adhering to these regulations is vital in maintaining the legitimacy of your cryptocurrency holdings. To ensure compliance, individuals must stay updated on the latest AML requirements and implement measures to prevent any involvement in illicit financial activities. Having a robust understanding of the AML landscape is crucial for individuals navigating the cryptocurrency space securely and ethically.

For more insights on Bitcoin Anti-money Laundering (AML) regulations in Bosnia and Herzegovina, check out this informative resource: bitcoin anti-money laundering (aml) regulations in bosnia and herzegovina.

Importance of Record-keeping 📝

Effective record-keeping is the backbone of regulatory compliance and financial transparency. Not only does it help individuals holding Bitcoin in Brazil stay organized, but it also serves as a crucial resource for verifying transactions, demonstrating compliance, and resolving any potential disputes. By maintaining accurate records of cryptocurrency transactions, individuals can ensure they have a clear trail of their financial activities, which can be invaluable in the event of an audit or investigation. Additionally, proper record-keeping can aid in tracking capital gains, losses, and tax obligations, ultimately simplifying the reporting process and helping to avoid any unforeseen compliance issues.

Seeking Professional Legal Advice 🧑⚖️

When it comes to navigating the complexities of Bitcoin compliance in Brazil, seeking professional legal advice is a crucial step. Legal experts can provide tailored guidance on tax obligations, reporting requirements, secure storage practices, and compliance with anti-money laundering laws. Their insights can help individuals understand the legal landscape surrounding Bitcoin transactions, ensuring full compliance while minimizing risks. By partnering with legal professionals well-versed in cryptocurrency regulations, individuals can proactively address any compliance-related concerns and stay updated on the latest legal developments in the ever-evolving digital currency space.

For more information on Bitcoin anti-money laundering (AML) regulations in Brazil, you can refer to the Bitcoin anti-money laundering (AML) regulations in Brazil.