Overview of Bitcoin Aml Regulations in Belgium 🇧🇪

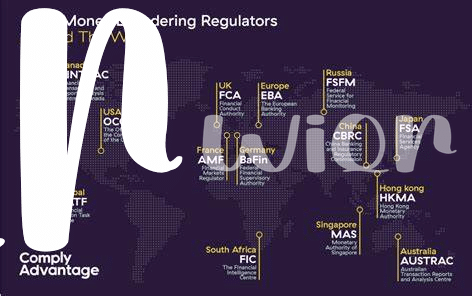

In Belgium, regulations surrounding Anti-Money Laundering (AML) compliance within the Bitcoin industry have been a critical focus. The country has established guidelines that aim to safeguard against illicit financial activities while fostering a secure environment for digital currency transactions. Understanding and adhering to these AML regulations is imperative for businesses operating within the Bitcoin space in Belgium.

Furthermore, the regulatory landscape continues to evolve, requiring constant vigilance and adaptation from businesses to ensure ongoing compliance. As Belgium positions itself amidst the dynamic global regulatory environment, businesses must stay informed and proactive in their approach to AML regulations in the context of Bitcoin transactions within the country.

Challenges Faced by Businesses in Compliance 🚫

Navigating compliance with AML regulations can be a daunting task for businesses in the realm of Bitcoin transactions. One of the key challenges faced is the complex and ever-evolving nature of regulatory requirements. Businesses need to stay updated on the latest compliance measures to avoid potential penalties or risks associated with non-compliance. Moreover, ensuring transparency in transactions while maintaining customer privacy adds another layer of complexity to the compliance process.

Implementing robust internal controls and training programs is essential for businesses to mitigate compliance challenges effectively. Additionally, establishing a culture of compliance within the organization can help in fostering a proactive approach towards meeting regulatory obligations. Leveraging technology, such as blockchain analytics and AI-powered software, can streamline compliance processes and enhance the overall effectiveness of AML efforts.

Impact of Regulatory Requirements on Bitcoin Transactions 💸

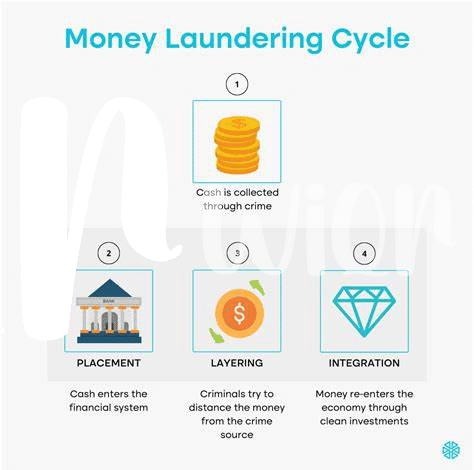

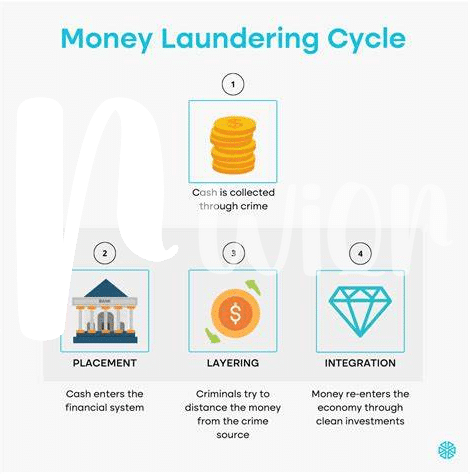

The enforcement of regulatory requirements on Bitcoin transactions in Belgium has significantly altered the landscape of digital currency operations within the country. Businesses engaging in Bitcoin transactions now face a heightened level of scrutiny and must navigate complex compliance measures to ensure adherence to Anti-Money Laundering laws. The impact of these regulatory obligations on Bitcoin transactions is profound, as it introduces additional layers of verification and reporting that can slow down the speed and efficiency of transactions. As a result, businesses operating in the cryptocurrency space must carefully consider these implications and work towards implementing robust compliance strategies to mitigate risks and ensure continued operations within the boundaries of the law.

Strategies for Ensuring Compliance with Aml Laws 📝

Certainly! Here is the requested text for point 4:

Strategies for Ensuring Compliance with Aml Laws 📝

Effective compliance with Anti-Money Laundering (AML) regulations necessitates a proactive approach by businesses. Implementing robust Know Your Customer (KYC) procedures, regular employee training on AML requirements, and conducting thorough due diligence on transactions are fundamental strategies. These efforts not only enhance adherence to regulations but also cultivate a culture of compliance within organizations. Embracing transparency in all dealings, maintaining accurate records, and promptly reporting suspicious activities are vital components in safeguarding against potential AML breaches.

To gain further insights into navigating the complexities of Bitcoin AML rules in Belgium, visit the informative article on bitcoin anti-money laundering (AML) regulations in Bangladesh on WikiCrypto.

Technological Solutions to Simplify Compliance Processes 🤖

As regulations around Bitcoin transactions continue to evolve, businesses are increasingly turning to technological solutions to streamline their compliance processes. By leveraging innovative tools and platforms, companies can automate KYC (Know Your Customer) procedures, monitor transactions in real-time, and simplify reporting requirements. These technologies not only enhance efficiency but also improve the accuracy and effectiveness of AML (Anti-Money Laundering) compliance efforts. As the regulatory landscape shifts, staying ahead with the right technological solutions can make a significant difference in navigating the complexities of compliance in the evolving digital currency space.

Future Outlook and Potential Changes in Regulations 🔮

In regards to the future outlook and potential changes in regulations for Bitcoin AML compliance in Belgium, it is essential to stay attuned to evolving legislative landscapes. With the cryptocurrency industry continuously evolving, regulatory bodies are likely to enhance and refine AML frameworks to mitigate risks associated with digital assets. Increased scrutiny and alignment with international standards are probable scenarios, requiring businesses to adapt swiftly to changing requirements. Collaboration between authorities, industry players, and technology innovators will be crucial in fostering a compliant and secure environment for Bitcoin transactions. Anticipating and proactively addressing regulatory modifications will be fundamental for businesses to navigate the evolving AML landscape effectively.

Link: Bitcoin Anti-Money Laundering (AML) Regulations in Belarus