Introduction to Aml Compliance 🌍

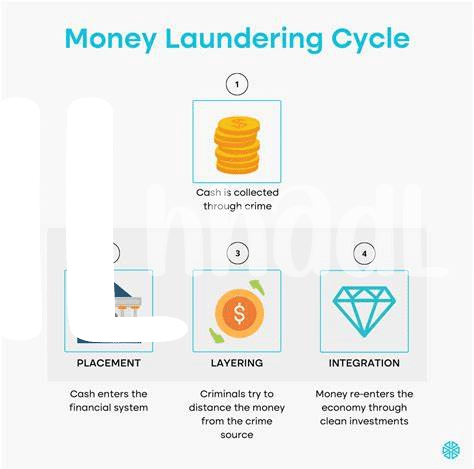

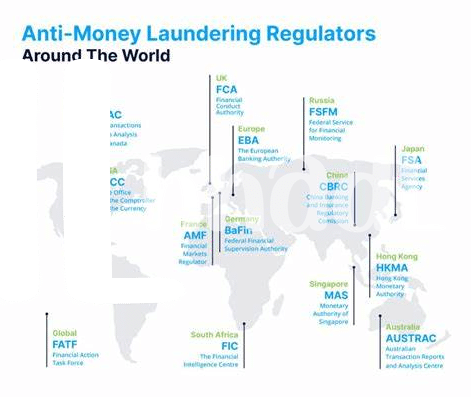

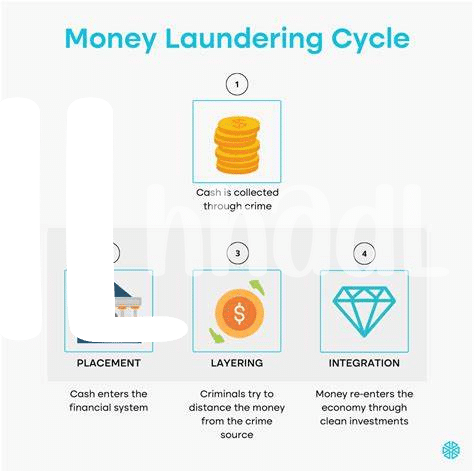

Anti-Money Laundering (AML) compliance is crucial in the financial world, aiming to prevent illicit activities by verifying the identities of customers and monitoring their transactions. This robust framework sets rules and procedures for financial institutions and other regulated entities to detect and prevent money laundering and terrorist financing. In today’s global economy, AML compliance plays a vital role in maintaining the integrity of the financial system and safeguarding against criminal activities.

Risks of Non-compliance 💰

Risks of Non-compliance in Anti-Money Laundering regulations can pose significant financial and reputational threats to Bitcoin investors. Failure to adhere to AML guidelines increases the risk of unwittingly facilitating illicit activities such as money laundering or terrorist financing. Non-compliance may result in severe penalties, including hefty fines or legal repercussions, potentially leading to substantial financial losses for investors. Additionally, neglecting AML requirements can damage the credibility of investors, eroding trust among stakeholders and creating barriers to market opportunities. It is crucial for Bitcoin investors to prioritize AML compliance to mitigate these risks and safeguard their investments in a rapidly evolving digital landscape.

Benefits of Aml Framework 📈

The AML framework offers various advantages to investors, including enhanced security measures, improved credibility within the industry, and better risk management strategies. By implementing robust AML procedures, investors can safeguard their investments, maintain compliance with regulatory requirements, and protect their assets from potential illicit activities. Furthermore, having a solid AML framework in place can help investors build trust with stakeholders, attract more reliable partners, and ultimately contribute to a more stable and sustainable investment environment. Embracing the benefits of AML not only mitigates risks but also strengthens the overall integrity of the investment landscape, fostering long-term growth and success.

Regulatory Environment in Belize 🇧🇿

The regulatory environment in Belize is evolving to address the challenges of AML compliance in the cryptocurrency sector. With the growing adoption of Bitcoin and other digital assets, Belize has been proactive in implementing guidelines to ensure transparency and accountability within the industry. By establishing clear regulations and compliance standards, the country aims to attract legitimate investors while mitigating the risks of financial crimes such as money laundering and terrorist financing. Investors in Belize are encouraged to stay informed about the latest regulatory updates and comply with AML requirements to safeguard their investments and contribute to a secure financial ecosystem. For further insights on similar regulatory frameworks, you can explore the dynamics of bitcoin anti-money laundering (AML) regulations in Belarus.

Best Practices for Investors 🔒

Investors looking to navigate the complexities of AML compliance in Belize should prioritize thorough due diligence processes, continual monitoring of transactions, and robust record-keeping practices. It is essential for investors to stay updated on regulatory requirements, undergo regular risk assessments, and implement internal controls to mitigate potential money laundering risks effectively. By fostering a culture of compliance within their operations and seeking guidance from industry experts, investors can safeguard their interests while contributing to a more transparent and secure financial ecosystem.

Aml Compliance Tools and Resources 💡

When it comes to AML compliance, having the right tools and resources at your disposal is crucial for investors navigating the complex landscape of regulations and requirements. These resources not only streamline the compliance process but also help in staying updated with the latest developments in AML protocols and standards. By utilizing specialized software, investors can efficiently monitor transactions, conduct due diligence, and identify any suspicious activities that may arise. Additionally, access to educational materials and training programs can enhance understanding and awareness of AML principles, empowering investors to make informed decisions and mitigate risks effectively.

For more information on Bitcoin AML regulations in other jurisdictions, such as the Bahamas, visit the official document on Bitcoin anti-money laundering (AML) regulations in Bahrain.