Key Compliance Requirements in Armenian Aml Laws 📝

Effective compliance with Armenian AML laws is crucial for Bitcoin businesses operating in the region. Understanding and adhering to the key requirements outlined in these regulations is essential for maintaining legality and trust within the industry. By prioritizing compliance measures, businesses can protect themselves from potential legal issues and ensure a secure environment for both themselves and their clients.

Having a comprehensive grasp of the specific compliance requirements set forth by Armenian AML laws enables Bitcoin businesses to establish a solid foundation for their operations. Implementing these measures effectively not only safeguards the business but also fosters credibility and transparency in the eyes of stakeholders. Compliance is not just a requirement; it is a strategic approach to running a sustainable and trustworthy business in the evolving cryptocurrency landscape.

Implementing Effective Kyc Procedures 🛡️

Effective Know Your Customer (KYC) procedures serve as the bedrock for ensuring compliance with Armenian AML laws. By implementing robust KYC measures, Bitcoin businesses can verify the identities of their customers, assess their risk profiles, and detect any potential suspicious activities. Utilizing advanced technology solutions and manual verification processes, businesses can streamline the onboarding process while maintaining a high level of security and trust. This not only enhances regulatory compliance but also builds a solid foundation for long-term customer relationships based on transparency and accountability. Partnering with reputable KYC service providers can further strengthen these procedures and facilitate seamless compliance with evolving AML regulations.

In today’s dynamic regulatory landscape, staying abreast of the latest KYC requirements is essential for Bitcoin businesses to navigate the complexities of compliance effectively. By integrating automation, artificial intelligence, and risk-based approaches into their KYC processes, businesses can adapt to changing regulatory expectations and mitigate emerging financial crime risks. Fostering a culture of compliance within the organization and fostering a proactive approach to KYC will not only enhance regulatory adherence but also safeguard the business from potential legal repercussions. Regularly updating and enhancing KYC procedures in alignment with Armenian AML laws will be pivotal in sustaining operational resilience and earning the trust of customers and regulators alike.

Ensuring Transaction Monitoring and Reporting ⚖️

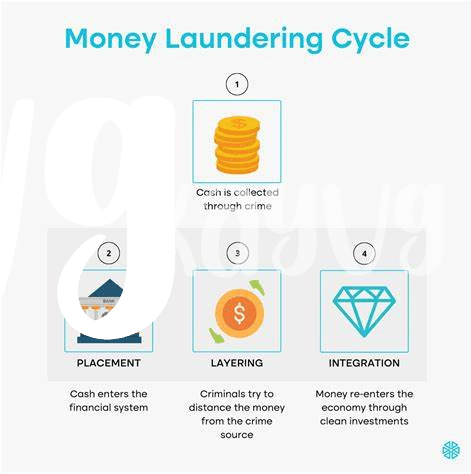

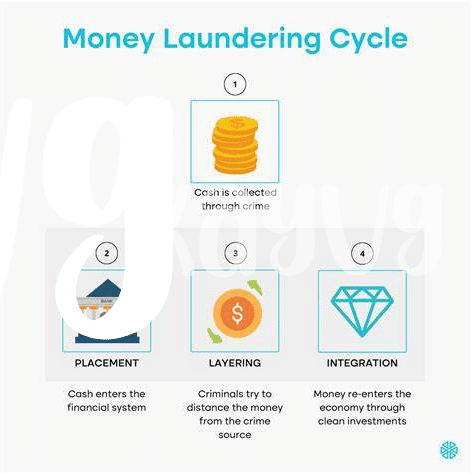

Proper tracking of transactions and timely reporting are crucial aspects in ensuring compliance with Armenian AML laws. By implementing robust monitoring systems, businesses can effectively detect and address any suspicious activities, thereby mitigating the risks associated with money laundering and terrorist financing. In addition, regular reporting to authorities helps maintain transparency and accountability within the bitcoin industry, fostering trust among stakeholders. Prioritizing transaction monitoring and reporting not only fulfills legal obligations but also strengthens the overall integrity of the business operations.

Securing Customer Funds and Assets 🔒

When it comes to safeguarding customer funds and assets in the realm of Bitcoin business compliance under Armenian AML laws, stringent measures must be put in place. A robust system of cold and hot wallets should be adopted to ensure the secure storage of digital assets. Implementing multi-signature wallets and advanced encryption protocols adds an extra layer of protection against potential cyber threats, bolstering the overall security infrastructure of the business.

Furthermore, regular audits and independent security assessments should be conducted to identify and address any vulnerabilities promptly. By prioritizing the security of customer funds and assets, Bitcoin businesses can instill trust and confidence among users while also staying compliant with regulatory requirements. Click here for insights into Bitcoin AML regulations in Azerbaijan.

Developing Staff Training Programs 📚

Staff training programs play a crucial role in ensuring all team members are well-versed in compliance measures and best practices. By providing comprehensive training on AML laws and regulations, employees can better understand their roles and responsibilities in preventing financial crimes within Bitcoin businesses. These programs should cover topics such as identifying suspicious activities, reporting requirements, and proper record-keeping procedures to enhance overall compliance efforts. In addition to regulatory aspects, training can also focus on cybersecurity awareness and customer communication skills to foster a strong culture of compliance and professionalism.

Engaging with Regulatory Authorities 🤝

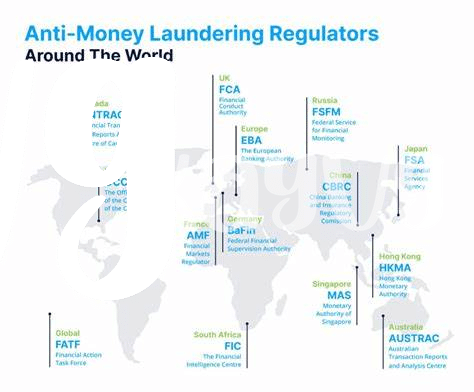

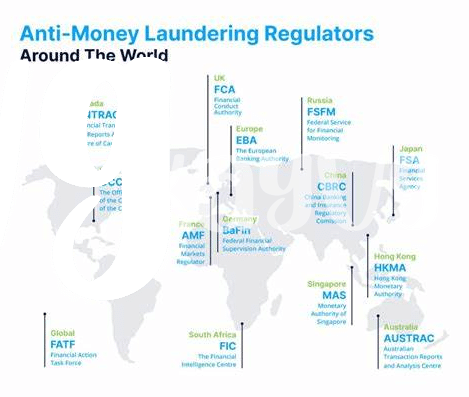

When engaging with regulatory authorities in Armenia, it is crucial for Bitcoin businesses to establish open communication channels and foster positive relationships. By proactively seeking guidance, clarifying regulatory expectations, and demonstrating commitment to compliance, companies can navigate the evolving AML landscape effectively. Building rapport with regulatory bodies not only promotes a culture of transparency and accountability but also positions businesses to adapt swiftly to regulatory changes and expectations.

For more information on Bitcoin AML regulations in Algeria, please refer to the Bitcoin Anti-Money Laundering (AML) Regulations in Argentina.