Tax Deductions Available for Crypto Investments 🌟

When it comes to crypto investments, there are unique opportunities for tax deductions that can benefit investors. By understanding how these deductions work and what expenses can be included, crypto investors can potentially reduce their tax burden and maximize their returns. From expenses related to mining activities to costs associated with trading platforms, knowing what can be deducted is crucial in optimizing tax benefits in the crypto space.

By keeping detailed records of investment-related expenses and staying informed about tax regulations in the cryptocurrency realm, investors can take full advantage of available deductions. This proactive approach not only helps in reducing tax liabilities but also ensures compliance with tax laws, ultimately contributing to a more financially savvy investment strategy in the crypto market.

Understanding Investment Expenses and Deductions 💡

When it comes to investing in cryptocurrencies, understanding your investment expenses and deductions is crucial. Keeping track of the costs associated with your crypto investments can help you maximize your tax benefits. From transaction fees to research costs, every expense may be potentially deductible. By carefully documenting these expenses, you can ensure that you are taking full advantage of the tax deductions available to you as a crypto investor. Additionally, exploring different deduction strategies can help you minimize your taxable income and maximize your overall returns. Being aware of the various investment expenses and deductions can not only save you money but also make your tax reporting process smoother and more efficient.

Maximizing Credits through Smart Crypto Investments 🚀

Thinking smartly about your crypto investments can lead to potential tax credits that you might not have considered before. By strategically planning your investments and understanding the tax implications, you can maximize your credits and reduce your overall tax burden. Taking the time to research different investment strategies and consulting with a tax professional can help you make informed decisions that may result in significant savings come tax time. Embracing a proactive approach to your crypto investments can ultimately lead to a more favorable tax outcome.

How to Report Crypto Activity on Your Taxes 📊

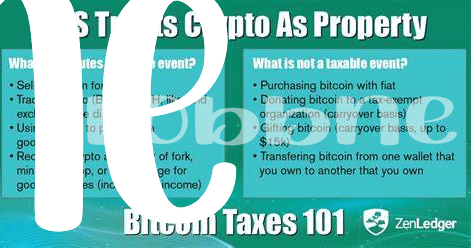

When it comes to reporting your crypto activity on your taxes, it’s essential to be thorough and accurate. Keep detailed records of all your transactions, including buys, sells, and trades. Make sure to report your gains or losses accurately, as failing to do so could lead to penalties from the IRS. If you’re unsure about how to navigate the complexities of crypto taxes, consider seeking guidance from a tax professional. They can help ensure you comply with the regulations and maximize any deductions or credits you may be eligible for. For more insights on tax implications of bitcoin trading in Ukraine, check out this informative article: Tax implications of bitcoin trading in Ukraine.

Utilizing Tax-loss Harvesting Strategies Efficiently 🌿

When it comes to managing your crypto investments, understanding how to utilize tax-loss harvesting strategies efficiently is key. By strategically selling off underperforming assets to offset capital gains, you can minimize your tax burden and optimize your overall investment portfolio. This approach can be particularly beneficial in the volatile world of cryptocurrencies, where prices can fluctuate rapidly. By staying proactive and staying informed about market trends, you can make the most of tax-loss harvesting and potentially enhance your overall financial standing. By incorporating these strategies into your investment planning, you can navigate the complexities of the tax system while maximizing your returns in the crypto market.

Navigating Tax Implications of Crypto Trading 🔄

Cryptocurrency trading can be an exciting venture, but navigating the tax implications requires careful consideration. Understanding how profits and losses from crypto trades are viewed by tax authorities is crucial. It’s essential to keep detailed records of each transaction, including purchase price, sale price, and dates, to accurately report your gains or losses.

For individuals trading Bitcoin in the United Arab Emirates, the tax implications differ from those in Turkmenistan. To learn more about the specific tax implications of Bitcoin trading in the UAE, check out this informative guide on tax implications of bitcoin trading in Turkmenistan. By staying informed about tax regulations and seeking professional advice if needed, crypto traders can navigate the complexities of tax obligations efficiently and ensure compliance.