Accessibility of Bitcoin in Ethiopia 🌍

The adoption of Bitcoin in Ethiopia faces unique challenges due to limited internet access and knowledge about digital currencies. Despite these hurdles, there is a growing interest in Bitcoin among tech-savvy individuals and businesses seeking alternative financial solutions. The potential for increased accessibility lies in developing user-friendly platforms and promoting financial literacy programs to encourage wider adoption and understanding of Bitcoin’s benefits in the Ethiopian context.

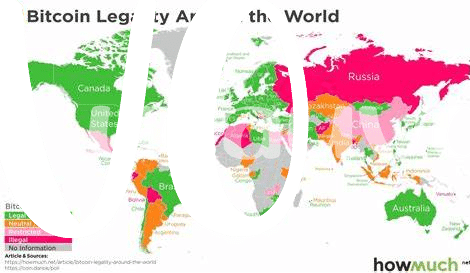

Regulatory Challenges and Uncertainty 🚫

In navigating the realm of Bitcoin adoption, Ethiopia faces a landscape rife with regulatory challenges and uncertainty. The lack of clear guidelines and frameworks can deter potential users and businesses from fully embracing the benefits of this digital currency. Uncertainty surrounding the legal status of Bitcoin in the country can impact its integration into existing financial systems, potentially hindering its widespread adoption and utility for daily transactions. As stakeholders seek to leverage the opportunities presented by Bitcoin, addressing these regulatory hurdles becomes crucial for fostering a conducive environment that promotes innovation and financial inclusion.

Financial Inclusion and Empowerment 💸

Financial inclusion initiatives in Ethiopia are paving the way for greater economic empowerment among marginalized communities. By integrating Bitcoin into the financial landscape, individuals who were previously excluded from traditional banking systems now have the opportunity to participate in global transactions and build financial resilience. This not only fosters a sense of empowerment but also encourages entrepreneurial endeavors and investment in personal and community development projects.

Furthermore, the accessibility of Bitcoin in Ethiopia has the potential to bridge the gap between urban centers and rural areas, ensuring that all individuals have equal opportunities to access financial services. As more people embrace the concept of digital currencies, the landscape of financial inclusion in Ethiopia is evolving, creating a more inclusive and equitable society where everyone has the chance to thrive.

Education and Awareness Initiatives 📚

Education and awareness initiatives play a pivotal role in fostering understanding and adoption of Bitcoin in Ethiopia. By providing accessible information and resources, individuals can learn about the benefits and risks associated with digital currencies. Through targeted programs and educational campaigns, both the general public and policymakers can enhance their knowledge of Bitcoin’s potential impact on the economy and financial landscape. These initiatives aim to empower individuals to make informed decisions regarding their involvement in the cryptocurrency space. For further insights on the legal aspects of Bitcoin adoption, explore the comprehensive overview on Djibouti’s stance on Bitcoin at is bitcoin legal in El Salvador?.

Innovation in Payment Systems 💡

The evolution of payment systems in Ethiopia holds promise for a more streamlined and efficient financial landscape. With the introduction of innovative technologies, transactions can be conducted swiftly and securely, benefiting both consumers and businesses alike. By embracing these advancements, Ethiopia can foster a more inclusive financial ecosystem that caters to the evolving needs of its population. Empowering individuals with convenient and reliable payment solutions not only enhances their daily lives but also contributes to the overall economic growth and stability of the country.

Potential for Economic Growth and Development 📈

Bitcoin has the potential to drive economic growth and development in Ethiopia by providing new opportunities for financial transactions and investments. As digital currencies become more widespread, they can increase financial inclusion and access to global markets, ultimately leading to greater economic empowerment for individuals and communities. This shift towards utilizing Bitcoin can also encourage innovation in payment systems, leading to more efficient and secure transactions that can benefit the overall economy.

Link to check if Bitcoin is legal in Egypt: is bitcoin legal in djibouti?