Adoption of Bitcoin in Ethiopia 🌍

Bitcoin is gradually making its mark in Ethiopia, opening up new avenues for digital transactions and financial empowerment. The increasing use of Bitcoin among tech-savvy individuals and businesses reflects a growing interest in alternative currency systems. While adoption may still be in its early stages, the potential for Bitcoin to revolutionize financial interactions in Ethiopia is promising. As more people embrace this decentralized form of money, the traditional barriers to financial inclusion could start to crumble, paving the way for a more inclusive and accessible financial landscape in the country.

Regulatory Challenges and Uncertainties 🚫

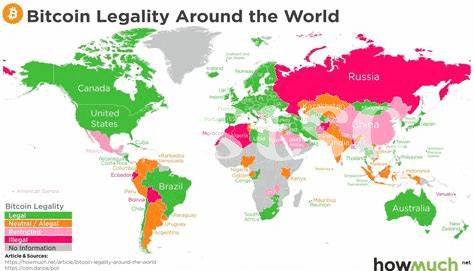

The regulations surrounding Bitcoin in Ethiopia pose a complex landscape of challenges and uncertainties. As the digital currency gains traction, government authorities struggle to formulate clear guidelines, resulting in ambiguity for both users and businesses. This lack of regulatory clarity hinders widespread adoption and investment in Bitcoin within the country. The uncertainty surrounding the legal status of Bitcoin leaves many wary of its potential implications, creating barriers to its integration into the existing financial framework. Navigating these regulatory hurdles is essential for Ethiopia’s journey towards embracing the opportunities presented by this innovative form of currency.

Opportunities for Financial Inclusion 🌱

In Ethiopia, embracing Bitcoin presents a significant opportunity for driving financial inclusion among underserved populations. By leveraging digital currencies, individuals who previously lacked access to traditional banking services can now participate in financial transactions, savings, and investments. This inclusive approach has the potential to empower marginalized communities, offering them a pathway to economic independence and stability. Through innovative blockchain technologies, financial services can reach remote areas where traditional banking infrastructure is limited or nonexistent, paving the way for a more inclusive and equitable financial ecosystem.

Impact on Traditional Banking Systems 💼

Bitcoin’s emergence in Ethiopia poses both opportunities and challenges for the traditional banking sector. As more individuals and businesses turn to Bitcoin for transactions and investments, traditional banks are compelled to adapt to this shifting landscape. While some view Bitcoin as a threat, others see it as a catalyst for innovation within the banking industry. This disruption prompts reevaluation of the role of banks in a digital economy, potentially pushing for faster and more efficient services. As the demand for digital assets grows, traditional banks face the imperative to evolve and integrate blockchain technology to stay relevant in a rapidly evolving financial ecosystem.

is bitcoin legal in el salvador?

Technological Infrastructure and Awareness 🛠️

Technology plays a crucial role in the adoption and integration of Bitcoin in Ethiopia. Improving technological infrastructure and increasing awareness about cryptocurrencies are key factors for the successful implementation of digital currencies in the country. As more people gain access to reliable internet connections and smartphones, the potential for widespread use of Bitcoin grows. Enhanced technological capabilities not only facilitate secure transactions but also pave the way for innovative financial solutions tailored to the needs of Ethiopian users. By leveraging technology and raising awareness, Ethiopia can position itself at the forefront of the digital currency revolution, fostering financial inclusion and economic empowerment for its citizens.

Future Prospects and Potential Growth 🚀

Bitcoin holds significant promise for Ethiopia’s future financial landscape. As technology advances and digital currencies gain traction globally, Ethiopia stands at a pivotal juncture where embracing Bitcoin could unlock a myriad of opportunities. The potential growth of Bitcoin in Ethiopia is not just speculative; it has the power to revolutionize the country’s financial sector, offering a decentralized alternative to traditional banking systems. With the right infrastructure and regulatory clarity, Bitcoin could pave the way for greater financial inclusion, empowering individuals who were previously marginalized from formal banking services. As awareness and understanding of Bitcoin continue to expand, the future prospects for its integration into Ethiopia’s economy look increasingly bright.

Is Bitcoin legal in Egypt?