Understanding Tax Obligations 💡

Navigating tax obligations can feel overwhelming, especially in the dynamic realm of Bitcoin trading. Understanding the rules and requirements set by the Moroccan tax authorities is crucial for any individual involved in cryptocurrency transactions. By grasping the fundamentals of tax obligations, traders can proactively manage their finances and minimize potential liabilities. Learning about what needs to be reported and the associated tax rates will provide clarity on how to stay compliant within the legal framework.

Ensuring compliance with tax regulations is not just a legal requirement but also a strategic move to secure your financial stability. Recognizing how the tax system applies to your cryptocurrency activities empowers you to make well-informed decisions and optimize your trading endeavors. Stay proactive in educating yourself on tax obligations to navigate the complexities of Bitcoin trading with confidence.

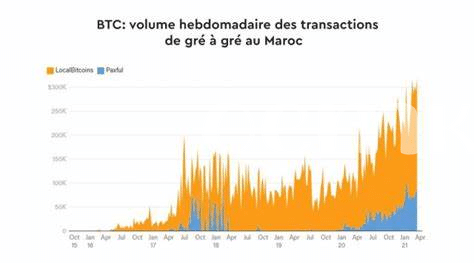

Keeping Detailed Records 📊

To effectively manage your Bitcoin trading tax liabilities, it is crucial to maintain detailed records of all your transactions. Tracking the dates, amounts, and purposes of each trade will not only streamline your tax reporting process but also provide clarity and transparency in case of any audits or inquiries. By organizing and documenting your trading activities, you can ensure compliance with tax regulations and maximize potential deductions. Additionally, keeping meticulous records can help you identify trends in your trading behavior and make informed decisions to optimize your tax obligations. Remember, the key to minimizing tax liabilities lies in the details.

Timing Your Trades Strategically ⏳

Timing your trades strategically in the world of Bitcoin trading can make a significant impact on your tax liabilities. By understanding the market trends and considering the timing of your transactions, you can potentially reduce the amount of taxes you owe. Whether it’s taking advantage of favorable tax rates at specific times or aligning your trades with exemptions or deductions, being intentional with your trading schedule can lead to more tax-efficient outcomes. Additionally, staying attuned to the ever-changing landscape of tax laws and regulations can help you adapt your trading strategies accordingly for maximum tax-saving benefits.

Considering Tax Deductions 💸

When it comes to minimizing tax liabilities in Bitcoin trading, considering tax deductions is a crucial step. By exploring available deductions, Bitcoin traders in Morocco can potentially reduce their overall tax burden and maximize their profits. From expenses related to trading activities to investment costs, identifying eligible deductions can make a significant difference in tax obligations. Understanding the nuances of tax deductions specific to Bitcoin trading is essential, as it can lead to substantial savings in the long run. To delve deeper into this topic and uncover more insights on tax deductions for Bitcoin investors, check out this informative article on tax implications of bitcoin trading in Nauru. Stay informed and make informed decisions to optimize your tax strategy.

To learn more about tax deductions available for Bitcoin investors, visit: tax implications of bitcoin trading in Nauru.

Seeking Professional Advice 🤝

When it comes to navigating the complexities of tax liabilities in Bitcoin trading, seeking professional advice is crucial. A knowledgeable tax professional can provide personalized guidance tailored to your specific situation, potentially helping you uncover opportunities to minimize tax liabilities legally. By consulting with a tax expert, you can gain insights into tax-saving strategies and ensure compliance with relevant regulations. Professional advice can not only help you optimize your tax position but also give you peace of mind knowing that you are handling your tax obligations correctly. Collaborating with a tax specialist can be a valuable investment in your financial future.

Staying Informed about Tax Laws 📚

Staying informed about tax laws is crucial for navigating the complexities of Bitcoin trading. Tax regulations can change frequently, impacting how your trading activities are taxed. By staying up-to-date with the latest tax laws, you can ensure compliance and minimize potential liabilities. This ongoing education empowers you to make informed decisions and adapt your strategies in response to any regulatory changes. To learn more about the tax implications of Bitcoin trading in Monaco, click here for detailed insights on the tax implications of Bitcoin trading in the Netherlands.

tax implications of bitcoin trading in netherlands