🌱 What Is Decentralized Finance (defi) on Ethereum?

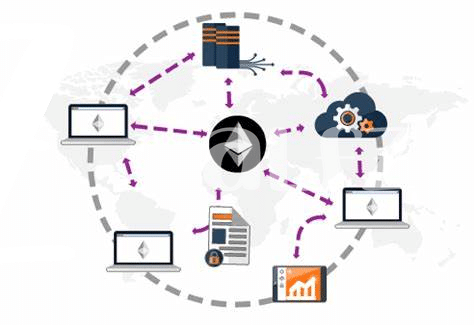

Imagine a world where the control of money isn’t in the hands of a few big banks or government bodies, but rather in a network spread across the globe, accessible to anyone with an internet connection. This is the vision of decentralized finance, or DeFi, and Ethereum is at the heart of it. DeFi on Ethereum is like building a financial Lego set; using Ethereum’s technology, developers can create their own financial tools and products without needing a central authority. This means you can lend, borrow, trade, and earn interest on your money directly, skipping traditional financial middlemen.

At its core, Ethereum powers these DeFi applications with smart contracts – bits of code that automatically execute a transaction once certain conditions are met. Imagine a vending machine: you select a snack, insert the correct amount of money, and the machine releases your choice without needing a shopkeeper. Ethereum’s smart contracts work similarly for financial transactions. This automation increases efficiency and opens up financial opportunities to those who might have been locked out of the traditional banking system. It’s a new frontier in finance, promising to make financial services more inclusive and accessible to everyone.

| Feature | Description |

|---|---|

| Smart Contracts | Automated contracts that execute transactions when conditions are met, without the need for intermediaries. |

| Accessibility | DeFi on Ethereum is open to anyone with an internet connection, making financial services more inclusive. |

🛠️ How Ethereum Powers Defi: the Tech Simplified

Imagine your favorite online game where everyone plays not just for fun but to earn real money. This world exists and is powered by Ethereum for what we call Decentralized Finance, or DeFi. In simple terms, Ethereum is like the game’s engine – it’s what makes everything run. Ethereum uses something called blockchain, which is a fancy way of saying a super-secure, online ledger that nobody owns but everyone can trust. This tech allows for DeFi applications to work smoothly, letting people lend, borrow, or even earn interest on their digital money without needing a big bank or company in the middle.

Now, you might wonder how one can get in on this. Starting is easier than you think, thanks to platforms that run on Ethereum. Imagine walking into a global, open-market where you can safely exchange digital money without the usual high fees or waiting times. Speaking of which, for those interested in learning how to save on transaction fees while participating in these global markets, a helpful guide can be found here. It’s technology like this that turns the complicated world of finance into a user-friendly, open space where anyone with an internet connection can become their own financial guru.

💸 Making Your First Defi Investment: a Step-by-step

Taking the plunge into DeFi investments on Ethereum feels like stepping into a vibrant new world, brimming with opportunities yet accompanied by its unique set of rules. Imagine yourself entering a bustling marketplace, but instead of buying fruits or clothes, you’re exchanging digital assets. You start by setting up a digital wallet, which serves as your personal safe, holding your digital money securely. With your wallet ready, you swap some of your traditional money (like dollars or euros) for Ethereum’s currency, Ether. Think of Ether as the golden key that unlocks the door to the DeFi universe.

With Ether in your wallet, you explore this universe, discovering platforms that let you lend your digital golden keys to others and, in return, earn interest, just like how a bank pays you for depositing money. Or, you might venture into trading pools, where you swap your keys for other kinds of digital treasures, betting on their future worth. Throughout this journey, you’re in control, acting as your own bank manager, making decisions that could grow your digital vault. It’s a path paved with possibilities and learnings, where each step forward is your own choice made in the vibrant, ever-evolving landscape of DeFi on Ethereum.

🔒 Safety First: Understanding Risks in Defi

Diving into the world of decentralized finance (DeFi) is like exploring a new frontier. It’s full of opportunities, but just like any adventure, there are risks too. Think of DeFi as a rollercoaster in the financial theme park; you need to know what the ride involves before hopping in. The first step is understanding that the technology is still in its infancy. This means there can be bugs or errors in the smart contracts (the automatic, self-executing contracts that power DeFi applications) which might lead to unexpected losses. Also, since it’s decentralized, there’s no customer service desk to call for help. It’s all on you to do your homework and make informed choices.

However, navigating these waters gets easier once you grasp the basics, such as knowing about the bitcoin transaction fee, which can give you a primer on how transactions work in the crypto world. It’s also crucial to understand the concept of liquidity – essentially how easy it is to convert your investment back into cash – as low liquidity could mean getting stuck with an asset you cannot sell. By recognising the importance of smart contract audits, staying informed through credible sources, and using trusted platforms, you’re taking important steps toward safeguarding your DeFi journey. Just like any investment, the golden rule in DeFi is to never invest more than you can afford to lose. With the right knowledge and cautious enthusiasm, DeFi has the potential to be an exhilarating ride.

🚀 Defi’s Rising Stars: Projects You Should Know

In the world of Decentralized Finance (DeFi) on Ethereum, new projects are popping up like mushrooms after the rain, each with its unique promise of revolutionizing how we think about money. Among these, a few stars are starting to shine brighter, capturing the attention of both seasoned investors and newcomers alike. Uniswap, for instance, has turned heads with its innovative approach to swapping different types of cryptocurrency without the need for a traditional exchange, making it a poster child for DeFi success. Similarly, Compound is redefining what it means to earn interest, offering a platform where anyone can lend their crypto and earn rates that traditional banks can’t compete with.

As we navigate this burgeoning landscape, it’s essential to keep an eye on projects that not only offer innovative solutions but also demonstrate strong security and a growing user base. Below is a table highlighting some of these rising stars, showcasing why they stand out in the ever-expanding universe of DeFi on Ethereum.

| Project Name | Description | Key Feature |

|————–|————————————————————————————————|——————————-|

| Uniswap | A decentralized protocol for automated token exchanges on Ethereum. | Liquidity pools |

| Compound | Allows users to earn interest or borrow cryptocurrencies over the Ethereum network. | Algorithmic, autonomous interest rates |

| MakerDAO | A decentralized credit platform on Ethereum that supports Dai, a stablecoin pegged to the USD. | Over-collateralized loans |

| Aave | An open-source and non-custodial protocol enabling the creation of money markets. | Flash loans |

| Yearn.finance| Optimizes your DeFi investment strategies for you. | Automated DeFi yield farming |

Each project brings something unique to the table, from creating more liquidity in the crypto market to providing new forms of lending and borrowing. They represent just the tip of the iceberg in a sea of opportunities that DeFi on Ethereum is set to offer. As the landscape evolves, keeping an eye on these and other emerging projects will be key to understanding and benefiting from the future of finance.

🌍 the Future Impact of Defi on Finance

Imagine financial services like lending, borrowing, or earning interest on savings, but available to anyone with an internet connection, no matter where they are in the world. This is the promise of decentralized finance (DeFi) built on Ethereum. It’s like a huge global bank, but instead of being controlled by a central authority, it’s run by codes on a network called Ethereum. This not just heralds a shift in how we perceive money, but it levels the playing field, giving everyone equal opportunity to financial services. The transformation could mean a future where financial inclusivity is the norm, and the barriers that once kept billions out of the global economy are dismantled.

Beyond inclusivity, DeFi on Ethereum is planting seeds for a future where financial transactions are more transparent, efficient, and secure. By removing the middleman, transactions become faster and cheaper, making everyday financial activities more accessible. However, the real magic lies in giving power back to the people. Your assets, your rules. As we venture into this new era, understanding the risks and keeping safety in mind will be crucial. If you’re intrigued by DeFi and are looking to dive into the world of cryptocurrencies, a good starting point could be learning where to buy Cardano crypto, a platform also exploring the possibilities of decentralized applications.