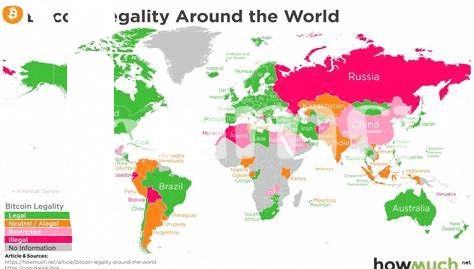

🌎 a Global Overview: Bitcoin’s Shifting Legal Landscape

Bitcoins, those digital coins that have everyone buzzing, have been on a wild ride around the world. Imagine Bitcoin as a globe-trotting adventurer, where in some places, it’s welcomed with open arms, and in others, it’s given the cold shoulder. Countries are split on how to treat this digital currency – some see it as the future of finance and are rolling out the red carpet, while others are wary, keeping strict rules or outright bans. This divide makes the world a patchwork quilt of regulations, a situation that can be puzzling for those wanting to buy, sell, or simply use Bitcoin. Despite the challenges, the trend is slowly shifting towards acceptance, with more countries exploring how to incorporate Bitcoin into their financial systems safely. Here’s a quick look at how different regions stand:

| Region | Stance on Bitcoin |

|---|---|

| North America | Generally positive, with regulatory frameworks being developed. |

| Europe | Mixed, with some countries embracing it and others imposing restrictions. |

| Asia | Varied, ranging from outright bans to full adoption as legal tender. |

| Africa | Growing interest, with some countries exploring regulation. |

| South America | Increasingly open, with Bitcoin being seen as an alternative to unstable local currencies. |

The landscape is constantly evolving as Bitcoin gains more attention, pushing countries to reconsider their positions on this digital frontier.

🔒 from Forbidden to Freed: Countries Embracing Bitcoin

Picture this: once upon a time, Bitcoin was the new kid on the block, viewed with suspicion and even barred in some places. Fast forward to today, and it’s a whole new world. A growing number of countries have moved from giving Bitcoin the cold shoulder to rolling out the red carpet. This change isn’t just about allowing Bitcoin to exist; it’s about embracing it with open arms. Schools of thought that were once skeptical are now seeing potential in this digital currency, considering it as a tool for economic growth and innovation.

In some corners of the globe, the adoption of Bitcoin is paving the way for exciting opportunities. For investors and everyday folk, this shift towards acceptance means more than just being able to trade freely. It’s about being part of a financial revolution that’s breaking down the old barriers of banking and money transfer, making everyone rethink what value really means. Amid this changing tide, staying informed is crucial. A good start? Dive into a comprehensive guide on managing Bitcoin transactions securely, especially given the global sanction policies, at https://wikicrypto.news/ensuring-security-best-practices-for-using-bitcoin-paper-wallets. This resource offers valuable insights into making the most out of Bitcoin while navigating the intricate dance of global finance.

🚫 Staying Offshore: Nations Keeping Bitcoin at Bay

Not every country is ready to roll out the welcome mat for Bitcoin. Imagine walking up to a door, excited to enter, only to find it locked. That’s the situation with Bitcoin in some parts of the world. These countries have decided to keep their distance from Bitcoin and similar digital currencies, preferring to stick with their traditional money systems. Their reasons vary, from concerns about money laundering to the fear that Bitcoin could disrupt the control central banks have over money. Just like some people are hesitant to trust anything new, these nations are waiting on the sidelines, watching how Bitcoin’s story unfolds elsewhere.

For folks living in these areas, the dream of tapping into the global Bitcoin ecosystem feels out of reach, like spotting an oasis in a desert but not being able to drink from it. This stance puts investors in a tricky spot, as they navigate a landscape where their interest in Bitcoin could be against the rules. They’re left to weigh their curiosity and potential gains against the legal boundaries set by their governments. It’s a balancing act, trying to stay informed and hopeful about Bitcoin’s potential while respecting the laws of the land.

💼 Impact on Investors: Navigating Legal Uncertainties

Navigating the swirling waters of Bitcoin’s legal uncertainties can feel like a voyage through unknown territories for investors. Picture embarking on a journey where the map keeps changing: one moment, Bitcoin is the treasure on a distant shore, welcomed with open arms, and the next, it’s forbidden fruit, cast out into the storm. This fluctuating legal environment puts investors in a tricky position, where understanding the impact of these changes becomes crucial to their investment strategy. For those looking to dive deeper, the impact of international sanctions on bitcoin transactions explained offers insights into how global policies influence market dynamics. In this ever-shifting landscape, savvy investors are learning to read the winds of legal change, adapt their sails, and navigate with caution. By staying informed and agile, they can weather the uncertainties and find opportunities in the complexities of Bitcoin’s legal journey around the world.

🏦 Banks and Bitcoin: a Complicated Relationship

Imagine giving a friend a ride and sometimes they help with gas money – that’s kind of how the relationship between banks and this digital currency works. At first, banks were like nervous parents, unsure about this new friend entering the financial playground. They worried about security and whether this friend played by the rules. This made things a bit rocky, and some banks didn’t want anything to do with it. They saw it, not as a friend, but as a rival disrupting the traditional flow of money.

However, as time passed, some banks began to see potential benefits. They thought, “If you can’t beat them, join them,” and started finding ways to work with, rather than against, this digital wave. They’re exploring how to use this technology to make transactions quicker and cheaper or even offer services related to it. The catch? They’re moving cautiously. Like learning to drive, both banks and this digital currency are figuring out how to share the road safely. It’s a complex dance, with steps forward, steps back, and a keen eye on what the future holds.

| Behavior | Risk Level | Potential Benefit |

|---|---|---|

| Cautious Engagement | Medium | High |

| Avoidance | Low | Low |

| Full Adoption | High | Very High |

🔄 Future Trends: Predicting Bitcoin’s Legal Evolution

Peering into the future of Bitcoin and its place in the legal landscape feels like gazing through a crystal ball—a blend of educated guesses and hopeful forecasting. As Bitcoin continues its journey from a niche curiosity to a mainstream financial asset, we’re likely to see a kaleidoscope of regulatory shifts. Countries that once viewed digital currencies with skepticism might soften their stance, attracted by the potential for innovation and economic growth. Conversely, the rapid expansion of Bitcoin could prompt some nations to tighten their controls, wary of the risks to financial stability. For investors and enthusiasts alike, understanding these changes will be crucial. The relationship between banks and Bitcoin, often marked by caution, may evolve as traditional financial institutions increasingly integrate cryptocurrency services. Amidst this evolving scenario, educating oneself on safe and efficient ways to manage Bitcoin becomes paramount. A critical tool for anyone looking to deepen their understanding is mastering how to create and use a Bitcoin paper wallet, an essential skill for protecting your digital assets. For a deeper dive into leveraging technology in Bitcoin management, consider exploring the intersection of artificial intelligence and bitcoin trading explained. This evolving synergy hints at a future where technology not only shapes how we trade but also how we safeguard our digital treasures. As we navigate these changing tides, staying informed and adaptable will be key to thriving in Bitcoin’s legal evolution.