Decoding Bitcoin: What’s in Your Digital Wallet? 🔍

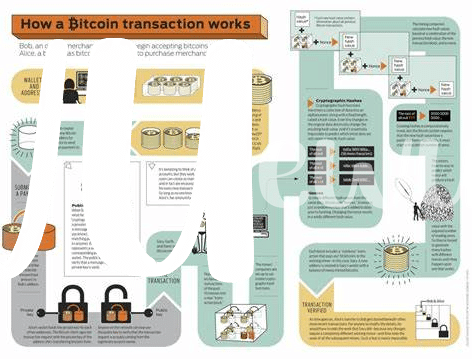

Imagine your wallet, but instead of paper money and coins, it’s packed with digital information. This is what happens when you step into the world of Bitcoin. Each Bitcoin is essentially a complex piece of digital code. When you ‘own’ Bitcoin, it means you have the key to unlock and send this code to someone else in exchange for goods, services, or other currencies. This digital wallet isn’t just a new way to shop; it’s a ticket to participating in the global digital economy.

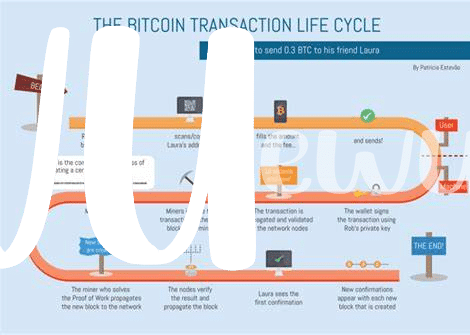

The beauty and complexity of Bitcoin lie in its technology – blockchain. Think of blockchain as a ledger or a record book that’s not held by one person or institution but spread across thousands of computers worldwide. Every transaction is a new ‘line’ added to this ledger, verified by multiple participants in the Bitcoin network to ensure everything is above board. This decentralized nature makes Bitcoin uniquely secure and transparent, setting the stage for a fascinating journey in digital finance.

| Feature | Description |

|---|---|

| Digital Wallet | Your digital store for Bitcoin |

| Blockchain | A decentralized ledger recording all transactions |

| Decentralization | Controlled by no single entity, but a network of computers |

The Global Chess Game: Understanding Sanctions 🌍

Imagine countries playing a giant game of chess on a global scale. Each move, carefully calculated, aims to control or limit the other’s power, especially in the economic arena. This is where sanctions come in, essentially rules set by one country or a group of countries to restrict or penalize another nation, with the hope of influencing its actions. It’s a strategy used to address various issues, such as human rights abuses or nuclear proliferation. The effects ripple through the chessboard, affecting not only the targeted countries but also the global community, altering the dynamics of international trade and finance.

Now, think of Bitcoin and other cryptocurrencies like a clever move in this intricate game. People and businesses in sanctioned countries might turn to cryptocurrencies as a workaround to some of the financial barriers they face. As digital, decentralized money, Bitcoin operates outside the traditional banking system, making it harder for countries to control and monitor. However, this innovative solution also presents new challenges and questions about regulation and compliance, not just for individuals but for the global economy at large. It’s a fascinating twist in the game, bringing a new layer of complexity to navigating the world’s economic sanctions. For in-depth exploration on safe crypto usage, consider the insights at https://wikicrypto.news/ai-and-bitcoin-trading-maximizing-profits-minimizing-risks.

Navigating the Maze: Bitcoin Transactions & Sanctions 🚀

In the world of Bitcoin, imagine each transaction as a journey through a complex maze, where walls shift based on the powerful rules of global sanctions. These rules, set by countries, are like invisible threads that can guide or block the path of your digital money as it zips around the world. It’s like being in a giant, global game where you need to move your money smartly without hitting a wall. Sometimes, these walls pop up suddenly when you least expect them, making it tricky to move your Bitcoin from point A to point B without running into trouble. 🚀🌐

This digital game of hide and seek gets more fascinating as you dive deeper. For folks trying to navigate these waters, understanding the lay of the land becomes crucial. It’s not just about avoiding the walls; it’s also about knowing where they might appear next. And here’s the kicker: as the global landscape shifts, the maze does too. The challenge is to stay one step ahead, keeping your transactions flowing smoothly while playing by the rules. This dance between moving digital money and adhering to sanctions is a delicate one, requiring a keen eye and a steady hand. 🕵️♂️💼

The Ripple Effect: How Sanctions Shape Crypto 🌊

When countries decide to put economic sanctions in place, it’s like blocking someone from the cool kids’ table; it makes certain financial interactions very tricky. For cryptocurrencies like Bitcoin, this can create a domino effect. Imagine throwing a small pebble into a pond; the ripples spread far and wide. Sanctions can push people towards cryptocurrencies as they seek alternative ways to move money without the usual roadblocks. But, it’s not all smooth sailing. These regulations can lead to tighter controls and more scrutiny on how digital currencies operate, influencing not just where and how they can be used, but also how they’re perceived globally. It’s a dynamic dance, with each step from policymakers causing the crypto world to adapt and shuffle. For those new to the scene, learning the basics, such as how to create and use a bitcoin paper wallet explained, becomes more than just practical advice; it’s essential knowledge in staying afloat and compliant in these choppy waters.

Staying Safe: Tips for Compliant Crypto Transactions 💡

Venturing into the world of Bitcoin can be like setting sail on the vast ocean of the internet. With the winds of global sanctions blowing, navigating these waters requires a keen understanding and a sharp lookout. The key to a smooth journey lies in abiding by the rules, much like following a treasure map where X marks the spot. Imagine a world where your digital wallet opens doors to treasure chests, but only if you have the right key. This means staying informed about the places and people you transact with, ensuring they’re not on any “no-go” lists set by the big ships of countries enforcing sanctions.

Here’s a handy table to keep your crypto journey compliant and your treasures safe:

| Tip | Details |

|---|---|

| 🔍 Know Your Transaction Partner | Ensure they are not on sanction lists by reputable bodies. |

| 🌐 Use Trusted Platforms | Engage in transactions on platforms that enforce compliance checks. |

| 🔏 Secure Your Wallet | Use strong passwords and multi-factor authentication. |

Adopting these practices isn’t just about avoiding stormy weather; it’s about ensuring that your journey through the crypto seas is profitable and above board. As the tides of policy and regulation change, staying informed and cautious will help you navigate these waters with confidence. Remember, the goal is not just to find treasure, but to enjoy the voyage while keeping your ship and crew safe.

Looking Ahead: the Future of Bitcoin and Policy 🚀

As we sail into the future, the relationship between Bitcoin and global policies is like watching the horizon for the next wave; it’s always changing and full of surprises. Governments around the world are catching up with technology and trying to find a balance. They’re crafting rules to ensure safety without stifling innovation. Imagine a world where your digital wallet plays nicely with these rules, keeping the essence of freedom that Bitcoin promises but within a framework that’s globally accepted. This is not a distant dream but a near possibility as discussions evolve and paths converge. The journey ahead is filled with potential breakthroughs that could redefine how we view and use digital currencies. Amidst this, understanding the bitcoin in literature and film: a cultural study explained could offer unique insights into how Bitcoin’s narrative might continue to unfold in the tapestry of global finance.

The dance between policy and Bitcoin is much like navigating through uncharted waters. 🚣♂️ As we look ahead, the intrigue lies not just in how policies will shape the use and acceptance of Bitcoin but also in how Bitcoin, in turn, could influence policy making. It’s a dynamic interaction that could lead to more sophisticated and inclusive financial systems globally. With every step forward, from embracing digital wallets to understanding the impact of sanctions, we are not just participants but also architects of this new era. The future promises a landscape where the lines between digital currencies and traditional finance blur, creating a world where financial empowerment and innovation go hand in hand. The key to thriving in this future? Staying informed, compliant, and open to change. 🌐🔑