🚀 the Excitement of Bitcoin Halving Explained

Imagine a world where the creation of money gets cut in half automatically every four years. That’s exactly what happens with Bitcoin, a digital currency that goes through an event known as “halving.” This event is like a scheduled party for Bitcoin enthusiasts, sparking excitement across the globe. During halving, the reward for mining new Bitcoins is reduced by 50%, making existing Bitcoins more scarce. Imagine if gold became twice as hard to mine overnight; its value might soar because it’s rarer. That’s the buzz around Bitcoin halving, enticing investors with the allure of rising values.

| Date | Halving Event | New Reward |

|---|---|---|

| 2009 | Genesis Block | 50 BTC |

| 2012 | 1st Halving | 25 BTC |

| 2016 | 2nd Halving | 12.5 BTC |

| 2020 | 3rd Halving | 6.25 BTC |

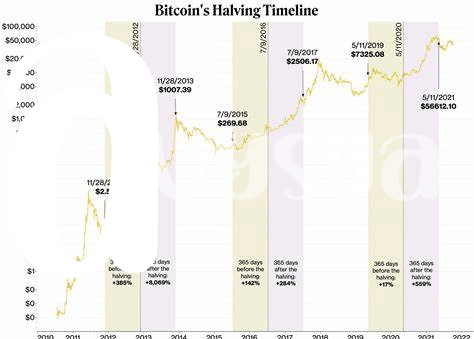

But it’s not just about making money harder to come by. The countdown to each Bitcoin halving event brings with it a wave of speculation, analysis, and potential strategy shifts for those invested in the cryptocurrency market. Like fans counting down to the release of a new blockbuster movie, participants in the Bitcoin space eagerly anticipate how this milestone can reshape the financial landscape. It’s this blend of scarcity-driven value increase and wide-eyed speculation that makes the halving cycle a thrilling ride for investors and observers alike.

🎁 Unwrapping Opportunities: Investing Prospects Ahead

When a Bitcoin Halving event draws near, it’s like the entire crypto world holds its breath, waiting to see where the chips will fall. But what exactly does this mean for someone looking to invest? Imagine standing at the edge of a vast, unexplored forest—the halving is your entry point, promising untold treasures within. As the reward for Bitcoin mining is cut in half, it typically sparks a surge in value, seeing as there’s less of it to go around. This scarcity effect is akin to finding a rare diamond in a sea of stones. For the savvy investor, this could be the perfect time to dive in or bolster existing investments. Yet, it’s not just about buying in anticipation of price spikes; there’s the potential for increased interest and adoption across the board, creating a ripple effect that benefits the entire ecosystem. Explore deeper nuances of the crypto world and how to navigate its shifts safely by visiting https://wikicrypto.news/bitcoin-vs-inflation-understanding-the-digital-safe-haven. Just remember, like any venture into the unknown, it’s crucial to tread carefully, armed with as much knowledge as possible.

🛑 Caution! Navigating Halving-related Risks

In the world of Bitcoin, the halving event is like a big wave that every surfer eagerly waits for, but not every wave is safe to ride. With the excitement it brings, there’s a side of caution every investor should heed. The halving could lead to unexpected market swings, making the sea of cryptocurrency more challenging to navigate. Some folks might find their investments taking a dip, as the reduced reward for mining Bitcoin could lead to less interest from miners, potentially slowing down the network and affecting its value.

🌊 Yet, it’s not all stormy seas. Understanding these risks is like having a map in a treasure hunt; it guides you on where to tread carefully. For investors, it means being aware and not putting all eggs in one basket, diversifying investments to manage potential downturns better. Being informed enables you to make decisions not just based on the buzz but grounded in how the halving’s ripple effects can impact the market and your portfolio. 🗺️💼

📈 Predicting Market Movements: before and after Halving

Imagine a seesaw that tips this way and that – that’s a bit like trying to figure out where Bitcoin’s price will go as we approach and pass through a halving event. Before the halving, investors might get a case of the jitters, wondering if now’s the time to buy or if they should hold off. The air is thick with anticipation, as some believe the price will soar due to the reduced supply of new Bitcoins. After the halving, we could see that anticipation morph into reality with price jumps, or the market could take a pause, leaving investors biting their nails. Amidst these fluctuations, it’s crucial to stay informed on all things Bitcoin, including the controversies surrounding bitcoin explained. With a thoughtful strategy and an eye on market behavior, enthusiasts and investors alike can navigate these waters, seizing opportunities while dodging potential setbacks. Remember, the crypto journey is a marathon, not a sprint.

💡 Smart Strategies for Crypto Enthusiasts

Diving into the world of Bitcoin halving, enthusiasts can adopt a few clever tactics to not just survive but thrive. First and foremost, educating yourself is key. Understand the basics of halving, why it occurs, and its historical impact on the market. This homework arms you with the knowledge to anticipate changes rather than react to them. Moreover, diversifying your investment portfolio prior to a halving event can cushion against unexpected market shifts. It’s not just about spreading your investments across different cryptocurrencies, but also considering other assets like stocks or gold.

Another savvy move is to keep a close eye on the market trends as the halving approaches. This period often sees heightened volatility, which, if navigated wisely, can be quite advantageous. Utilizing tools and resources like market analyses, expert opinions, and real-time data can give you an edge. Remember, the goal is to make informed decisions that align with your long-term investment strategy. Lastly, patience is paramount. The true benefits of a halving event might not be instantly recognizable, but history has shown that patience tends to pay off in the crypto world.

| Strategy | Description |

|---|---|

| Education | Understand the basics of halving and its market impact. |

| Diversification | Spread investments across different assets. |

| Market Monitoring | Watch for volatility and utilize tools for informed decisions. |

| Patience | Wait for the long-term benefits post-halving. |

🌍 Global Impact: What It Means for You

The buzz around Bitcoin halving isn’t just for those knee-deep in the world of cryptocurrency; it has ripples that touch the shores of our global economy. Think of it as a butterfly effect, where actions within the digital realm of bits and bytes can stir winds of change in real-world markets and individual financial strategies. This isn’t merely about the ebb and flow of a single digital currency’s value. It’s about the broader implications for inflation rates, the strength of traditional currency, and the way we approach investing and saving across the globe. For anyone looking to safeguard their financial future against the unpredictable waves of inflation, understanding cold storage methods for securing your bitcoin explained becomes not just useful, but essential. This phenomenon showcases the growing influence of digital currencies in shaping our economic landscape, offering a glimpse into a future where the digital and real economies intertwine more closely than ever before.