🌍 Why El Salvador Took the Bitcoin Plunge

El Salvador made headlines when it decided to fully embrace Bitcoin, becoming the first country to do so. This bold move was not made on a whim. The country was searching for a way to boost its economy and make life easier for its people. Many folks in El Salvador don’t have easy access to traditional banks, but nearly everyone has a smartphone. By saying “yes” to Bitcoin, they opened up a new world where everyone could participate in the economy, using just their phones. It was also a way to attract investors and tech-savvy businesses from around the world, hoping to transform their economic landscape.

But why Bitcoin, of all the digital currencies out there? The answer is pretty straightforward. Bitcoin is the most well-known and widely used cryptocurrency, with a proven track record. There’s a lot of trust in Bitcoin, and it’s seen as a stable digital currency compared to the newer ones. Plus, by adopting Bitcoin, El Salvador aimed to make it easier for Salvadorans living abroad to send money home without the hefty fees usually involved in cross-border transfers. Here’s a quick look at some key reasons behind El Salvador’s big Bitcoin bet:

| 🌐 Broad Accessibility | 📈 Economic Boost | 💸 Lower Remittance Fees |

| Easy access through smartphones for the majority of the population. | Attracting global investors and tech companies. | Making it cheaper and faster for families to receive money from abroad. |

By jumping into the world of Bitcoin, El Salvador set out on a path they hoped would bring more fairness, opportunity, and prosperity to their people.

🔍 Searching for the Next Bitcoin Pioneer Countries

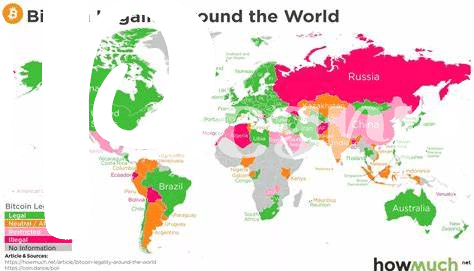

As the world keeps an eye on El Salvador’s bold move, many wonder who will follow in its footsteps. Countries around the globe are now pondering the potential of Bitcoin and how it might reshape their economies. The quest for the next Bitcoin pioneer is not just about who will say “yes” first, but about understanding the unique benefits and addressing the specific needs of each nation. Factors like economic stability, digital infrastructure, and public interest play significant roles. Additionally, countries with a high volume of remittances or those looking to bolster their tourism industry might find Bitcoin especially appealing. Given its ability to provide financial services to the unbanked, regions with low access to traditional banking could see this as a golden opportunity. Amidst this exploration, it’s important for countries to also consider the technical and regulatory groundwork needed to make such a transition. For e-retailers interested in the technical side of integrating Bitcoin payments in their business model, a detailed guide can be found here. This journey is as much about innovation and progress as it is about caution and due diligence, as countries navigate the evolving landscape of digital currencies.

💡 What Makes a Country Ideal for Bitcoin?

Imagine a place where paying for your morning coffee or sending money to a friend far away could be done quickly, safely, and without the need for traditional money. This is the kind of future some countries dream of by welcoming Bitcoin with open arms. But what makes a country the perfect match for Bitcoin? First off, a strong interest in technology among the people. Folks need to be curious about digital trends and open to trying new forms of money. Then, there’s the need for a stable internet connection across the country, as Bitcoin lives online. Another key ingredient is support from leaders. Imagine the people in charge saying, “Yes, let’s give this new money a shot and see how it helps us.” Additionally, having rules in place to protect users while also allowing room for growth is crucial. These elements combined create a fertile ground for Bitcoin to not only grow but thrive, offering a glimpse into a future where digital currency is as common as the phone in your pocket. 🌐🚀✨

🌐 Regions Showing Interest in Cryptocurrency Adoption

Around the globe, several regions are tipping their toes into the cryptocurrency pool, showing a keen interest in joining the Bitcoin bandwagon. In Latin America, where financial inclusivity remains a persistent challenge, countries like Argentina and Venezuela are witnessing a surge in Bitcoin transactions among their citizens, driven by the desire for a more stable and accessible form of money than their local currencies can offer. Over in Asia, particularly in Southeast Asia, nations such as the Philippines and Thailand are geared towards creating a friendly environment for digital currencies, seeing them as a gateway to enhanced financial services for their populations. Europe isn’t staying behind either, with countries like Switzerland and Estonia making headlines for their progressive stance on cryptocurrencies, looking to position themselves as leading tech hubs. The attraction to Bitcoin and its kin across these regions isn’t just about jumping on a trend; it’s a strategic move towards financial empowerment, innovation, and stability. For those eager to delve deeper into the world of cryptocurrencies and even learn how to engage in bitcoin futures trading explained, the journey ahead promises a mix of discovery, opportunity, and, of course, challenges.

🚀 Possible Challenges in the Bitcoin Adoption Journey

Embarking on a bitcoin adoption journey can spark a mix of excitement and uncertainty. One of the biggest hurdles is the technological leap required. Not everyone is tech-savvy, and moving to a digital currency system means everyone from local coffee shop owners to retirees needs to get on board with using new tools and apps. It’s a big ask, and without the right support and education, this can be a stumbling block. Then there’s the roller coaster of bitcoin’s value. Imagine saving up bitcoins only to find their value has dropped significantly overnight. It’s a risky game, and such volatility can scare off not just individuals but entire countries. Additionally, governments around the world are watching and sometimes they’re not too keen on cryptocurrencies. They might introduce strict rules that can make it hard for bitcoin to really take off. Here’s a quick look at some of these challenges:

| Challenge | Description |

|---|---|

| Technology Adoption | Ensuring the population is equipped and knowledgeable to use bitcoin. |

| Price Volatility | Dealing with the unpredictable changes in bitcoin’s value. |

| Regulatory Uncertainty | Navigating through potential government restrictions and laws against bitcoin. |

Keeping an eye on these factors will be crucial for any country considering taking the leap into the world of bitcoin.

🎉 Potential Benefits for Early Bitcoin Adopting Countries

When countries decide to step into the world of Bitcoin early on, they’re not just jumping onto a trend; they’re setting their sails for a journey filled with potential. Imagine, for a moment, a future where these pioneering nations enjoy increased financial inclusion. This means more people have access to banking and the ability to save or grow their money, especially in places where traditional banking might as well be a world away. Then there’s the boost to their economy; by opening up to global cryptocurrency markets, they’re inviting investment and innovation right to their doorstep. Not to mention, by incorporating Bitcoin, they’re also tapping into a younger, tech-savvy demographic eager to engage with modern financial tools. Plus, for businesses, the adoption could streamline operations and reduce costs, especially in international transactions. And while concerns about the environmental impact of Bitcoin mining are valid, there are ongoing discussions and developments aimed at making it more sustainable—something interested individuals can learn more about here: utilizing bitcoin for e-commerce transactions explained. In sum, these early adopters could very well be setting the stage for a more inclusive, efficient, and dynamic financial future, showcasing the power of embracing change and innovation.