Tesla’s Huge Investment in Bitcoin Explained 🚗

Imagine opening your favorite news app and finding out a big-name car company has just made a blockbuster move in the digital money world. That’s right, we’re talking about Tesla, the electric car pioneer, deciding to jump into the deep end of the Bitcoin pool with a massive investment. It shook up both the car industry and the crypto universe because, let’s face it, when a company led by one of the most forward-thinking CEOs takes a leap, people sit up and take notice.

But what does this all mean? Well, Tesla didn’t just buy a cup of coffee with Bitcoin; they went all in, purchasing $1.5 billion worth of this digital currency. This move wasn’t just about diversifying their investment portfolio; it was a bold statement of trust in Bitcoin’s future. Now, imagine the buzz this created among investors and tech enthusiasts alike. It was like witnessing history, where the paths of electric cars and digital money collided, promising an electrifying journey ahead.

| Date | Event | Impact |

|---|---|---|

| February 2021 | Tesla Announces $1.5 Billion Investment in Bitcoin | Significant increase in Bitcoin’s price; increased credibility and interest in cryptocurrency as a whole |

How the Car Giant Shocked the Crypto World 🌍

When Tesla announced it had sunk a hefty sum into Bitcoin, the news sent shockwaves through the crypto universe. Imagine the ripple of surprise and excitement that traveled far and wide—everyone from casual enthusiasts to hardcore investors felt the impact. Suddenly, a pioneering car company known for pushing boundaries in renewable energy was placing a significant bet on digital currency. This move wasn’t just a statement; it was a colossal vote of confidence in Bitcoin, lighting up online forums, social media, and news outlets with fervent discussions. Questions flew thick and fast: What does this mean for Bitcoin’s legitimacy? How will this affect its value? Overnight, Tesla had transformed from an electric vehicle manufacturer to a key player in the cryptocurrency saga, sparking intense speculation on the future of digital finance. For those intrigued by the intersect of technology and currency, this deep dive into Bitcoin’s evolving security landscape showcases how hardware wallets are increasingly outshining their software counterparts https://wikicrypto.news/revolutionizing-subscription-models-bitcoin-micropayments, paving the way for safer and more reliable crypto transactions.

Impact on Bitcoin’s Price: a Rollercoaster Ride 🎢

Imagine hopping onto a wild amusement park ride, unpredictably swooping up and down—that’s what happened to Bitcoin’s value when Tesla revealed its massive investment in the cryptocurrency. This unexpected move by the electric car titan sent waves through the financial world, catapulting Bitcoin’s price to dizzying heights before plunging it into valleys of uncertainty. Much like spectators watching a high-stakes gamble, the global audience was glued to their screens, tracking every twist and turn in the saga. Tesla’s backing seemed to stamp a seal of approval on Bitcoin, inviting more players to take a seat at the crypto table. However, this whirlwind adventure wasn’t just a show of confidence in digital currencies; it was a prime example of how influential companies can sway market tides, leaving small investors riding the waves of their decisions. Beyond just numbers on a chart, this episode underscored the volatile nature of cryptocurrencies and Tesla’s potential to act as both a catalyst and a disruptor in this digital domain.

Tesla’s Strategy: Why Bitcoin and Why Now? 💡

In the world of big moves and even bigger surprises, Tesla’s dive into the Bitcoin pool was more than just splashing about. This decision didn’t come out of the blue; it was a calculated strategy painting a broader picture for the future. Imagine a world where your car doesn’t just take you from point A to point B, but could also play a part in this digital gold rush. By investing in Bitcoin, Tesla wasn’t just hedging its bets against traditional currency fluctuations. It was signaling a vote of confidence in a digital currency future, making everyone sit up and pay closer attention to Bitcoin. This move sparked a conversation on the role of corporations in the crypto market, pushing the idea that maybe, it’s time for more companies to think outside the traditional financial box.

The timing couldn’t have been more intriguing. With the world tilting more towards digital payments and the idea of digital gold becoming more appealing, Tesla’s pivot to Bitcoin seems like a futurist’s bet. But it’s not just about being futuristic; it’s about resilience and diversification. Investing in Bitcoin at a time when the world is questioning and reshaping the concept of value and wealth shows a pursuit for innovation and flexibility. For those curious about stepping into this evolving digital finance landscape, there’s a wealth of information available on choosing between software and hardware bitcoin wallets market trends, a cornerstone decision for anyone looking to navigate these waters. Tesla’s big bet is more than a headline; it’s a chapter in a larger story about the meeting point of technology, finance, and innovation.

The Ripple Effect on Other Companies and Markets 📊

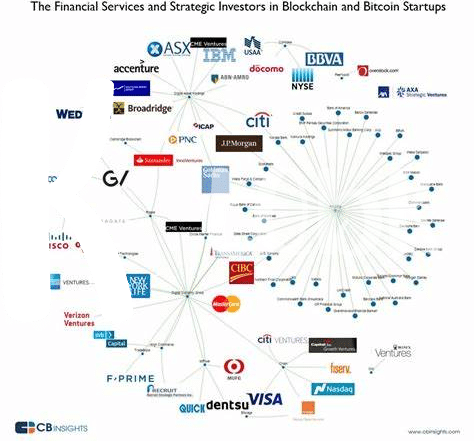

When Tesla announced its investment in Bitcoin, it sent ripples through the business world, encouraging other companies to consider cryptocurrencies as a viable part of their investment portfolio. 🚀📈 Imagine a stone thrown into a calm pond; Tesla’s move was that stone, and the wider market is the pond. Waves spread outwards, reaching far and wide. Other giants in tech and finance began examining how they too could benefit from integrating Bitcoin and other digital currencies into their business strategies. This interest sparked a broader acceptance, slowly shifting the perception of Bitcoin from a speculative asset to a more mainstream financial instrument. In a way, Tesla laid down a path that others are now eager to follow, potentially transforming the future of digital payments and investments.

Here’s a glimpse of how companies have started exploring cryptocurrencies:

| Company | Action |

|---|---|

| Microsoft | Accepting Bitcoin Payments |

| PayPal | Launching Cryptocurrency Services |

| Visa | Partnering with Crypto Platforms |

The future looks bright as more businesses join the fray, further solidifying Bitcoin’s position in the global market.

Looking Ahead: Tesla and Bitcoin’s Future Together 🔮

As we cast our eyes to the horizon, the partnership between Tesla and Bitcoin seems primed to launch into new territories. Tesla’s pioneering spirit, coupled with Bitcoin’s digital frontier, could potentially unlock groundbreaking innovations in how we view and use money. Imagine a world where electric vehicles not only drive us forward but also facilitate our daily transactions effortlessly through Bitcoin, making things like charging your car a seamless, almost invisible financial transaction. This symbiotic relationship could lead to the development of more sustainable financial models, especially as we see how bitcoin supports philanthropic initiatives globally market trends. Together, Tesla and Bitcoin could set the pace for how businesses integrate cryptocurrency into their operations, driving both market growth and greater acceptance in society.

Tesla’s daring move into Bitcoin is more than just an investment; it’s a statement about the future of money and technology. Other companies are watching closely, likely to follow Tesla’s lead into the cryptocurrency space, further cementing Bitcoin’s role in the global economy. As Tesla continues to innovate in the automotive and energy sectors, its association with Bitcoin could pave the way for a new era of financial technology where cryptocurrency is at the heart of transactional operations, powering not just cars but potentially every aspect of our digital lives. The journey of Tesla and Bitcoin, embarking together, promises to be an exciting ride, reshaping our concepts of money, value, and technology in a rapidly evolving world 🌍🚗💡.