🌍 Unbanked Community: Who Are They?

Imagine a group of people, living their daily lives, earning, spending, saving but with one big difference – they don’t have bank accounts. This group, known as the unbanked community, includes millions of individuals around the world. For various reasons, from not having enough money to open an account to living too far from a bank or not trusting these institutions, they operate outside the conventional financial system. This means no credit cards, no online payments, and no safety net if their cash is lost or stolen. It’s a reality that might seem distant to those of us with easy access to financial services, but it’s a day-to-day challenge for a significant portion of the global population.

For a clearer perspective, let’s sprinkle some numbers. According to the World Bank data from 2021, about 1.7 billion adults worldwide remain unbanked. They predominantly rely on cash transactions, which can limit their opportunities for economic growth and make it harder to achieve financial security.

| Region | Unbanked Adults (in millions) |

|---|---|

| East Asia & Pacific | 453 |

| South Asia | 372 |

| Sub-Saharan Africa | 350 |

| Latin America & Caribbean | 210 |

| Middle East & North Africa | 168 |

| Europe & Central Asia | 117 |

| High-income OECD | 16 |

This situation underlines a significant inequality in the financial world, leaving these individuals vulnerable and often unable to tap into economic advancements that could improve their lives. It’s a story of exclusion in a world moving swiftly towards digital and financial integration.

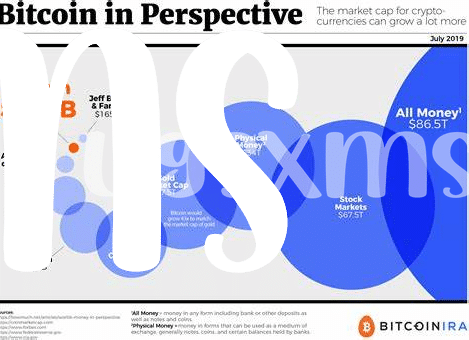

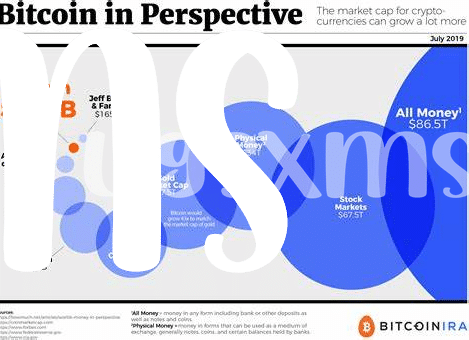

💡 Bitcoin Basics: Understanding the Basics

Imagine a world where everyone has the power to manage their own money, no bank account needed. This is the promise of Bitcoin, a type of money that’s entirely online. Think of it like sending an email, but instead of words, you’re sending money to someone else, anywhere in the world, day or night. No banks are middlemen snooping around or charging extra fees. It’s like having your own little bank in your pocket, only you hold the keys. This digital money is kept secure through some clever math and rules everyone agrees on, no matter where you are. So, whether buying a cup of coffee or sending help to a friend far away, Bitcoin is making it as simple as sending a text message. For a closer look into how Bitcoin is stepping up its game, especially in areas of security, check out https://wikicrypto.news/enhancing-security-why-hardware-bitcoin-wallets-outshine-software. Here, you dive into how protecting your Bitcoin is becoming simpler and stronger with hardware wallets, offering a peace of mind in your digital financial journey.

🤝 How Bitcoin Changes Lives: Inspiring Stories

Imagine a world where your money doesn’t rely on a physical bank. That’s the reality for some people thanks to Bitcoin. 🌏✨ From a farmer in a remote village to a small business owner in a bustling city, these individuals have found financial freedom. For the farmer, Bitcoin means selling his crops at a fair price directly to buyers anywhere, without losing a chunk in transaction fees. Meanwhile, the small business owner uses Bitcoin to buy materials from overseas without the headaches of currency exchange. Their stories are not just about making or saving money; they’re about empowerment and breaking free from traditional banking barriers. These real-life tales show how Bitcoin is more than just digital currency; it’s a lifeline to the unbanked, connecting them to the global economy. 🚀💼

🚀 Overcoming Challenges: from Skepticism to Trust

Shifting people’s attitudes from skepticism to trust towards Bitcoin wasn’t an easy road. Initially, many saw it as complex or risky, especially those not familiar with digital trends. However, real-life success stories began to emerge, showcasing how Bitcoin provided a lifeline for those without access to traditional banking. This wave of positive outcomes played a crucial role in changing perceptions. For instance, in regions where bank fees are too high or banks are too far away, Bitcoin became a beam of hope, enabling people to safely send and receive money. Challenges like understanding how Bitcoin works or the fear of the unknown were gradually overcome through community support, educational resources, and firsthand experiences of benefits. These stories of transformation and the active roles taken by renowned corporate giants investing in bitcoin: a trend analysis market trends further bolstered confidence. People started to see Bitcoin not just as an alternative, but as a reliable option for financial inclusion, bridging the gap between the digital currency and everyday life. Now, as trust continues to grow, so does the curiosity and openness towards embracing Bitcoin, paving the way for a more inclusive financial future.

🛠 Practical Steps: Getting Started with Bitcoin

Diving into the world of Bitcoin might seem complex at first, but it’s like learning to ride a bike – once you get the hang of it, it’s a breeze. The first step is setting up a digital wallet, think of it as your online piggy bank where you’ll store your Bitcoin. There are plenty of options out there, each with its own set of features. Whether you prefer something user-friendly for beginners or something more advanced, there’s a wallet out there for you. Remember, ensuring the safety of your digital wallet is crucial – just like you wouldn’t leave your physical wallet lying around.

After getting a wallet, the next step is buying your first Bitcoin. You can do this through online exchanges, which work a bit like currency exchange at an airport, but for digital currencies. Here’s a simple guide to help you start your journey:

| Step | Action |

|---|---|

| 1 | Choose a digital wallet |

| 2 | Secure your wallet |

| 3 | Find a Bitcoin exchange |

| 4 | Buy your first Bitcoin |

| 5 | Practice sending and receiving Bitcoin |

This table is your roadmap. Start small with what you’re comfortable losing as you learn the ins and outs. Bitcoin isn’t just a new type of money; it’s a community, and there’s plenty of support out there for newcomers. Forums, social media groups, and local meetups can be great resources. Dive in, ask questions, and soon you’ll find yourself part of an exciting, ever-evolving world.

🌈 the Future: What’s Next for Bitcoin Adoption?

As Bitcoin continues to weave its path through the economic tapestries of societies worldwide, we stand on the brink of a pivotal shift in how we perceive and engage with money. This digital currency, once a novel concept wrapped in mystery and skepticism, is now sparking a revolution that extends beyond the tech-savvy enthusiasts to reach everyday folks striving for financial inclusion and empowerment. The beauty of Bitcoin lies in its ability to provide an alternative for those previously sidelined by traditional banking systems. But what lies ahead is even more exciting. As technology evolves, we’re seeing innovative solutions like making micropayments feasible with bitcoin market trends, which aim to harness the power of Bitcoin to make even the smallest transactions viable and efficient. This advancement could open a plethora of opportunities for micro-entrepreneurs globally, further democratizing economic participation.

Looking towards the horizon, the journey of Bitcoin adoption is set to break new ground. The ongoing development and refinement of user-friendly platforms promise to lower the entry barriers even further, making it more accessible for everyone, irrespective of their tech know-how or financial background. Innovations in securing and managing digital wallets, especially the choice between software and hardware solutions, will play a crucial role in fostering trust and confidence among new and existing users alike. As we delve into this uncharted future, the cornerstone of success will hinge on education and community support. By empowering individuals with the knowledge and tools needed to navigate the Bitcoin ecosystem, we’re not just transforming the way we transact; we’re reshaping the financial landscape to be more inclusive, equitable, and attuned to the needs of the global unbanked population.