What Is Bitcoin and Why It Matters 🌍

Picture opening your digital wallet, not to pull out cash or a card, but to use a type of money that’s entirely online. That’s where Bitcoin comes in! Born from the internet, Bitcoin is like digital gold that anyone can send to each other, no banks needed. It matters because it’s changing how we think about money. Before, we needed banks to guarantee our money’s value and to transfer it, but Bitcoin does this with technology, allowing people to send money directly to each other from anywhere in the world.

| Feature | Bitcoin | Traditional Money |

|---|---|---|

| Physical form | No, completely digital | Yes, coins and notes |

| Need for a bank | No | Yes |

| Global transfer | Easy and fast | Can be slow and expensive |

What makes Bitcoin a game changer is not just its digital nature, but its ability to give the power of money back to the people. Without needing a middleman, it offers freedom in financial transactions that’s never been possible before. This is why understanding Bitcoin is not just about witnessing a new kind of money, but about seeing the potential for a revolution in how financial freedom can be achieved worldwide.

Unraveling the Mystery: How Blockchain Works 🔗

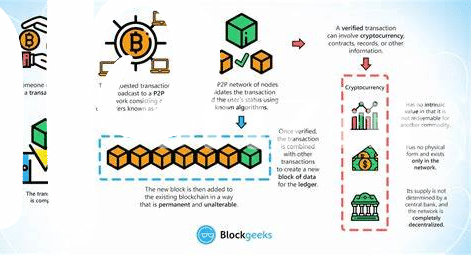

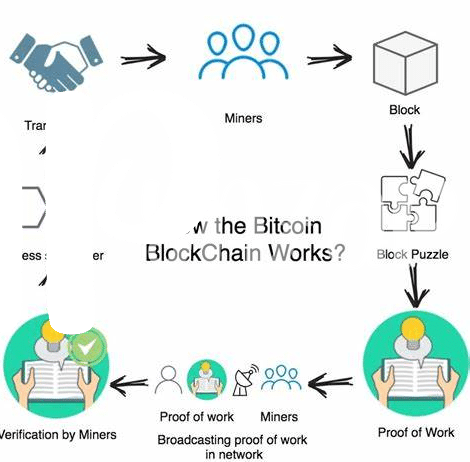

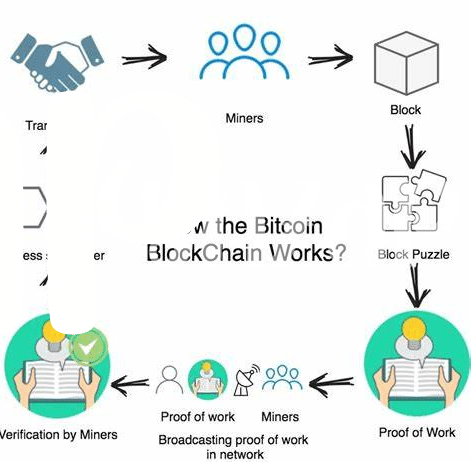

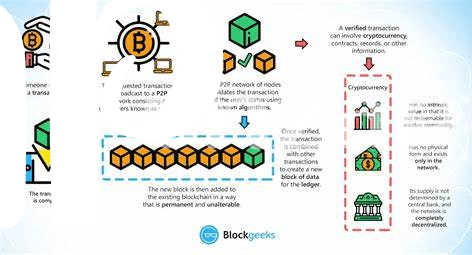

Imagine a world where keeping your money safe doesn’t require a bank, but a network of computers. This is where blockchain, the technology behind Bitcoin, changes the game. Simply put, blockchain is like a digital ledger that keeps a secure and unchangeable record of transactions. When someone buys, sells, or transfers Bitcoin, the transaction is recorded on a “block.” Each block is then linked to the one before and after it, creating a chain of blocks – hence the name, blockchain. This process is overseen by a community of users, not a central authority, making it incredibly difficult for any naughty business to tamper with the records.

What’s truly revolutionary about blockchain is that it enables trust in a trustless environment. Imagine handing a stranger a ten-dollar bill. You can see the bill moving from your hand to theirs. Blockchain does something similar for digital transactions, but instead of you and the stranger, it’s thousands of computers witnessing the transaction. This transparency means everyone can see the details of the transaction (though not who’s behind it), ensuring that it’s fair and secure. For more in-depth insights into navigating this landscape, https://wikicrypto.news/analyzing-trends-how-cryptocurrency-technologies-are-changing-finance offers a wealth of information.

Bitcoin Vs. Traditional Money: the Key Differences 💵

When we think about money, our minds usually jump to images of paper bills and metal coins. Traditional money, the kind we can hold in our hands, has been around for ages. It’s something issued by governments, something we have trusted to buy our needs and save for our wants. Then comes Bitcoin, a completely digital form of money. Unlike the dollars or euros in your wallet, Bitcoin lives on the internet. You can’t touch it, but you can use it to buy things and even trade it, much like traditional money. The big difference? Bitcoin isn’t controlled by any government or single entity. It’s decentralized, which means its fate isn’t tied to the decisions of a central authority. This independence from traditional financial systems is a breath of fresh air to some, but a point of concern for others. Another big difference is how new Bitcoins are created. While central banks can print more money, Bitcoin’s creation is strictly controlled by complex math problems solved by computers. This setup is designed to mimic the scarcity and effort required to mine precious metals, adding a unique twist to the idea of ‘making money.’ 😲💻💸

The Global Impact of Bitcoin and Blockchain 🌐

Imagine a world where transferring money is as simple as sending a message, and investing in projects from halfway across the globe is as easy as buying a cup of coffee at your local store. This is the world Bitcoin and blockchain are creating, tearing down the traditional boundaries of finance and inventing new ways for money to move and grow. With Bitcoin, anyone with an internet connection can participate in a global economy, free from the limitations and fees of traditional banking systems. Meanwhile, blockchain, the technology behind Bitcoin, is becoming the backbone of a new type of internet—think of it as a ledger that everyone can see, but no one can tamper with. This transparency and security could mean a future where corruption is a thing of the past, and every transaction is fair and clear. For those interested in exploring how these technologies can be integrated into daily life, visiting how to create and use a bitcoin paper wallet market trends is a great place to start. Yet, as the globe embraces these changes, the ripple effect alters everything from how we invest in businesses to how we think about currency, making the possibilities as boundless as they are exciting.

Challenges and Controversies Surrounding Bitcoin 🚧

Bitcoin, often seen as the future of money, isn’t without its share of challenges and controversies. A major roadblock is its volatile nature; imagine waking up to find your digital wallet’s value has drastically dropped overnight! This unpredictability scares many potential users and investors away. There’s also the issue of security – while Bitcoin prides itself on its secure transactions, its digital nature makes it a hot target for savvy hackers. Remember, once your Bitcoin is gone, it’s almost impossible to get it back. Then, there are concerns about its use in illegal activities. Since Bitcoin transactions can be made anonymously, it’s become the go-to for the online black market. This notoriety has led to wary eyes from governments worldwide, with some even banning its use. Moreover, the technology behind Bitcoin, called blockchain, although revolutionary, consumes a tremendous amount of energy, raising environmental concerns. To sum up, while Bitcoin promises a new era of financial transactions, it’s tangled in a web of issues that needs untangling for it to truly become the future of money.

| Challenge | Description |

|---|---|

| Volatility | Bitcoin’s value can dramatically fluctuate, causing instability. |

| Security Risks | High targets for hackers with a risk of irreversible loss. |

| Illegal Use | Anonymous nature makes it appealing for illicit activities. |

| Regulatory Issues | Governments scrutinizing and sometimes banning its use. |

| Environmental Concerns | Blockchain’s significant energy consumption raises sustainability issues. |

Imagining the Future: Bitcoin’s Potential and Possibilities 🚀

Imagine a future where your money isn’t just a piece of paper but a secure, digital token – that’s Bitcoin for you, a currency that’s as free as the internet itself. This futuristic currency allows you to be your own bank, making transactions without the need for a middleman. The possibilities are as vast as they are thrilling. Imagine buying your morning coffee, your house, or even investing in businesses directly with Bitcoin. This could mean lower costs and more power in the hands of everyday people. Plus, with Bitcoin, sending money across the globe is as easy as sending a text message, potentially revolutionizing international trade and aid.

But the wonder doesn’t stop with Bitcoin. The technology behind it, known as blockchain, could change how we do everything online. Think of it as a book where each page (block) records transactions, and once written, it’s there forever. This could mean more than just safe money. It could lead to secure, transparent voting systems, unbreakable contracts, and even artists being paid directly for their music and art. For those interested in diving deeper into this exciting world, consider exploring educational resources to understand the nuances of these technologies. Navigating the world of bitcoin and nft collaborations market trends can offer insights into how these technologies intertwine, paving the way for a future where digital currencies and online transactions are the norms, transforming how we view, use, and trust money in a digital age.