🪙 What Exactly Is Bitcoin Halving?

Imagine a digital universe where Bitcoin, the pioneering cryptocurrency, decides to play a little game every four years. It’s called the halving, and it’s a bit like a magic trick that affects how many new bitcoins come into the world. Picture miners – not with pickaxes, but with powerful computers, working to solve complex puzzles. Each time they succeed, they’re rewarded with Bitcoin. But every four years, this reward is cut in half. It’s Bitcoin’s way of making sure its treasure doesn’t run out too quickly, aiming to keep things fair and valuable for everyone involved.

This event isn’t just a big deal for Bitcoin miners but also shapes the future of the digital coin world. It’s like when a major player in a game changes the rules, everyone has to adapt. The halving is designed to control the supply of Bitcoin, making it a rare find and potentially more valuable over time. It’s a concept that adds a layer of excitement and anticipation for what’s to come, encouraging players in the crypto space to stay on their toes.

| Halving Event | Date | Reward Before Halving | Reward After Halving |

|---|---|---|---|

| 1st Halving | 2012 | 50 BTC | 25 BTC |

| 2nd Halving | 2016 | 25 BTC | 12.5 BTC |

| 3rd Halving | 2020 | 12.5 BTC | 6.25 BTC |

🚀 the Immediate Impact on Bitcoin’s Value

When Bitcoin halving occurs, it’s like a big celebration in the world of digital currency, but instead of fireworks, what we see is a change in how Bitcoin miners are rewarded. Just like cutting a cake into smaller pieces, the reward for mining Bitcoin is halved, meaning miners receive 50% less Bitcoin for their efforts. This might seem like bad news for miners, but it has a fascinating impact on Bitcoin’s value. Imagine if overnight, the amount of gold a miner could dig up halved. Everyone would suddenly see gold as more scarce, and therefore, more valuable. Similarly, when Bitcoin halves, it subtly reminds everyone that there’s only a limited amount of this digital gold out there, which often causes the value of Bitcoin to jump. It’s like the market takes a moment to remember what makes Bitcoin special in the first place – its scarcity.

Looking into how this sudden leap in value can affect things, we see that it’s not just about Bitcoin. There’s a ripple effect that touches every nook and cranny of the cryptocurrency world. For those curious about how these shifts can be leveraged for other types of profit in the tumultuous seas of cryptocurrency trading, exploring strategies for profiting from Bitcoin futures market volatility can offer some intriguing insights. As Bitcoin’s value takes its post-halving leap, it sets off a chain reaction. Other digital currencies, often referred to as altcoins, see their values and trading dynamics change in response. This interconnectivity means that a single event in the Bitcoin ecosystem doesn’t just stay within Bitcoin’s borders; it sends waves throughout the entire cryptocurrency ocean.

🌊 Ripple Effects: What Happens to Altcoins?

When Bitcoin goes through one of its famous halving events, where the reward for mining new bitcoins is cut in half, it’s not just Bitcoin that feels the waves; altcoins (alternative cryptocurrencies) get rocked by this event too. Imagine throwing a large stone into a pond — the splash represents the impact on Bitcoin, and the ripples that follow mimic the effect on altcoins. As Bitcoin becomes scarcer and potentially more valuable post-halving, investors’ interest often spreads to altcoins, hoping to discover the next big thing. This surge in attention can lead to price increases across the board, as the entire crypto market often moves in sympathy with Bitcoin.

However, it’s not just a straightforward tale of rising tides lifting all boats. Some altcoins may benefit more than others based on various factors, including how their technology compares, their current market position, and how their development teams respond to the changing market dynamics. The anticipation and reaction to Bitcoin halving can drive speculation, leading to significant price swings in altcoins, creating both opportunities and risks for investors. Navigating this period requires a keen eye on market trends and an understanding of how the interconnected nature of cryptocurrencies can affect investments across the board.

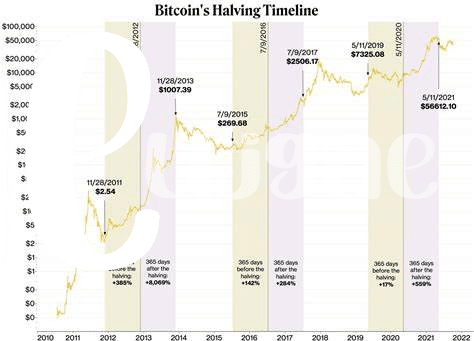

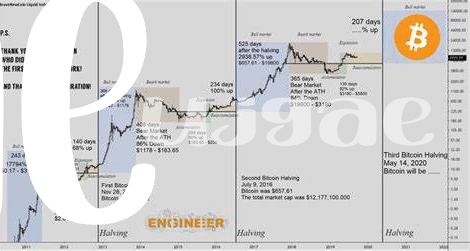

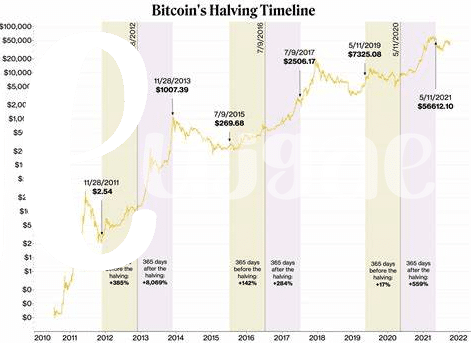

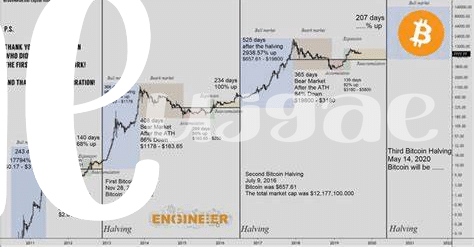

📈 Analyzing Past Halvings and Altcoin Behavior

When we dive into the history books, we notice a fascinating trend each time Bitcoin decides to cut its rewards in half—a little event we like to call halving. This isn’t just a big moment for Bitcoin; it’s a tidal wave that sends ripples across the whole sea of altcoins. Imagine a giant rock thrown into a pond, and you’ve got the right idea. Following these pivotal moments, altcoins tend to embark on a rollercoaster ride of their own. Sometimes, they skyrocket, finding new heights as investors look for new opportunities. Other times, they take a nosedive if everyone’s eyes are glued to Bitcoin. It’s like watching dominoes fall—one push and everything starts moving. This dance between Bitcoin and altcoins isn’t just a spectacle; it offers sharp insights into the interconnected nature of the cryptocurrency world. For anyone keen on keeping their privacy while navigating these shifting sands, understanding the nuances, including privacy in the bitcoin network: enhancements and challenges market trends, is crucial. Whether you’re a seasoned investor or a newcomer trying to make sense of the crypto craze, these patterns illuminate the path forward, helping you anticipate the next big wave.

💡 Why Should Altcoin Investors Care?

Imagine you’re at the beach, watching the waves: when a big one hits, it’s not just the spot where it crashes that feels the impact; the ripples spread, reaching far and wide. In the world of digital currencies, Bitcoin is like that massive wave, and the altcoins are like the shores receiving the ripples. Every time Bitcoin undergoes a halving—where the rewards for mining new bitcoins are cut in half—its scarcity increases, potentially boosting its value. This event doesn’t happen in isolation; it sends shockwaves through the entire cryptocurrency market. Altcoin investors should perk their ears because, following a Bitcoin halving, the dynamics of the market can shift dramatically. Historically, some altcoins have seen their values soar as investors diversify their portfolios, wary of the volatility and high prices of Bitcoin. For anyone holding or considering investing in altcoins, these periods post-halving are ripe with both opportunities and risks. It’s a time when understanding the interconnections between Bitcoin and altcoins can help in making informed investment decisions—and perhaps even spotting the next big wave before it hits.

| Effects on Altcoins Post-Bitcoin Halving | Opportunity | Risk |

|---|---|---|

| Increased Attention | 📈 Potential for higher gains | 📉 Potential for greater volatility |

| Market Shifts | 🔄 Diversification options | 🔍 Need for careful analysis |

| Value Fluctuations | 💸 Chance to buy low | 💰 Risk of buying high |

🛠️ Strategies for Navigating Post-halving Market Shifts

After the Bitcoin halving, navigating the wild waves of the crypto market requires a keen eye and a solid plan. Think of it as setting sail in unpredictable waters – preparation is key. For starters, keeping a close watch on market trends is crucial. Understand that the market might be more volatile right after a halving, but this also means opportunities may arise. Diversifying your portfolio can be a good strategy. Don’t put all your eggs in one basket; instead, explore other promising altcoins or blockchain projects. This doesn’t mean you should jump on every new coin that comes along. Do your homework, research thoroughly, and maybe even dabble a bit in Bitcoin futures trading to hedge against potential losses.

On that note, understanding how to safely engage in these market maneuvers is essential. Protecting your investments from cyber threats becomes even more critical in such volatile times. To sail smoothly through these choppy waters, equip yourself with the right knowledge and tools. For detailed strategies on staying secure while capitalizing on market trends, check out preventing bitcoin cybercrime: tips and tools market trends. Remember, in the dynamic world of cryptocurrencies, staying informed and cautious is the key to navigating post-halving market shifts successfully. 🌐💼