🌍 a World Tour of Bitcoin Regulations

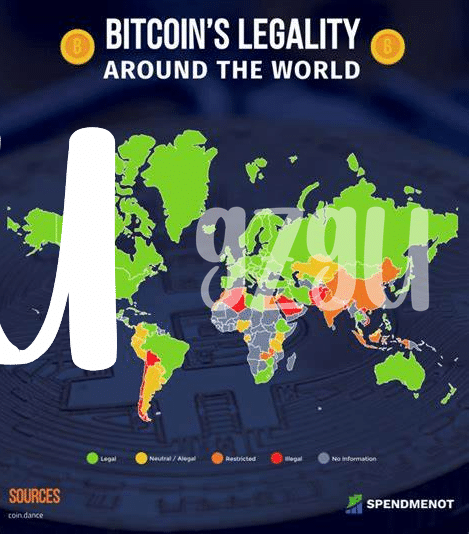

Imagine taking a journey around the globe to explore how different places treat Bitcoin. Picture countries as spots on a map, each colored based on their stance towards this digital currency. Some places warmly welcome it, seeing it as a breakthrough in finance. Others are cautious, putting up rules to make sure everything stays in order. Then, there are those that firmly say no, worried about the risks. This global overview isn’t just about where you can use Bitcoin; it’s about understanding the diverse beliefs and concerns that shape its regulation. It’s like seeing the world through a financial lens, highlighting how tradition and innovation are trying to find common ground. This variety isn’t just interesting—it directly influences how Bitcoin grows and is accepted worldwide.

| Region | Stance on Bitcoin |

|---|---|

| North America | Mixed, innovation-friendly but with regulatory safeguards |

| Europe | Generally open, with a strong regulatory framework |

| Asia | Varied, from very welcoming to outright bans |

| Australia | Positive, with clear and supportive regulations |

| Africa | Emerging, with growing interest and adoption |

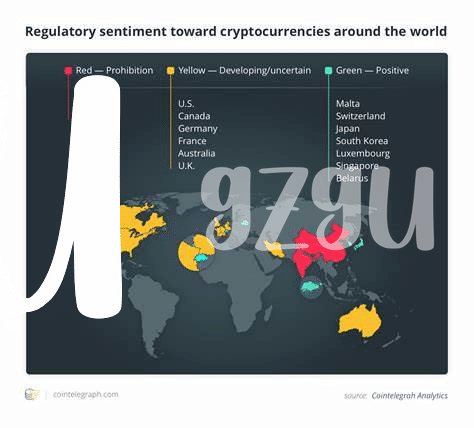

🚦 Bitcoin: Red Lights, Green Lights, and Yellow Lights

In the world of Bitcoin, regulations vary like traffic signals across the globe. Some countries wave the green flag, embracing Bitcoin with open arms, fostering innovation and growth. Others show the yellow light, proceeding with caution but recognizing the potential benefits and risks alike. And then, there are nations that have slammed the red light on Bitcoin, fearing its impact on financial stability and potential for misuse. This ever-changing landscape makes navigating through the regulations a thrilling yet challenging adventure. As Bitcoin continues to evolve, the delicate dance between technology and law becomes more complex. For those keen to understand the nuances of keeping their Bitcoin secure amidst these fluctuations, diving into the differences between hot wallets and cold wallets can provide valuable insights, ensuring one’s digital treasure stays safe in the tumultuous seas of regulation.

🔍 Close-up on the U.s.: the Bitcoin Battleground

In the U.S., Bitcoin finds itself in a hot spot that feels a bit like a competitive sports game. On one side, you’ve got a team playing offense, pushing for freedom and fewer rules to let Bitcoin grow naturally. They say it’s all about innovation and making sure the U.S. keeps up with the rest of the world. On the other side, there’s the defense, worried that without enough oversight, things could get messy. They’re concerned about protecting people from scams and making sure bad actors can’t use Bitcoin for shady deals.

This tug-of-war creates a dynamic battlefield where every move and countermove can cause waves. With different states setting their own rules – some rolling out the welcome mat for Bitcoin businesses, while others eye them with caution – the landscape is anything but uniform. This patchwork of regulations makes navigating the Bitcoin world in the U.S. a unique challenge. As we watch the play-by-play, it’s clear this game is far from over, with new developments and strategies constantly emerging.

📈 the Ripple Effect: How Regulations Impact Bitcoin’s Value

Imagine a world where every news headline about government decisions on Bitcoin makes your digital wallet feel a bit heavier or lighter. That’s the reality we’re living in, where the rules set by countries can make the value of Bitcoin soar to the skies or dive deep into the ocean. It’s like watching traffic lights change colors; a green light in one part of the world might send Bitcoin values racing, while a red light elsewhere could slam on the brakes. This push and pull create what we like to call a “ripple effect” across the globe, directly affecting how much your Bitcoin is worth. For those invested in keeping their digital currency secure and understanding the latest in market trends, staying updated on these regulatory changes is crucial. It’s why diving into best practices for securing your bitcoin against theft market trends can be a game-changer, offering insights and strategies to navigate these choppy waters. As regulations evolve, so does the cryptocurrency landscape, and staying informed is your best bet for weathering the storm.

🛠️ Adapting to Change: Bitcoin Technology Vs. Lawmakers

In the fast-evolving world of Bitcoin, technology and law are in a constant race, each trying to outpace the other. Picture this: on one side, we have tech wizards, creating ingenious ways to make Bitcoin faster, more secure, and easier to use. On the other side, there are lawmakers, wearing their regulatory hats, attempting to ensure that this digital currency doesn’t become a wild west of finance, but rather a safe and lawful space. It’s a bit like watching a game of cat and mouse, where the mouse is super tech-savvy. This dynamic has led to some groundbreaking innovations in Bitcoin’s technology, pushing it to adapt and evolve in ways that keep it several steps ahead. Yet, this rapid development doesn’t always make it easy for laws to catch up, sometimes leaving regulators scratching their heads. Let’s not forget, every tweak and adjustment in Bitcoin’s tech landscape sends waves across the globe, influencing how different countries approach their regulations. 🌍🔧📜

| Year | Bitcoin Technology Update | Regulatory Response |

|---|---|---|

| 2023 | Introduction of Lightning Network for faster transactions | Review by various countries to adapt to faster transaction speeds |

| 2024 (Projected) | Enhanced privacy features | Potential regulatory challenges due to increased anonymity |

Through this, Bitcoin continues to ride the waves of tech advancements, always looking for the next breakthrough to keep itself ahead of the curve and, interestingly, sometimes even shaping the very laws that seek to govern it.

🌐 the Future Forecast: Global Bitcoin Regulation Trends

As we gaze into the crystal ball to discern the patterns that will shape tomorrow, one cannot help but observe a tide of change on the horizon for Bitcoin and its cousins in the crypto world. Different corners of the globe are buzzing with discussions, each adding their colors to the regulatory canvas. Some nations lean toward embracing these digital wonders, weaving them into their economic fabric with supportive laws, while others tread with caution, painting strict guidelines to shield their financial ecosystems. Amidst this kaleidoscope, a pressing question looms: How will these varying stances intertwine to sketch the global outlook of Bitcoin regulation? In this ever-evolving saga, the push for sustainable practices in the crypto domain becomes pivotal. For those navigating this space, understanding the nuances of sustainable bitcoin mining practices for the future regulatory outlook is crucial. This insight not only illuminates the path ahead but also ensures one’s journey through the crypto landscape is both mindful and forward-thinking, aligning with the broader vision of a digitally inclusive world that doesn’t compromise our planet’s well-being.