Current Legal Landscape 🌍

Bitcoin’s rising popularity as a digital currency has sparked a global conversation on its legal status. The evolving landscape of regulations surrounding Bitcoin reflects a mix of apprehension and curiosity among policymakers. The decentralization aspect of Bitcoin poses a challenge to traditional financial systems, prompting governments to reevaluate their stance. Greater clarity in the legal framework is essential to foster trust and encourage mainstream adoption of Bitcoin in the UK and beyond.

Digital Payments Revolution 💳

The evolution of digital payments has sparked a transformative wave in financial transactions, reshaping traditional paradigms and challenging conventional banking systems. As society adapts to the convenience and efficiency of cashless transactions, cryptocurrencies like Bitcoin are emerging as key players in this digital revolution. Empowering individuals with direct control over their assets and bypassing intermediaries, cryptocurrencies present a decentralized alternative to conventional banking structures. The seamless integration of digital payment systems has the potential to enhance financial inclusivity and revolutionize the global economy.

Public Perception and Acceptance 🤝

Public perception and acceptance of Bitcoin continues to evolve as more individuals and businesses are becoming open to the idea of digital currencies. While skepticism still exists, there is a growing curiosity and willingness among people to explore the potential benefits and risks associated with using Bitcoin for transactions. The ease of international transfers and increasing accessibility through various platforms are gradually shaping a more positive outlook towards Bitcoin’s role in the future of financial transactions.

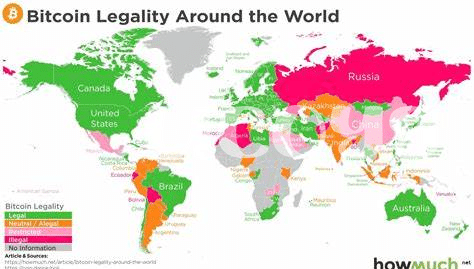

Regulatory Challenges and Opportunities 🚫

The regulation of Bitcoin as legal tender in the UK poses both challenges and opportunities. On one hand, the decentralized nature of cryptocurrencies raises concerns about potential misuse and illegal activities, prompting regulatory bodies to seek ways to ensure compliance with laws and prevent financial crimes. On the other hand, embracing digital currencies could open up new avenues for innovation and economic growth, presenting opportunities to streamline transactions and enhance financial inclusion for individuals who are currently underserved by traditional banking systems. This dynamic landscape calls for a careful balance between oversight and fostering innovation. For more insights on the legal aspects of cryptocurrency, you can explore the analysis on is bitcoin recognized as legal tender in united states?.

Economic Implications and Stability 💰

As the world navigates the potential shift towards Bitcoin as a legal tender in the UK, the economic implications and stability of such a move are significant. The adoption of Bitcoin could potentially disrupt traditional financial systems, leading to both challenges and opportunities for economic growth. The stability of Bitcoin prices and its impact on inflation rates are key considerations in evaluating its long-term feasibility as a widely accepted form of currency. Additionally, the integration of Bitcoin into the mainstream economy could offer new investment opportunities and reshape the global financial landscape.

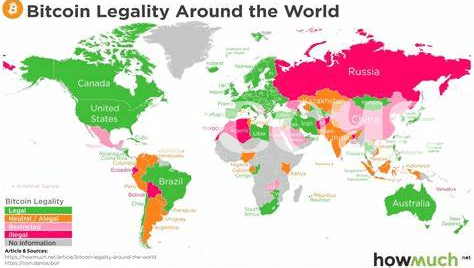

Potential Global Impact and Adoption 🌐

The potential global impact and adoption of Bitcoin present thrilling possibilities on a worldwide scale. As digital currencies continue to gain traction, the idea of a decentralized financial system is becoming increasingly feasible. With more countries exploring the acceptance of Bitcoin as legal tender, the barriers to global adoption are gradually diminishing. This gradual shift could potentially reshape traditional financial systems and pave the way for a more interconnected global economy. To dive deeper into the legal status of Bitcoin in various countries, you can explore if Bitcoin is recognized as legal tender in Uzbekistan with the question in mind – is Bitcoin legal in Rwanda?.