Exploring Bitcoin’s Magic in Swift Transactions 🚀

Imagine sending money to a friend in another country as easily as sharing a photo online. That’s the power Bitcoin brings to the table, making transferring funds faster than ever before 🚀. Traditional bank transfers can feel like they’re moving at a snail’s pace, taking days or even weeks, and often come with a hefty price tag. However, Bitcoin operates on a global network that’s awake 24/7, meaning transactions can happen anytime, anywhere, cutting down the wait to just minutes. Plus, it all happens without having to rely on banks or payment processors, which often slow things down with their procedures and working hours. The beauty lies in the simplicity and speed of Bitcoin transactions, opening up a world where sending money across the globe is as hassle-free as sending an email, forever changing the game in how we think about global payments 🌍💸.

| Feature | Traditional Bank Transfer | Bitcoin Transaction |

|---|---|---|

| Speed | Days to weeks | Minutes |

| Availability | During banking hours | 24/7 |

| Global Reach | Limited by bank networks | Anywhere with internet |

| Cost | High fees | Low fees |

Cutting Unnecessary Middlemen with Blockchain 🛑

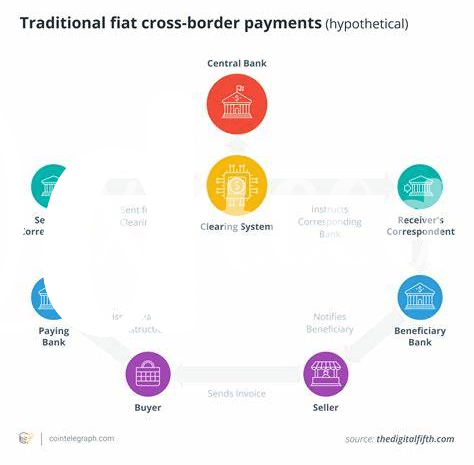

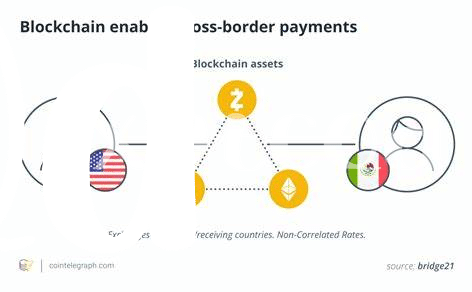

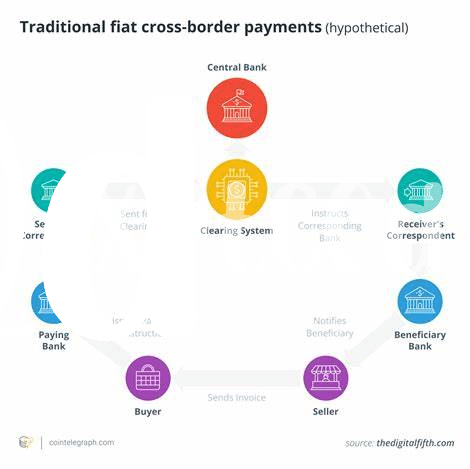

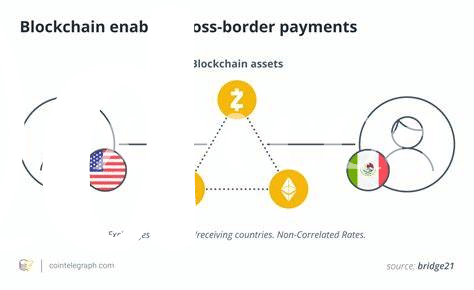

When we think about sending money across borders today, it’s like inviting a bunch of strangers to a party, each one taking a slice of your cake before it reaches its destination. That’s where Bitcoin steps in, waving its blockchain magic wand. Blockchain technology, which underpins Bitcoin, works by distributing information across a network of computers. This means no single party has control, and each transaction is recorded in a way that’s transparent and secure. Imagine a world where sending money is as easy as sending an email, without having to wait for days or pay hefty fees to banks or remittance services. That’s the promise of blockchain – it removes the need for these middlemen by allowing direct transactions between sender and receiver.

Moreover, every transaction is encrypted and linked to the previous one, creating a chain (hence, blockchain) that is nearly impossible to tamper with. This ensures your money isn’t just faster on its journey across borders; it’s also safer. By drastically reducing the number of hands your money passes through, not only does it arrive faster, but the transaction fees shrink to a fraction of traditional costs. To understand more about how this technology is revolutionizing small transactions, you can dive deeper into the topic here.

The Miracle of Tiny Fees: Bitcoin’s Advantage 💸

One of the most cheering aspects of using Bitcoin for sending money across the globe is how little it costs. Imagine you want to send a present in the form of money to a friend living on the other side of the planet. Traditionally, this would mean going through banks or money transfer services, which take a sizeable chunk as fees. 🚀 Now, enter Bitcoin. By using this digital currency, the hefty fees charged by intermediaries magically shrink. Because Bitcoin operates on a decentralized network, it sidesteps these traditional gatekeepers, making the transfer faster and cheaper. 🌍

This economic efficiency is not just about saving a few dollars. It’s about making financial transactions accessible to everyone, everywhere. Especially for people in countries with less stable currencies or higher transaction fees, the savings can be a game-changer. 💸 Plus, lower fees mean you can send small amounts without the costs eating up a significant portion of the transfer. This could revolutionize the way we think about sending money, making generosity and support across borders a reality for more people. 🛡️

Overcoming Currency Conversion Hurdles 🌍

When you send money across borders the old-fashioned way, you bump into a big roadblock: currency conversion. It’s like going to a party where everyone speaks a different language, and you need a translator to mingle. Traditional banks and money services act as those translators, but they charge a hefty fee for their work, eating into the money you send or receive. Enter Bitcoin, a savvy traveler that speaks every financial language fluently. With Bitcoin, you bypass these costly translators. Transactions become a straight line from Point A to Point B, no detours through expensive exchange services. This means more money stays in your pocket, and the receiver gets a bigger slice of the pie. Imagine sending money to a friend overseas and they receive exactly what you sent, without the bite taken out by conversion rates and fees. Furthermore, for a deeper dive into how Bitcoin is reshaping small transactions and what’s on the regulatory horizon, check out optimizing bitcoin payment channels for small transactions regulatory outlook. It’s a world where your money travels freely, without the barriers of traditional currency exchange.

Safeguarding Your Money Across Borders: Bitcoin’s Security 🛡️

When we send money across borders, it feels like a leap of faith, doesn’t it? Imagine handing your hard-earned cash to a series of strangers, hoping it safely reaches your friend in another country. That’s where Bitcoin steps in, offering a digital handshake that’s more like an ironclad promise. Thanks to the underlying technology called blockchain, every Bitcoin transaction is securely recorded in a way that is transparent and nearly impossible to tamper with. This means, once you send Bitcoin, you can track its journey with the assurance it hasn’t been intercepted or altered. 🛡️

| Feature | Description |

|---|---|

| Transparency | Every transaction is visible, ensuring no hidden tricks. |

| Immutability | Once a transaction is made, it’s set in stone. No take-backs, no alterations. |

| Decentralization | No single point of failure, making it harder for thieves to make a move. |

But what makes Bitcoin extra special is its border-agnostic nature. Regardless of where you or the recipient live, the process and security measures stay the same – global but personal, expansive yet secure. This universality not only breaks down barriers but also instills a sense of confidence and reliability in cross-border money movements. As we look towards the future, it’s clear that Bitcoin isn’t just changing the way we think about security in financial transactions; it’s redefining it. 🌍💼

The Future Landscape of Global Payments with Bitcoin 🌅

Imagine a world where sending money is as easy as sending a text message. That’s the vision bitcoin is bringing to the table for global payments. 🌅 With its decentralized nature, bitcoin promises a future where transactions are not only faster but also cheaper and more accessible to people around the world, regardless of their location. The beauty of bitcoin lies in its ability to remove barriers, making it possible for individuals and businesses to transact directly with each other without the need for traditional banking systems. This paradigm shift is not just about moving money; it’s about creating a more inclusive and efficient financial ecosystem.

As we move forward, the integration of bitcoin with the broader financial system is becoming increasingly important. For those interested in diving deeper into how bitcoin complements the current financial evolution, a step-by-step guide to bitcoin mining for newcomers market trends with the synergy between bitcoin and the defi ecosystem regulatory outlook provides insights into the mechanics and benefits of this integration. The journey toward a global payment landscape where bitcoin plays a central role is filled with opportunities and challenges. Embracing this change requires understanding and adapting to new technologies but promises a future where financial transactions are more democratic, secure, and user-friendly.