🌊 Understanding the Basics of Cryptocurrency Investment

Diving into the world of cryptocurrency can feel like exploring a vast ocean full of promise and peril. At its core, investing in digital currencies involves understanding how these virtual tokens operate in an online realm, governed by complex technology. Unlike traditional investments, such as stocks or bonds, cryptocurrencies are decentralized, meaning they aren’t controlled by any single authority. This gives them their unique charm and challenges. To initiate your journey, you’ll need to grasp the concepts of blockchain technology, which is the backbone of most cryptocurrencies. This digital ledger records all transactions across a network of computers, offering transparency and security but also a steep learning curve for newcomers. Additionally, understanding the market’s volatility is crucial. Prices can skyrocket or plummet within hours, making informed decisions and timing key to navigating these waters successfully. Moreover, familiarizing oneself with regulatory landscapes, which can vary significantly across regions, is essential for ensuring compliance and avoiding potential legal entanglements.

| Term | Description |

|---|---|

| Blockchain | A digital ledger that records all transactions of a particular cryptocurrency across a network of computers. |

| Decentralization | The distribution of power away from a central authority in the management and decision-making of a cryptocurrency network. |

| Volatility | Rapid and significant price changes within short periods, a common characteristic of cryptocurrency markets. |

| Regulatory Landscape | The legal and regulatory framework within which cryptocurrencies operate, varying significantly by country and region. |

🔍 Selecting the Right Crypto for Your Portfolio

Diving into the world of cryptocurrency can feel like exploring the deep sea, full of wonders and risks alike. Just like in the ocean, knowing what to look for makes the journey more rewarding. Imagine you’re looking for the perfect fish for your aquarium – not every fish will fit. It’s similar when picking cryptocurrencies for your investment portfolio. You’ll want to consider how well a certain crypto fits with your company’s financial goals. Think about its stability, how it has grown over time, and its potential to continue growing. Just as a sailor reads the stars, you should read up on market history and expert analyses. For example, understanding different storage options for your digital assets is crucial for safeguarding your investment, much like knowing the safest harbors for a storm. It’s handy to consult comprehensive resources, like https://wikicrypto.news/the-evolution-of-bitcoin-discourse-in-tech-journalism, to navigate these waters safely. Remember, making informed choices now can set your corporate ship sailing smoothly into the future of digital currencies.

🛡️ Mitigating Risks in the Crypto Seas

Diving into the world of cryptocurrency can feel a bit like setting sail in uncharted waters. With the right approach, however, navigating these digital seas can be less daunting. Think of it as putting on a life jacket before stepping onto your investment ship. It starts with knowing what you’re diving into – research is key. 📚 Understand that cryptocurrencies are volatile; their values can go up and down very quickly. To stay afloat, consider spreading your investments across different types of cryptocurrencies. This is like having several boats in the water, so if one encounters a storm, you’re not left stranded. 🌧️ Another smart move is to keep a close eye on the weather forecast, or in investment terms, stay updated on market trends and news. Tools and tech designed to safeguard your investments, such as secure wallets and robust encryption, are your lifeboats and life vests. 💼 Finally, don’t go it alone. Sailing in a fleet, or working with investment advisors knowledgeable about the crypto climate, can help navigate through rough waters. Together, these strategies form your map and compass in the vast ocean of cryptocurrency investment, helping to shield you from unexpected waves and guiding your corporate vessel to potentially prosperous shores.

⚙️ Integrating Crypto into Your Corporate Strategy

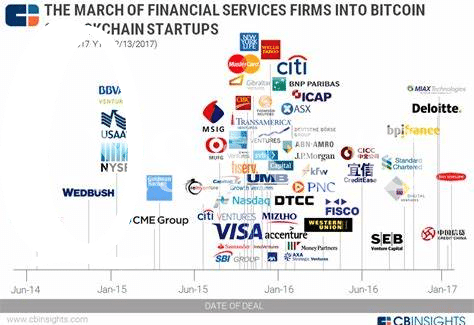

Bringing cryptocurrency into your company’s game plan isn’t just about jumping on a new trend; it’s about opening doors to innovative growth opportunities and diversifying your investment portfolio. Imagine your business navigating through the vast ocean of digital finance, where each decision on crypto investments can lead to uncharted territories of potential profit and innovative customer engagement strategies. Incorporating digital currencies requires a delicate balance, much like steering a ship, where every turn needs careful consideration, from understanding the complexities of blockchain technology to ensuring your financial operations run smoothly. A significant part of this journey involves staying secure and compliant, which means learning about cold storage methods for securing your bitcoin regulatory outlook is crucial. This ensures not only the safety of your assets but also builds trust with your clients and stakeholders. Integrating crypto goes beyond just buying digital coins; it’s about adapting to a digital ecosystem that’s constantly evolving. By analyzing market trends and remaining forward-thinking, companies can navigate the crypto waters with confidence, ensuring they’re not left behind as the world moves towards a more digitalized economy. Preparing for this shift means embracing change, staying educated, and always being ready to adjust your sails to the wind of innovation and regulation in the crypto universe.

📊 Analyzing Market Trends for Informed Decisions

In the ever-changing world of digital currency, keeping a watchful eye on market trends is like having a compass in the vast ocean. Just as a captain studies the waves, winds, and weather before setting sail, businesses must analyze the currents and undercurrents of the crypto market. This involves looking beyond the immediate to gauge long-term patterns, such as which currencies are gaining traction or which technologies are being adopted at a faster rate. An insightful approach combines historical data with a keen eye on emerging developments, ensuring your investment decisions are informed and ahead of the curve. For instance, tracking the rise and fall of different cryptocurrencies over time can provide invaluable insights into potential future movements.

| Year | Trending Technologies | Prominent Cryptocurrencies |

|——|———————–|—————————-|

| 2022 | Blockchain Scaling Solutions | Bitcoin, Ethereum |

| 2023 | Decentralized Finance (DeFi) | Binance Coin, Solana |

By keeping attuned to these trends, companies can navigate the cryptocurrency waves with greater confidence, turning the vast, unpredictable seas into a realm of opportunity. Continuous learning and adaptation are your best allies in this journey, ensuring that your corporate strategy remains both resilient and dynamic in the face of crypto’s shifting tides.

💡 Staying Ahead with Continuous Learning and Adaptation

In the ever-evolving world of cryptocurrency, staying up-to-date and ready to adapt is like learning to surf on constantly changing waves. It’s not just about catching the right wave; it’s about continuously learning from the sea itself. Imagine cryptocurrency as an ocean of opportunity and challenge. To navigate these waters successfully, a corporate investor must become a lifelong learner, keeping an eye on the horizon for new trends and shifts in the wind. This commitment to learning goes beyond understanding the technical details. It involves a deep dive into how these digital currencies are reshaping the financial landscape and influencing our culture and media. A great start is to explore bitcoin’s influence on popular culture and media regulatory outlook, as it sheds light on misconceptions and provides insights into the regulatory environment.

Embracing this journey of continuous learning and adaptation allows a corporation to not just survive but thrive in the crypto seas. It’s about creating a culture within your organization that values curiosity and innovative thinking. This approach enables you to anticipate changes rather than react to them, making informed decisions that align with your corporate strategy. Through ongoing education, engaging with experts, and leveraging resources, your team can develop the agility needed to navigate the complexities of the cryptocurrency market. Remember, in a sea of constant change, the most powerful tool at your disposal is knowledge.