🤯 What Is Bitcoin Halving? Making It Simple.

Imagine you’re at a birthday party where the cake slices represent bitcoins. At first, there’s plenty of cake for everyone, so slices are big. But as the party goes on, to make sure there’s enough cake for everyone till the end, the slices get smaller. This is similar to what happens during a Bitcoin halving event. Every four years, the reward that Bitcoin miners get for adding a new block of transactions to the blockchain is cut in half. It’s like our cake slices getting smaller, making it a bit harder for miners to “fill their plate” with Bitcoin as a reward.

Why does this matter, you wonder? When miners get fewer bitcoins for their efforts, it changes a lot about how they operate, but it also affects the whole Bitcoin environment in some interesting ways. Here’s a quick look at what makes this event so special in a table:

| Aspect | Pre-Halving | Post-Halving |

|---|---|---|

| Miner Rewards | Higher | Lower |

| Bitcoin Supply | Increasing Faster | Slows Down |

| Impact on Value | Varied | Potential Increase |

This event isn’t just about making things harder for miners; it’s a built-in feature to ensure Bitcoin remains valuable as a finite resource, much like gold. To keep the party analogy going, it ensures there’s enough cake for future parties, making each slice—in the long run—potentially more valuable as a rare treat.

⛏️ the Life of a Miner before and after Halving.

Imagine being a miner, not the one with a pickaxe delving into the earth, but a digital miner where your tools are computers powerful enough to solve complex puzzles. Before a Bitcoin halving event, these miners are in a kind of gold rush, solving these puzzles to earn Bitcoins as a reward. Every ten minutes, like clockwork, these rewards are doled out, filling digital wallets and encouraging more to join this digital equivalent of a gold rush. But then, halving happens, and suddenly, the reward for the same amount of work is cut in half overnight. It’s a game-changer. Instantly, mining becomes a tougher gig – not everyone can keep up with the expenses like electricity and the advanced computing power needed when the rewards have dwindled. This moment separates the hobbyists from the deeply invested, as miners scrutinize their operations, searching for efficiencies or considering relocation to areas where electricity costs less. Amidst this upheaval, the ecosystem adjusts, miners evolve, and the whole mining community braces for how these changes affect Bitcoin’s value and their future in this digital frontier.

💰 Impact on Bitcoin Value: Immediate and Long-term.

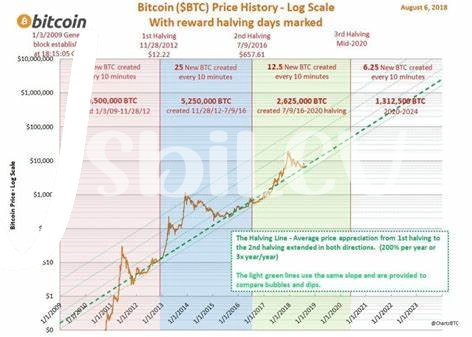

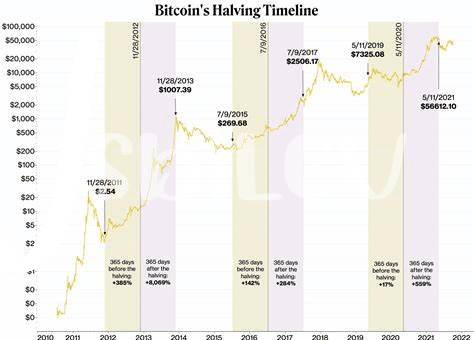

Whenever Bitcoin halving happens, it’s like a plot twist in our favorite show, leaving us wondering how it will affect Bitcoin’s value both now and down the road. Initially, this big event often leads to a whirlwind in the market. Think of it as suddenly finding out your favorite chocolate bar will be produced half as much going forward. Everyone rushes to buy what’s left, increasing its price. In the Bitcoin world, this translates to a spike in value as people anticipate the reduced supply leading to higher demand. But it’s not just a fleeting moment; it sets the stage for what’s to come.

Over the long haul, this change can be a bit like planting a seed that slowly grows into a towering tree. As newly minted bitcoins become scarce, their value tends to gradually increase, assuming demand remains steady or grows. This scarcity acts like a magnet, attracting more investors and users to the ecosystem, contributing to its overall stability and growth. It’s a complex dance between supply, demand, and human psychology, all playing out in the digital realm, shaping the future of not just mining, but the entire Bitcoin universe.

📈 Mining Difficulty: What Happens When Rewards Halve?

When the rewards for mining Bitcoin are halved, think of it like a big payday that suddenly gets cut down to half for doing the same amount of work. This makes things a bit tougher for miners since they’re putting in the same effort—using their computers to solve complex puzzles—but getting less Bitcoin for it. It’s like if you were getting paid in slices of pizza for delivering pizzas, and suddenly, you only get half a slice per delivery instead of a whole one. This change pushes miners to work even harder or find more efficient ways to solve these puzzles because the rewards just aren’t what they used to be. But here’s where it gets interesting—the fewer rewards might discourage some, leading to fewer people mining. This could make mining a tad bit easier, but it’s a balancing act. For a deeper dive, consider analyzing bitcoin price volatility and its causes regulatory outlook which sheds light on the broader implications of these changes.

The change also stirs up the mining ecosystem quite a bit. Fewer rewards mean not everyone can keep up, leading to a situation where only the big fish with the most efficient mining rigs can stay in the game. This gradually shifts the landscape of mining, bringing more consolidation. On the flip side, it could also spark innovation as miners seek out new, more efficient technologies or methods to stay profitable. The balance between the cost of mining and the rewards received is always delicate, but the halving event puts it to the test, demanding adaptability and resilience from the mining community. As the rewards drop, the conversation about the sustainability and future of mining becomes even more pertinent, challenging miners to anticipate and prepare for what’s next in this ever-evolving space.

🌍 Global Mining Distribution: Shifts and Trends Post-halving.

Imagine the world map lighting up with activity as Bitcoin mining spreads from corner to corner. Before the halving, the activity was brightest in places where electricity was cheap because the cost to run the powerful computers needed for mining didn’t take too big a bite out of profits. But here’s the twist: after the halving, the rewards for mining Bitcoin were cut in half, turning the heat up under miners to find even cheaper electricity or more efficient ways to mine to keep their operations profitable. This led to a significant shuffle in the global mining landscape. Here’s a quick look at how mining distribution shifted:

| Region | Pre-Halving Share | Post-Halving Share |

|---|---|---|

| Asia | 70% | 60% |

| North America | 15% | 25% |

| Europe | 10% | 10% |

| Other | 5% | 5% |

As you can see, areas like North America began to glow a bit brighter in the mining world, thanks partly to their ability to adapt quickly to changing conditions, like finding cheaper power sources or innovating with cooler-running tech. This shift doesn’t just change the map; it could redefine the future pathways for Bitcoin’s growth and sustainability, making the mining ecosystem more diverse and possibly more resilient against challenges.

🚀 Future of Bitcoin Mining: Predictions and Possibilities.

Venturing into the future of Bitcoin mining feels like stepping into a realm filled with both incredible promise and intriguing uncertainty. As we look ahead, whispers and predictions swirl about how mining will evolve, especially in the wake of technological advancements and the ever-changing energy landscape. One prevailing thought is that miners will continue to innovate, searching for greener, more efficient ways to mine, potentially sparking a revolution in renewable energy use. This shift isn’t just about keeping things running; it’s about miners worldwide uniting in a quest to make Bitcoin mining a sustainable part of our digital future. Furthermore, collaboration among countries could lead to a more balanced global mining distribution, making the network stronger and more decentralized.

Meanwhile, for those eyeing Bitcoin’s role beyond the mining rigs, there’s plenty to ponder about its impact on economies, especially in emerging markets. As the digital currency space matures, Bitcoin is poised to play a pivotal role, potentially offering a new layer of resilience and opportunities for growth. Amidst this backdrop, understanding the role of bitcoin in bolstering emerging market economies regulatory outlook becomes crucial. It’s not just about predicting where mining will be years down the line but also grasping how Bitcoin’s growth and challenges could shape the financial landscape globally. Through collaboration, innovation, and a bit of crystal ball gazing, the journey ahead for Bitcoin mining looks both challenging and exhilarating, holding promises of transformation that could ripple across economies and redefine our digital world.