Setting Sail: a Brief History of Bitcoin 🚤

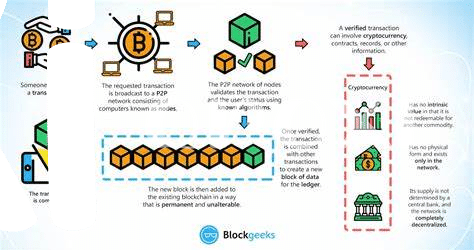

Imagine a world where sending money is as easy as sending an email. That’s the idea that brought Bitcoin into existence. In 2008, a person (or group of people) under the pseudonym Satoshi Nakamoto introduced Bitcoin as a digital currency that didn’t need banks or governments to work. It was a revolutionary idea, promising a future where financial transactions could be faster, cheaper, and more secure. Using something called the blockchain, Bitcoin enabled anyone, anywhere, to send and receive money with just an internet connection.

| Year | Event |

| 2008 | Bitcoin idea proposed by Satoshi Nakamoto 📜 |

| 2009 | First Bitcoin software released, network goes live 🚀 |

| 2010 | First known Bitcoin purchase (two pizzas for 10,000 BTC) 🍕 |

The journey of Bitcoin from an obscure digital token to a globally recognized currency is nothing short of fascinating. Early on, it was mainly tech enthusiasts and libertarians who saw its potential. However, over the years, as Bitcoin began to gain value and attention, it attracted a wider audience. What started as an experiment in financial freedom has now sparked a global conversation about the future of money itself. Despite its ups and downs, Bitcoin has laid the foundation for a new kind of financial system.

Regulatory Rumblings: Current Global Bitcoin Laws ⚖️

Imagine a world where every country has its own rulebook for a game everyone’s playing. That’s what’s happening with Bitcoin right now. Across the globe, from the bustling markets of Japan to the tech-savvy cities of the United States, governments are scribbling down all sorts of rules for Bitcoin – some are welcoming it with open arms, while others are keeping it at arm’s length with strict regulations. It’s like trying to navigate a ship through a maze of icebergs; every move needs to be calculated and precise. This global patchwork of laws creates a fascinating puzzle for Bitcoin enthusiasts and businesses alike. They need to be Sherlock-Holmes-level detectives to figure out where they can sail smoothly and where they might hit the regulatory icebergs. Amidst this patchwork is a growing trend towards finding solutions that help Bitcoin zip around these obstacles, such as exploring the speed of Bitcoin Lightning vs Ethereum transactions. This journey through the waters of regulations is far from dull, presenting a thrilling adventure for those willing to navigate its challenges.

Navigating Stormy Seas: Challenges in Regulating Bitcoin 🌩️

In the journey through the unpredictable world of Bitcoin, steering through the regulatory waves presents its own set of unique challenges. Imagine a captain trying to navigate through a storm without a map; that’s somewhat what it feels like for governments trying to regulate this digital treasure. Unlike traditional currency, Bitcoin doesn’t play by the usual rules – it’s decentralized, meaning it isn’t controlled by any single authority, like a bank or government. This freedom is a double-edged sword, offering the allure of financial liberty but also opening doors to misuse, such as for illegal transactions. Further complicating matters, Bitcoin’s technological backbone, the blockchain, is a tough nut to crack. Its global nature means one country’s rules might not work in another, leading to a regulatory patchwork quilt that could stifle innovation or leave loopholes wide open. Plus, there’s the challenge of keeping up with the rapid pace of digital currency evolution. As we sail into this uncharted territory, finding a balance that safeguards both the innovative spirit of Bitcoin and the financial security of its users is the key to weathering the storm. 🌍💼🔍

Charting the Course: Potential Future Regulations 🗺️

As we look ahead, navigating the possible paths for Bitcoin regulation unfolds like a map to uncharted territories. Governments around the world are scratching their heads, trying to figure out the best way to embrace this digital gold rush without letting it disrupt the financial order. One road might lead to stricter rules on how Bitcoin is traded and stored, ensuring that everyone plays by clear rules and that dodgy dealings are kept at bay. Another path could involve guidelines that encourage innovation, helping to clear the fog around Bitcoin, making it safer and more attractive to both everyday folks and big companies. For those looking to dive deeper into how these regulatory changes could pave the way for a brighter future, including solutions to bitcoin scalability issues and future prospects regulatory outlook might be just the compass you need.

The journey doesn’t stop here, though. As we chart this course, it’s likely we’ll see a fusion of viewpoints 🌍, with some regions opting for a tight grip on Bitcoin, while others may give it room to breathe and grow. This mix-and-match approach could lead to a patchwork of policies, but also a testing ground for innovative solutions. Just like sailors navigating through stars, regulators, and enthusiasts will need to keep their eyes on the ever-evolving landscape of digital currencies, ready to adjust their sails to harness the winds of change. The ultimate goal? To dock at a future where Bitcoin bolsters the global economy without triggering storms 🚀🌊.

The Crew’s Morale: Public and Corporate Reactions 🧑🤝🧑

Just like sailors feeling the wind’s direction, the public and businesses are keenly watching how governments will navigate the complex waters of Bitcoin regulation. Their reactions are a mixed bag of apprehension and enthusiasm. For many people, regulating Bitcoin feels like taming the wild seas – necessary for safety but potentially restricting freedom. Businesses, especially those rooted in cryptocurrency, echo this sentiment but also crave clear rules that could legitimize and stabilize their ventures. As debates swirl and governments hint at upcoming legislations, forums, social media, and boardrooms are abuzz with speculation and strategic planning. Here’s a snapshot of the varying reactions:

| Group | Reaction |

|---|---|

| General Public | Mixed feelings, ranging from concern over potential loss of privacy and freedom to optimism about fraud reduction and increased security. |

| Cryptocurrency Businesses | Eager for clarity and rules that could bring stability, yet wary about overregulation hindering innovation. |

| Investors | Watching closely, as regulations could either boost the market by providing legitimacy or cause fluctuations by restricting crypto operations. |

This vivid landscape of hope, caution, and strategic maneuvering greatly influences how the next chapters of the Bitcoin saga will be written, steering the ship of innovation with a keen eye on the horizon of regulation.

Safe Harbor: the Impact of Regulation on Innovation ⚓

Rules and regulations often steer the ship when it comes to innovation, much like a lighthouse guiding vessels away from hazardous shores. In the realm of Bitcoin and other cryptocurrencies, the introduction of new regulations is not just about control but also about nurturing an environment where safe, innovative financial technologies can flourish. This balance is crucial; too much regulation can stifle creativity and slow down the progress of promising new technologies. On the other hand, a lack of oversight might lead to chaos in the seas of finance, with investors and users possibly facing high risks without any form of protection. It’s a delicate dance, much like navigating through foggy waters, where the goal is to reach a point where innovation is not hampered but encouraged, ensuring that the ecosystem grows in a healthy and sustainable manner.

One of the areas ripe for innovation is the speed and efficiency of transactions. The potential of the Bitcoin Lightning Network versus Ethereum is a hot topic, promising a future where transactions can be nearly instantaneous and much cheaper. This is where regulation can play a supportive role, by providing a framework that allows for such advancements to be integrated safely into the financial system, benefitting not just tech enthusiasts but everyone. By fostering an environment where new ideas can be tested and implemented without fear of undue restrictions, regulations can help pave the way for breakthroughs that could redefine our understanding of money and transactions. It’s about finding that sweet spot where innovation thrives within a framework that ensures security, stability, and trust.