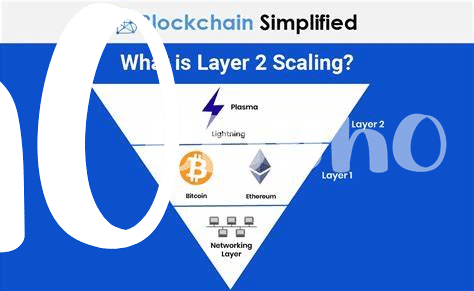

🚦 Setting the Stage: What’s the Race About?

Imagine a world where sending money is as easy and quick as texting a friend. That’s the dream both Bitcoin Lightning and Ethereum are racing towards, transforming our digital wallets into super-fast transaction machines. This contest is not just about who crosses the finish line first but about shaping the future of how we interact with money. With Bitcoin Lightning sprinting with its specialized tracks for lightning-fast payments and Ethereum tuning its engine for robust, programmable transactions, we’re on the edge of a revolution. Each contender, with its unique strengths, promises to make delays and hefty fees a thing of the past. But, as we wave them off, questions linger about the practicality, adaptability, and, ultimately, which technology will define our digital currency experience. Dive deep with us into this race, not just of speed but of innovation, efficiency, and the quest to redefine financial boundaries.

| Crypto | Focus of Race |

|---|---|

| Bitcoin Lightning | Specialized for Lightning-Fast Payments |

| Ethereum | Tuning for Robust, Programmable Transactions |

⚡ Lightning Fast: Delving into Bitcoin Lightning

Imagine we have two speedy cars, one representing Bitcoin Lightning and the other, our traditional Bitcoin transactions. Bitcoin Lightning, in simple terms, is like a special fast track, allowing Bitcoin users to send and receive money much quicker and cheaper than usual. Think of it as taking a shortcut in a race, bypassing all the traffic to get to your destination faster. This system works by setting up mini-race tracks, or payment channels, between users, which they can zip across as many times as they like, almost instantly, and at a fraction of the cost of regular transactions. Once they’re done, they can close the track and settle the score on the main Bitcoin road, making it super efficient for frequent, small transactions. To better understand the nuances of transaction costs in the crypto world, particularly for aspiring Ethereum enthusiasts, a helpful resource could be https://wikicrypto.news/bitcoin-fees-explained-what-influences-transaction-costs. This solution not only speeds up the transaction process significantly but also addresses the issue of scalability that has been a bottleneck for Bitcoin, allowing more people to join the race without causing traffic jams.

🛠 Ethereum’s Engine: How It Powers Transactions

Under the hood of Ethereum, transactions zip around like cars on a busy highway, powered by something called “gas.” 🏎💨 Imagine you’re playing a video game, and every move you make costs a tiny bit of fuel. That’s pretty much how Ethereum works! For every transaction, whether it’s swapping digital art, buying a cool new virtual outfit, or sending some ether (that’s the currency of Ethereum) to a friend, you need to pay a little bit of this gas. The amount of gas isn’t fixed; it changes like the price of real fuel. During rush hour, when the network is super busy, gas prices go up. 🚀🌕 This system makes sure that transactions are processed efficiently, but it also means the speed and cost can vary a lot depending on how crowded the network is.

🏁 Comparing Speed: the Transaction Race Results

When we dive into the nitty-gritty of cryptocurrency transactions, particularly focusing on Bitcoin Lightning and Ethereum, we uncover some intriguing results in their speed comparison. Bitcoin’s Lightning Network, designed for lightning-fast transactions, almost feels like you’re snapping your fingers, and bam! The transaction is done. It’s a unique layer on top of Bitcoin’s base, meant to make things quicker. On the flip side, Ethereum, with its own set of magic under the hood, also performs impressively, ensuring that transactions are processed efficiently and reliably. But when these two are put side by side, Bitcoin Lightning often takes the lead in the speed department, highlighting its potential for everyday microtransactions without the wait.

However, it’s not just about who crosses the finish line first; it’s also about understanding the technology that powers these speeds and how it fits into the broader picture of digital finances. For those eager to dive deeper and wrap their heads around the technical marvels that make these speeds possible, exploring educational courses on bitcoin and cryptocurrency technologies versus ethereum can be an enlightening journey. These resources shed light on the intricate mechanisms at play and provide a clearer view of why and how Bitcoin Lightning and Ethereum stand out in their respective lanes, opening doors to a new era of speedy and efficient digital transactions.

💵 Fee Face-off: Cost of Speed in Crypto

Just like deciding between a fast sports car and a fuel-efficient compact, when you choose between Bitcoin Lightning and Ethereum for your transactions, you’re looking at a trade-off between speed and cost. Bitcoin Lightning, a super-fast lane built on top of the regular Bitcoin road, lets you zoom through with barely any waiting. But, here’s the twist: it tends to ask for less in fees, especially for tiny transactions, making it like paying for a fast-track ticket at an amusement park—worth it for the thrill and time saved.

On the other side, Ethereum, with its powerful engine, can also push through a hefty number of transactions pretty quickly. However, when the network gets busy, like a big concert letting out, the cost to jump the line can shoot up dramatically. This makes Ethereum a bit like a taxi in rush hour; you’ll get there fast, but the price might make you wince. Here’s a quick look at how their fees compare:

| Crypto Platform | Average Transaction Fee |

|---|---|

| Bitcoin Lightning | 💰 A few cents |

| Ethereum | 💰 Varies, can be a few dollars to tens of dollars |

So, when we dive into the cost of speed in the crypto world, it’s clear that the choice between a quick dash and a wallet-friendly ride hinges on your needs. Whether it’s saving time or saving money, both these lanes offer you valuable options.

🤔 the Future Lane: What’s Next for Speed?

As technology zips ahead, so too does the quest for even speedier blockchain transactions. Imagine a world where sending crypto is as easy and instantaneous as liking a post on social media. That’s the direction we’re heading, with both Bitcoin Lightning Network and Ethereum exploring innovations that could make near-instant transactions a daily reality. The focus? Reducing those pesky wait times even further and making the whole process more wallet-friendly. Developments like sharding for Ethereum, which breaks data into smaller pieces for quicker processing, and further layers atop Bitcoin’s Lightning, promise to press the accelerator on transaction speeds. This evolution isn’t just about who can do it faster; it’s about making these digital currencies more accessible and efficient for everyday use, opening up a world of possibilities for real-time, global financial operations without the traditional barriers. For a deeper dive into the intricate dance of speed, cost, and efficiency in the crypto world, consider exploring the role of public ledgers in bitcoin’s transparency versus ethereum, shedding light on the nuanced interplay of technology and economy shaping the future of digital money.