The Birth of Ethereum: More Than Just Money 💡

Imagine a new player stepping onto the digital stage, not just to join the game but to change it completely. That’s what happened in 2015, when Ethereum made its debut. Unlike its predecessor, Ethereum wasn’t just about sending and receiving digital money. It introduced a whole new way to build and use applications on the internet without any centralized control. This idea lit up the imagination of tech enthusiasts and developers all around the world, sparking a wave of innovation.

| 💡 Ethereum Features | 🌍 Impact |

| Smart Contracts | Automated, secure agreements |

| Dapps (Decentralized Applications) | Apps free from central control |

| Ether (Currency) | More than just money, a key to using and building on Ethereum |

Ethereum’s vision was bold and broad, aiming to do much more than replicate the digital cash concept. It was about creating a decentralized internet, where anyone could create and use applications that are secure and run exactly as programmed without any chance of fraud or third-party interference. This opened up limitless possibilities for developers and entrepreneurs, setting the stage for an explosion of new and innovative apps.

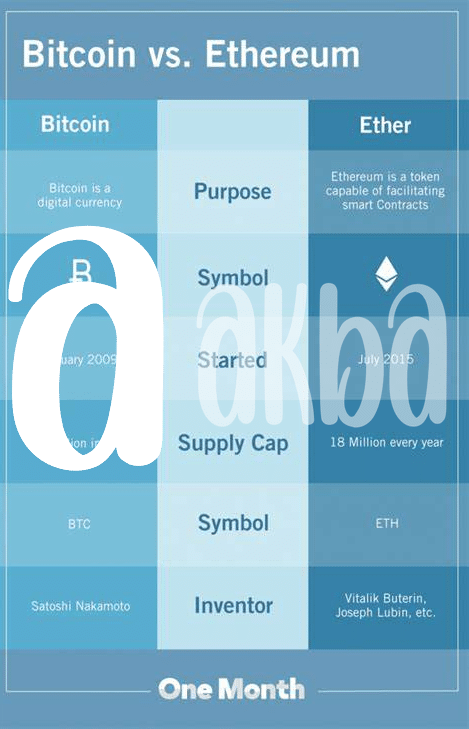

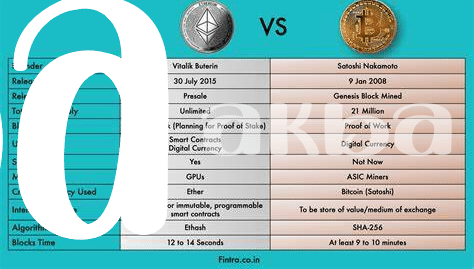

Breaking down Bitcoin: the Digital Gold Standard 🏆

Bitcoin is often hailed as the pioneer in the world of digital currencies, likened to gold in its form as an asset. Much like the precious metal, Bitcoin has established itself as a standard for value, not just because it was the first, but because of the unmatched security and limited supply it offers. This foundation has made it a go-to for those looking to park their wealth in a “safe” digital asset. Its essence lies in its simplicity and the robust network that backs it, making it a resilient store of value over the years.

Yet, its allure isn’t just in being a digital version of gold. The journey of Bitcoin is marked by its capability to create a trustless system where transactions are transparent and immutable. Since its inception, it has grown in appeal, captivating a wide audience from tech enthusiasts to investors looking for a hedge against traditional financial systems’ volatility. This growth has not only showcased the potential of digital currencies to reshape financial landscapes but also sparked conversations around the future of money itself.

Ethereum’s Innovative Edge: Smart Contracts and Dapps 🔧

When we think about Ethereum, it’s like stepping into a world where money does much more than just sit in your wallet. Imagine you’re playing with LEGO blocks, but instead of toys, these blocks can make agreements that run all by themselves, without anyone needing to double-check if everyone’s sticking to their promises. That’s the magic of what we call smart contracts. Now, these aren’t contracts on paper but rather bits of code that automatically do something when certain conditions are met, like transferring money when a job is done. But Ethereum doesn’t stop there. It’s also a bustling city for Dapps, or decentralized applications, which are like the apps on your phone but run on a network spread across the globe, not controlled by any single company. This makes them more like a funfair, where everyone’s welcome to play, create, and share without worrying about the fun being shut down. This playground for financial innovation is what sets Ethereum apart, making it not just a digital currency but a whole new way to think about and interact with the digital world. 🌍🔍💫

Diving into Defi: Ethereum’s Financial Playground 🎢

Imagine stepping into a world where the financial playground isn’t just banks and stock markets, but something much more vibrant and dynamic. Welcome to the realm of Decentralized Finance or DeFi, a space where Ethereum plays a starring role. Unlike traditional finance, DeFi places the power directly in the hands of the people, no middlemen, no waiting days for transactions to clear, and certainly no hefty fees for moving your own money. It’s about taking control, with Ethereum facilitating this new era through smart contracts—think of them as self-operating computer programs that automatically execute when certain conditions are met. This is game-changing because it opens the door to all kinds of financial services without the need for traditional banks. From borrowing and lending platforms to insurance and savings products, Ethereum’s DeFi ecosystem is rich with opportunity. The best part? It’s accessible to anyone, anywhere, at any time. And as more people begin to explore this financial frontier, the potential for growth is immense. To understand more about the complexities and benefits of using digital currencies for global transactions, consider the leveraging bitcoin for cross-border payments: benefits and challenges versus ethereum. This dive into Ethereum’s DeFi could very well represent the future of how we think about and handle our wealth.

Price Patterns: Ethereum Vs. Bitcoin over Time 💹

Looking at the journey of Ethereum and Bitcoin, one can’t help but be taken in by the mesmerizing dance of their prices over the years. Bitcoin, often hailed as the very foundation of the cryptocurrency world, erupted onto the scene and quickly skyrocketed, placing it in the spotlight as the digital version of gold. Ethereum, on the other hand, entered with a different proposition, bringing not just a new form of currency but also a platform for creating decentralized applications. This added utility gives Ethereum a fascinating edge. Over time, we’ve watched Bitcoin maintain a strong and steady lead in terms of value, a testament to its unwavering demand. Yet, Ethereum’s price has seen its own impressive climbs, fueled by the growing interest in its broader applications beyond just a currency. This seesaw of value and potential between the two offers a unique glimpse into the evolving landscape of digital wealth storage, revealing that Ethereum might not just be following in Bitcoin’s footsteps but crafting its own path.

Here’s a simple breakdown of their price trends:

| Year | Bitcoin Price | Ethereum Price |

|---|---|---|

| 2015 | $313 | $0.93 |

| 2018 | $6,437 | $207 |

| 2021 | $29,374 | $730 |

The Future of Wealth Storage: Ethereum’s Potential 🚀

As we look toward the horizon of financial evolution, it’s clear that the way we perceive and store wealth is dramatically shifting, propelled by the advancements in technology. Ethereum, with its unique capabilities, stands at the forefront of this transformation. Unlike traditional assets or even its predecessor, Bitcoin, Ethereum offers a platform not just for storing wealth, but for creating and executing agreements without intermediaries, through something called smart contracts. This capacity to not only hold value but to programmatically manage and move it according to pre-set rules presents an entirely new paradigm in the concept of asset management and wealth storage.

These smart contracts, in combination with decentralized applications (Dapps) that run on the Ethereum network, are not mere technological novelties; they represent a significant leap towards a more dynamic and functional form of digital asset. This opens up myriad possibilities for individuals and businesses alike, creating a financial playground where the traditional barriers of entry to financial services are dismantled. For those pondering the future of wealth storage, understanding the potential of Ethereum is essential. To delve deeper into how businesses can navigate these novel waters, especially in terms of legal considerations and practical implementations of cryptocurrency solutions, exploring adopting bitcoin payment solutions for small businesses versus ethereum can offer valuable insights.