Ethereum’s Basics: More Than Just Digital Money 💰

Imagine a world where money does more than just sit in a bank; it can make decisions, enter contracts, and even automate tasks. This is the realm of Ethereum, not just a type of digital cash, but a whole platform where developers can build all sorts of applications that go beyond just transactions. Think of it as a vast playground where, instead of swings and slides, you have apps that can do everything from managing your identity to running entire companies on the blockchain.

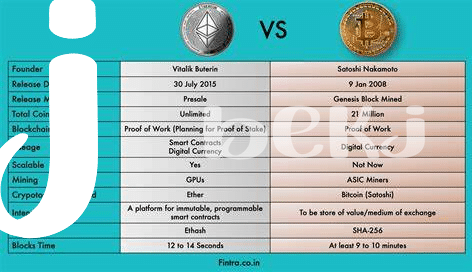

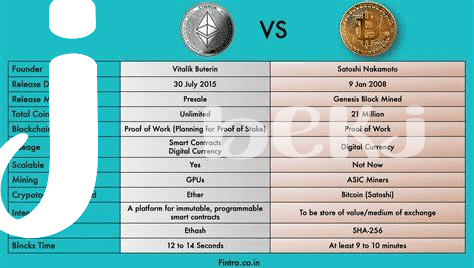

What makes Ethereum stand out is its ability to handle ‘smart contracts’. These are like usual contracts, only they automatically execute when certain conditions are met, without needing a third party to oversee them. It’s a bit like having a vending machine that not only takes your money and gives you a snack but also ensures that the snack is restocked, the machine is in good working order, and even donates a percentage of the profits to charity, all by itself! The table below captures the essence of Ethereum in comparison to traditional digital money:

| Feature | Ethereum | Traditional Digital Money |

|---|---|---|

| Functionality | Supports smart contracts and DApps | Limited to transactions |

| Usage | Wide range, from finance to gaming | Primarily for purchases and transfers |

| Control | Decentralized, no single entity in charge | Controlled by banks/governments |

| Technology | Blockchain-based | Varies, not necessarily blockchain |

This distinction highlights Ethereum’s flexibility and the broader potential it holds, not just in the realm of finance but across a spectrum of uses, paving the way for innovative applications we’ve only just begun to explore.

Big Companies Diving into Ethereum: Who and Why? 🏊♂️

Imagine huge companies, the kind we see everywhere from our phones to our coffee cups, starting to explore a new land of opportunity. That’s exactly what’s happening with Ethereum. These corporate giants are diving headfirst into what may seem like the digital equivalent of uncharted waters. They’re drawn in by Ethereum’s ability to not just act as digital money, but as a platform where applications can be built and run without any downtime, fraud, control, or interference from a third party. This innovative feature opens up a myriad of possibilities for businesses, from streamlining operations to creating entirely new services.

Curious about who’s leading the charge and why? Companies from sectors as diverse as finance, technology, and retail are making their move. They’re not just looking to invest in Ethereum; they’re exploring how they can use its technology to gain a competitive edge. By harnessing the power of Ethereum’s smart contracts, firms can automate transactions and agreements, ensuring they are executed exactly as programmed without any chance of fraud or third-party interference. This leap into Ethereum signifies a broader shift in corporate strategy towards embracing blockchain technology, promising a future where digital and real worlds seamlessly intersect. If you’re keen on navigating these shifts even further, especially how Bitcoin developers are moving towards Ethereum, check out this insightful guide at https://wikicrypto.news/navigating-the-blockchain-bitcoins-proof-of-work-unveiled.

Ethereum Vs. Regular Investing: What’s the Difference? 📊

When we think about putting our money into something hoping it’ll grow, many of us picture the stock market, savings accounts, or maybe buying a piece of land. These are what we call “regular investments.” They’re kind of like planting seeds in a garden and waiting for them to bloom. Ethereum, on the other hand, is like planting a seed in a digital garden. You can’t touch it or see it in your backyard, but it’s growing in an online world. The big difference here is that while both can grow, Ethereum does it in a world that’s constantly changing with new technology. It’s not just about buying and holding; it’s also about being a part of something that’s evolving and could change how we do a lot of things in the future.

Jumping into Ethereum is more like getting on a fast-moving train than planting a garden. The value goes up and down a lot more sharply and quickly than traditional investments. Think of it like a rollercoaster ride in comparison to a gentle pony ride. This makes it exciting but also a bit riskier. However, the payoff could be significant. While traditional investments often rely on things like company performance or real estate values, Ethereum’s growth is fueled by innovation, tech advancements, and how many people start to use and trust this digital platform. It’s not just about the financial return; it’s also about being part of the new digital era. 🌐💡

Real-world Uses: Ethereum in the Corporate World 💼

Ethereum is stepping out from the shadows of being merely digital cash to something much bigger, especially in the eyes of the corporate world. Giants in various industries are starting to see Ethereum not just as a cryptocurrency but as a platform that can offer innovative solutions to old problems. For example, supply chain management can be revolutionized with Ethereum’s blockchain technology, making tracking products from manufacture to delivery seamless and tamper-proof. Similarly, Ethereum allows for smart contracts, which are agreements that self-execute when certain conditions are met, without the need for intermediaries. This capability is particularly appealing for businesses looking to automate and secure their operations efficiently. With such potential, it’s no wonder that big companies are diving headfirst into exploring Ethereum’s capabilities, looking to harness its power to stay ahead in the competitive market. Amidst growing interest, individuals keen on aligning with technological trends may find valuable insights by joining a bitcoin developer community: how to contribute versus ethereum. The embrace of Ethereum by the corporate sector is not just a passing trend; it represents a shift towards smarter, blockchain-powered business models that promise efficiency, security, and transparency.

Risks and Rewards: the Ethereum Investment Rollercoaster 🎢

Imagine stepping onto a rollercoaster; your heart races as you ascend slowly, teetering on the brink of dizzying heights, only to plunge into the depths moments later. This thrill is akin to investing in Ethereum, where the promise of high rewards comes hand-in-hand with risks. On one hand, Ethereum sets itself apart with its smart contracts and decentralized applications (DApps), offering a playground for innovation that attracts corporations seeking to revolutionize business operations. This innovative edge could mean significant returns for investors who back projects that become integral to digital infrastructure. On the other hand, the landscape is fraught with volatility. Prices can skyrocket or plummet based on market sentiment, regulatory news, or technological breakthroughs, making it a high-stakes investment. Furthermore, the tech is still in its infancy, and as companies experiment with its capabilities, there’s a risk of unforeseen pitfalls, from unexpected costs to technological hiccups. Yet, for those willing to strap in for the ride, the potential for unprecedented gains is tempting, drawing a bold line under the adage of high risk, high reward.

| Rewards | Risks |

|---|---|

| Innovative edge with smart contracts and DApps | Market volatility |

| Potential for significant returns | Regulatory uncertainty |

| Revolutionizing business operations | Technological infancy and unforeseen pitfalls |

Looking Ahead: Ethereum’s Role in Future Investments 🔮

As we gaze into the crystal ball, it’s clear that Ethereum could play a major role in shaping investment landscapes of the future. Imagine a world where traditional barriers in finance start to crumble, and businesses globally can access funds or invest with the speed of a click, all thanks to the Ethereum network. This isn’t just a dream. Big names across various industries are already tuning into Ethereum’s potential, leveraging its technology to transform everything from payments, contracts, to how corporate assets are managed and traded. But what really sets Ethereum apart is its ability to not just digitize money, but also processes, agreements, and much more. With choosing the right hardware wallet for bitcoin storage versus ethereum, investors are beginning to understand the unique benefits and challenges that come with Ethereum, compared to traditional investments or even other cryptocurrencies like Bitcoin. The path forward involves navigating its volatility, regulatory changes, and technological advancements. Yet, the promise of a more efficient, transparent, and inclusive financial system could make all the rollercoaster moments worth it. As corporations and individual investors alike increasingly recognize the value Ethereum brings to the table, it’s not just about the investment returns—it’s about being part of a revolutionary shift towards a decentralized financial future. 🚀🌐💡