🎲 Setting the Game Board: Bitcoin Vs. Ethereum Basics

Imagine stepping into a vast, virtual playground, where two giants – Bitcoin and Ethereum – have laid out their boards, inviting players from around the globe to partake in a digital showdown. Bitcoin, the first of its kind, is like the grandmaster of this realm, focusing on being digital gold, a secure place to store your wealth. Ethereum, on the other hand, brings a twist to the game, not just storing value but also allowing players to create and run their apps on its platform, thanks to smart contracts. This creates a vibrant ecosystem where not only money but ideas and innovations flow freely.

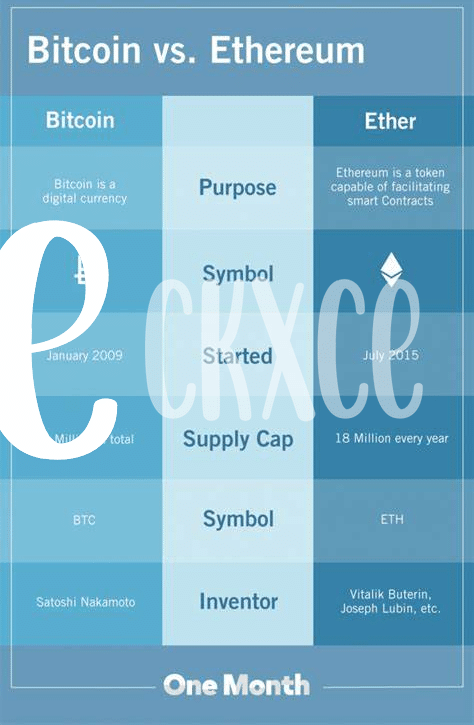

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Primary Use | Store of Value | Decentralized Platform |

| Technology | Blockchain | Blockchain + Smart Contracts |

| Transaction Speed | Slower | Faster |

| Creation Year | 2009 | 2015 |

Each player, or ‘miner’, in this game contributes to the network’s security and operation, influencing outcomes and potentially earning rewards. Yet, despite their differences, both Bitcoin and Ethereum share a common goal: to revolutionize how we think about and use money. The game is ever-evolving, with strategies and alliances forming at every turn, promising a future where finance is no longer bound by the traditional rules set by physical banks and borders.

🔄 the Players’ Moves: How Miners Influence the Game

Think of Bitcoin and Ethereum as two giant board games where everyone is trying to figure out the best move. Miners play a huge part in this. Imagine these miners as players who use their computers to solve complex puzzles. By doing this, they get a chance to add a block to the chain and earn some digital coins as a reward. This process isn’t just about making money; it’s crucial for keeping the network safe and running smoothly. Each miner’s move can influence the direction of the game, shaping the strategies of others in this digital ecosystem.

The competition among miners is fierce, as everyone wants to solve the puzzle first and grab the rewards. But there’s a twist—sometimes, they have to decide between working alone or teaming up with others. This decision isn’t easy, as it involves calculating the odds of winning solo versus the benefits of sharing the prize. As the game evolves, miners adapt by upgrading their equipment or joining mining pools, showing how versatile and strategic they have to be to stay ahead. For a deeper dive into how these principles apply to Bitcoin and Ethereum, check out this detailed comparison here.

🏆 Winning Strategies: Securing the Network

In the fascinating world of digital currencies like Bitcoin and Ethereum, think of securing the network as the ultimate goal in a high-stakes game. Here, every player, from individual users to miners, plays a crucial part. Imagine miners as the game’s guardians. They use powerful computers to solve complex puzzles, validating transactions and, in turn, keeping the network safe and sound. This process, known as mining, isn’t just for show; it’s the backbone that ensures the system remains transparent and trustworthy. But it’s not just about competition. Cooperation plays a key role too. Through a delicate balance of rivalries and alliances, the network becomes stronger and more resilient against attacks. This teamwork, coupled with advanced technologies, forms a shield that protects the network, ensuring that everyone’s digital treasure remains safe and sound, today and in the future. Such strategies highlight the brilliance behind these digital currencies, showcasing how they’re not just about making transactions but also about creating a secure, decentralized world.

💡 Lightning and Layer 2: Game Changers?

Imagine a world where sending money is as easy as sending a text message, and online transactions are swift, cheap, and secure. This isn’t just a dream; it’s becoming a reality thanks to innovative technologies like the Lightning Network for Bitcoin and Layer 2 solutions for Ethereum. Think of these as turbo-charged engines for cryptocurrencies, designed to speed things up and cut costs. They work by taking some of the heavy lifting off the main blockchain, akin to taking a shortcut that avoids traffic jams. This not only makes transactions faster but also opens doors to new possibilities, like playing real-time games or trading tiny amounts without worrying about fees. As players in the digital currency world explore these new paths, the game changes. It’s not just about who can keep their network secure; it’s also about who can offer users the best experience. For more insight into how these technologies stack up against each other, consider the contrasts between Bitcoin’s and Ethereum’s approaches, especially in terms of security and user friendliness. A great resource for understanding these differences is how to create and use a bitcoin paper wallet versus ethereum, which dives deep into the stability and fragmentation concerns around these currencies.

🤝 Cooperation Vs. Competition: Forks and Alliances

In the world of Bitcoin and Ethereum, the lines between working together and going head-to-head blur quite a bit. Think of it like choosing teams on the playground; sometimes you’re better off joining forces, and other times it’s every player for themselves. This is especially true when we talk about forks and alliances. Forks can split a community in two, creating rival camps that push their own version of the game. But, alliances, like those forming around scaling solutions, can strengthen the network. These dynamics make the ecosystem much like a giant, ongoing game of chess, where every move can shift the balance of power.

| Strategy | Description | Impact |

|---|---|---|

| Forks | When a blockchain splits into two separate paths. | Can create competition but also innovation as each fork pursues its vision. |

| Alliances | Partnerships formed for mutual benefit, often around technological advancements. | Strengthens the network by pooling resources and aligning strategies. |

Predicting which route will lead to victory isn’t simple; it requires understanding not just the technology but also the philosophy guiding the players. Whether through forks that challenge the status quo or alliances that fortify it, the crypto ecosystem thrives on a delicate balance between cooperation and competition. This balance is what keeps the game interesting, pushing it towards unexpected innovations and developments.

🚀 Predicting the Future: Game Theory’s Crystal Ball

Peering into the world of Bitcoin and Ethereum through the lens of game theory is like wielding a crystal ball, giving us unique insights into how the strategies of these digital giants could shape the future. It uncovers how the actions of miners, developers, and users create a dynamic playing field, where every move has the potential to shift the balance and influence the direction of the cryptocurrency ecosystem. At its core, it’s a dance between cooperation and competition, where the outcomes of decisions, such as forks or the development of new technologies like Lightning and Layer 2 solutions, are not just technical updates but pivotal moments that could redefine the landscape.

Understanding the intricate dynamics between Bitcoin and Ethereum, and how game theory applies, sheds light on some of the big questions and myths surrounding these cryptocurrencies. For deeper insights, reading about debunking common bitcoin myths and misconceptions versus Ethereum can be incredibly revealing. It’s through this game theory lens that we can begin to predict how the strategies of these cryptocurrencies may evolve, considering not just the technological advancements but also the human elements of governance, incentives, and the eternal tug-of-war between collaboration and rivalry, painting a comprehensive picture of what the future might hold.