The Birth of Bitcoin and Ethereum 🌟

Imagine a world where two digital superheroes make their grand entrance, sparking a revolution. First up, Bitcoin, stepping into the spotlight in 2009, crafted by the mysterious Satoshi Nakamoto. It was like nothing ever seen before – a digital form of money that let people send value across the globe quickly, without needing banks or big institutions. Then, not wanting to be left out, Ethereum arrives on the scene in 2015, thanks to a young visionary named Vitalik Buterin. Ethereum took the baton from Bitcoin, but it added a twist – it wasn’t just digital money; it was a whole platform where anyone could build their own digital applications. These two pioneers laid the foundation for what many call the blockchain revolution. Each had its unique charm: Bitcoin, with its promise of digital gold, and Ethereum, as a wizarding world of endless possibilities.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Creator | Satoshi Nakamoto | Vitalik Buterin |

| Main Purpose | Digital Currency | Smart Contract Platform |

| Highlight | First of its kind | Innovative Smart Contracts |

The Legal Landscape: Bitcoin Vs. Ethereum 🏛️

Diving into the heart of digital currencies, Bitcoin and Ethereum have sparked quite the legal debates across the globe. Imagine two superheroes battling it out in different arenas; that’s what it’s like when comparing the legal challenges each faces. Governments worldwide are scrambling to figure out how to deal with these digital giants. On one hand, Bitcoin, the first of its kind, has been more widely scrutinized due to its association with financial anonymity and the fears of it being used for less-than-legal activities. Ethereum, although newer, isn’t slipping under the radar either, especially with its smart contracts feature that’s like a Swiss Army knife for digital agreements but also raises eyebrows on regulatory fronts. These digital currencies are walking through a minefield of regulations that differ wildly from one country to another, making their growth and evolution a fascinating study of law meets tech. Amidst this legal tug-of-war, it’s interesting to see how each of these cryptocurrencies pave their way, influencing legal frameworks around the world. For a deeper dive into how cryptocurrencies like Ethereum are becoming appealing to the corporate giants, check out https://wikicrypto.news/ethereums-rise-corporate-giants-next-big-investment-frontier.

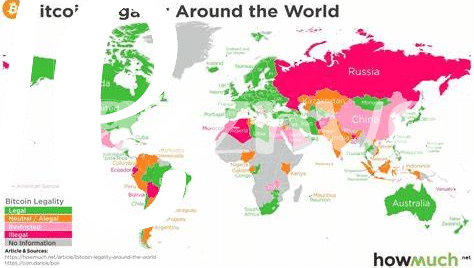

Worldwide Crackdowns: Stories from Different Countries 🌍

Around the globe, governments have been eyeing Bitcoin and Ethereum with a mix of intrigue and concern, leading to a colorful mosaic of legal actions. In some corners, you have countries rolling out the red carpet, seeing these cryptocurrencies as pioneers of financial evolution. Yet, elsewhere, the welcome has been less warm, with authorities waving red flags, worried about potential mischief – from dodgy deals to untraceable transactions. Take China, for example, which put its foot down hard, banning all crypto transactions to curb what it saw as financial risk and disorder. Contrast that with Switzerland, known for its chocolate and banks, embracing these digital currencies and even creating a “Crypto Valley” to become a global hub. This tale of two attitudes has shaped a world where, depending on where you are, Bitcoin and Ethereum might be seen as either the future of finance or a troublesome fad, making their journey across borders a fascinating saga of adaptation and resistance.

Regulation Maze: Navigating through Complex Laws 🗺️

Finding your way through the complex laws that govern Bitcoin and Ethereum feels like trying to walk through a maze without a map. Think of it this way: in one country, Bitcoin might be welcomed with open arms, seen as the future of finance. Meanwhile, just across the border, it could be viewed with suspicion, tangled in red tape and restrictions. Ethereum faces a similar predicament, its groundbreaking technology both celebrated and scrutinized under the watchful eyes of regulators. This varying acceptance worldwide creates a patchwork of rules that can be dizzying for investors and creators alike.

For those immersed in the world of digital currencies, understanding this intricate legal landscape is crucial. Knowledge is power, after all. That’s why insights into the relationship between bitcoin and the dark web versus ethereum can be incredibly valuable. It offers a clearer perspective on how these leading cryptocurrencies navigate the murky waters of global regulations. As we move forward, the ability to adeptly maneuver through these legal labyrinths will not only protect investments but also pave the way for the revolutionary potential of digital currencies to be fully realized.

The Future Implications of Legal Battles 🚀

Looking ahead, the tug-of-war between emerging technologies like Bitcoin and Ethereum and global legal frameworks is a promising yet challenging frontier. This battleground sets the stage for potentially transformative changes in how we understand and interact with these digital assets. As legal skirmishes unfold, they could pave the way for clearer regulations, fostering a safer and more transparent ecosystem for users and investors alike. The ripple effect of these battles might also encourage innovation, as developers strive to create technologies that comply with new legal standards while pushing the boundaries of what these platforms can achieve. Interestingly, the outcomes of these legal confrontations hold the power to shape public perception, possibly swaying more individuals and institutions to adopt these technologies as they become viewed as more legitimate and stable. However, navigating this ever-evolving landscape demands adaptability from all stakeholders involved, from lawmakers to technology creators, and even everyday users.

| Impact Area | Possible Outcome |

|---|---|

| Regulation Clarity | Clearer, more uniform legal frameworks globally |

| Technology Innovation | Development of new, compliant technologies |

| Market Stability | Increased trust and stability in digital currency markets |

| User Adoption | Broader acceptance and use of cryptocurrencies |

| Public Perception | Greater legitimacy and reduced skepticism |

How These Battles Influence the Market 📉

When legal battles flare up around Bitcoin and Ethereum, the waves are felt across the market, causing ripples that either pull the prices up or push them down. Imagine two giant ships (Bitcoin and Ethereum) navigating through the stormy seas of legal issues. Sometimes the sea is calm, showing clear skies for investments and sparking interest among corporate giants investing in Bitcoin: a trend analysis versus Ethereum. Other times, the sea is rough, making even the most seasoned sailors (investors) hesitant. These fluctuations aren’t just numbers on a screen; they reflect people’s confidence in these digital currencies, influencing whether they’re seen as safe harbors or turbulent waters.

Moreover, each development in the courtroom can act as a beacon, guiding future projects and investments in the crypto world. It’s like deciding to join a voyage by joining a Bitcoin developer community: how to contribute versus Ethereum, where the outcome of these legal skirmishes can either encourage new members to come aboard or dissuade them. As these battles unfold, their impact is not just limited to current prices but also shapes how cryptocurrencies are perceived and embraced globally, influencing the evolution of digital finance.