What Is Inflation Hedging? 🌍

Imagine you’re at the store, noticing that the price of your favorite snacks has gone up, again. This is inflation at work, where your money buys less than it did before. Now, inflation hedging is like finding a secret tunnel that protects your money from these rising prices. It’s a way to keep your purchasing power strong even when inflation tries to weaken it. People have used various methods over the years, like investing in gold or property, hoping these assets will grow in value over time, just like the cost of living. By aligning your savings with something that increases in value, you’re essentially putting up a shield against the eroding force of inflation. This strategy is crucial for folks looking to safeguard their future buying power in an unpredictable economic landscape 🌍💼🛡.

| Term | Explanation |

|---|---|

| Inflation | A general increase in prices, leading to a decrease in the purchasing power of money. |

| Hedging | Using investment strategies to reduce the risk of adverse price movements in an asset. |

| Inflation Hedging | Investing in assets expected to maintain or increase in value over time, offsetting the effects of inflation. |

Bitcoin’s Basics: More Than Digital Gold 🥇

At the heart of the digital currency world, Bitcoin shines as a beacon of potential, not just as a means to buy and sell online but as a hedge against the rising tide of inflation. Imagine it as a lifeboat in a sea where your money’s value keeps sinking. Unlike traditional gold, which you can hold in your hand, Bitcoin is like gold you can send across the internet. It started back in 2009 by someone named Satoshi Nakamoto, a mystery figure whose vision was a currency free from control by any single government or institution. This makes Bitcoin a kind of “digital gold” but with a twist. It’s designed to be scarce, similar to how there’s only so much gold buried in the Earth. No matter how much people might want more Bitcoin, there’s a hard limit set to exist — only 21 million bitcoins will ever be made. This scarcity is key because it helps keep Bitcoin’s value stable over time, making it an attractive option for protecting savings against the creeping loss of purchasing power that comes with inflation. Meanwhile, in the broader realm of digital currencies and their acceptance worldwide, interesting developments occur, such as Ethereum’s approaches to security and legal recognitions of cryptocurrencies which you can explore more at https://wikicrypto.news/countries-leading-the-charge-in-cryptocurrency-legal-recognition. This blend of scarcity, independence, and digital convenience gives Bitcoin its edge, offering a modern twist to the age-old idea of storing wealth in precious metals.

Ethereum’s Role in the Digital Economy 💻

Imagine a bustling city where everyone speaks a different language, but they all need to talk to each other to trade, share ideas, and build cool things together. That’s a bit like what Ethereum does in the world of digital currency and online transactions. It’s not just another type of money you can save or spend; it’s more like the town square of this digital city, facilitating conversations and transactions. Ethereum introduces smart contracts, which are like automatic agreements that live in the digital world. They do what they’re told, when they’re told, if the conditions are right; kind of like a vending machine that only drops your favorite snack when you insert the correct amount of money. This smart contract feature enables people to make deals, create new digital tokens, and even build whole new applications on top of Ethereum. So, while Bitcoin might be seen as digital gold, a safe place to store your savings away from the wild swings of the economy, Ethereum is the bustling marketplace where these savings can be used to create, trade, and innovate.

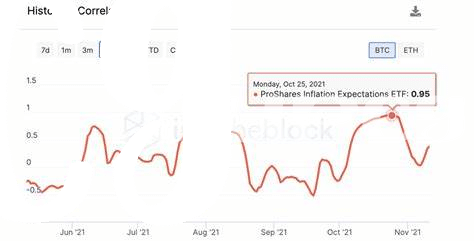

Comparing Bitcoin and Ethereum in Inflation Protection 📊

When we dive into how Bitcoin and Ethereum stack up against each other in keeping your money safe from inflation, it’s like comparing apples and oranges, but for your wallet. Bitcoin, often hailed as ‘digital gold,’ acts as a sturdy shield in the world of inflation hedging. Its capped supply of 21 million coins is a hard stop on ever making more, which helps it keep its value over time. Imagine it as a castle with a limited number of gold coins; no matter how much the world outside changes, the amount of gold in the castle stays the same. Now, on the flip side, Ethereum operates on a different model. It’s not just digital money but a whole ecosystem where digital applications live. Although it has introduced measures to reduce its available supply, it doesn’t have a cap like Bitcoin. This means its ability to act as a protection against inflation might not be as strong because its supply can still increase.

Both assets bring unique strengths to the table when it comes to fighting inflation. However, the conversation becomes even more fascinating when we consider their technological advancements and future-proofing plans. For a more in-depth analysis, consider reading about how each is preparing bitcoin for quantum computing threats versus ethereum. This discussion not only highlights their differences but shows how each might be positioned to tackle future economic challenges. As inflation continues to be a hot topic, understanding where Bitcoin and Ethereum stand can help us navigate the waves of economic change with a bit more confidence.

Real-life Examples of Bitcoin Hedging Against Inflation 💡

In the world where the value of money seems to dip with each passing day, tales of Bitcoin rising up as a shining armor against inflation have painted the financial landscape. Take, for instance, countries grappling with high inflation rates; many citizens turned their gaze towards Bitcoin. Venezuela and Zimbabwe, facing hyperinflation, saw individuals flocking to Bitcoin as a lifeboat amidst their rapidly sinking economies. This digital asset offered them a way to preserve the value of their savings, as their local currencies plummeted. In more stable economies, savvy investors eyeing the incessant money printing by governments, especially during crisis times like the COVID-19 pandemic, have considered Bitcoin a safe haven. They view it as a means to shield their wealth from the diminishing purchasing power that inevitably comes with inflation. Unlike traditional hedges like gold, Bitcoin is easily accessible to the common man, requires no physical storage, and its digital nature means it can be transferred across borders effortlessly, highlighting its utility in preserving wealth regardless of where you are in the world.

| Country | Inflation Rate | Bitcoin Adoption Level |

|---|---|---|

| Venezuela | Hyperinflation | High |

| Zimbabwe | Hyperinflation | High |

| Global | Varies | Rising |

Why Bitcoin May Be the Better Choice ✅

When looking at safeguarding your money against the rise of living costs, Bitcoin shines for several reasons. Its limited supply, akin to precious metals like gold, positions it as a rare asset that can’t be easily devalued by creating more of it, which isn’t something we can say about traditional money or even Ethereum to the same extent. This scarcity mirrors the properties of assets that have historically held up well in times when money buys less. Moreover, Bitcoin has garnered significant trust and adoption, receiving nods of approval as a form of legal tender in various countries, a step that further solidifies its standing and potential to stay resilient against economic fluctuations.

To get a clearer picture, consider the the intersection of artificial intelligence and bitcoin trading versus ethereum. This comparison not only highlights Bitcoin’s legal acceptance but also emphasizes its attractiveness to investors looking for stability in a digital form. Whether it’s being used to buy a coffee or as part of a more complex investment strategy, Bitcoin is emerging as a reliable store of value. This edge, coupled with its groundbreaking inception that introduced the world to blockchain technology, showcases why it may just be the stronger safeguard against the ever-looming shadow of inflation.