The Origins and Visions 🌟: Bitcoin Vs. Ethereum

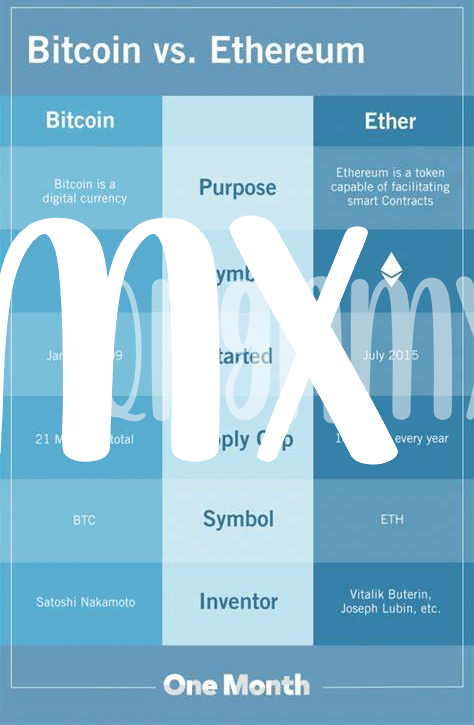

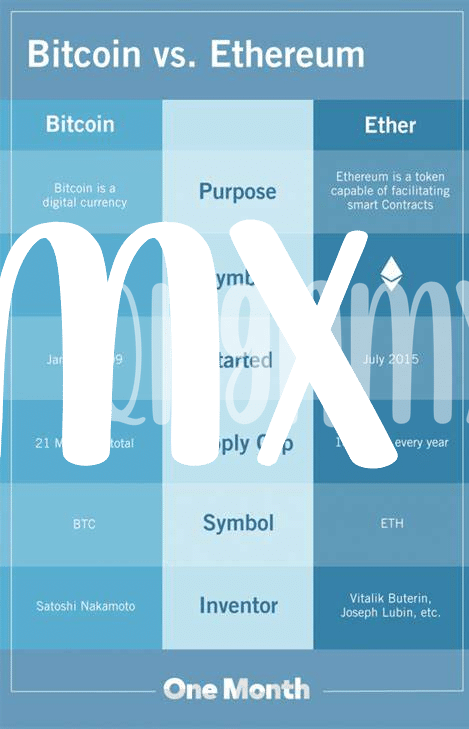

Imagine two pioneering travelers, setting off on distinct paths towards a shared horizon of digital innovation. Bitcoin, the first of its kind, embarked on its journey in 2009, holding a vision of a new kind of money. This digital currency was designed to operate independently of central governments or banks, aiming to create a system where transactions could be made directly from person to person. Its creator, known by the pseudonym Satoshi Nakamoto, envisioned a world where financial transactions are transparent, secure, and without borders.

On the other side, Ethereum took its first steps in 2015, crafted by Vitalik Buterin and his team with a different dream in mind. While Bitcoin aimed to revolutionize the way we view and use money, Ethereum sought to take this a step further by transforming how we use the internet itself. It introduced the concept of smart contracts, self-executing contracts with the terms directly written into code, enabling not just transactions of currency, but the creation of decentralized applications. This opened a realm of possibilities, from creating new digital assets to building decentralized organizations, fundamentally challenging how we conceive and implement digital trust and security.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Vision | Decentralized digital currency | Decentralized platform for smart contracts and DApps |

| Launch Year | 2009 | 2015 |

| Key Inventor | Satoshi Nakamoto | Vitalik Buterin |

| Main Use | Peer-to-peer transactions | Building decentralized applications |

Understanding Forks: Types and Reasons ⚙️

In the world of digital currencies, think of forks as the moments when the road takes a surprise turn, leading to some interesting journeys. Imagine you’re on a road trip with your friends (Bitcoin and Ethereum), and suddenly, you come to a fork in the road. One path is well-trodden, familiar – that’s your traditional “soft fork,” where minor tweaks happen without creating a new road. Then there’s the less traveled path, a “hard fork,” thrilling but unknown, creating a brand-new road based on disagreements or the desire for improvement. Why do these forks happen, you ask? For a bunch of reasons! Sometimes, people find bugs that need fixing or want to add new features to make everything run smoother, safer, and better. Other times, the community can’t agree on the direction of the journey, leading to a split and the birth of a new coin. Just like in life, these changes are about evolution, about trying to get better, even if it means taking a bit of a gamble on a new path. For a deeper dive into how these updates are shaping the financial landscape, check out https://wikicrypto.news/ethereum-giving-transforming-philanthropy-with-smart-contracts, exploring Ethereum’s unique role in this changing world.

Major Bitcoin Forks: a Historical Overview 🗺️

Throughout Bitcoin’s journey, it has branched out like a tree, creating new paths called forks. Imagine having a family recipe that you tweak a bit every time you cook – some changes might lead to a completely new dish. That’s how Bitcoin forks work; they are changes in the recipe of how Bitcoin operates. Some notable forks include Bitcoin Cash and Bitcoin Gold. Bitcoin Cash emerged in 2017, aiming for faster transactions to make everyday use easier. Bitcoin Gold followed, with a mission to democratize mining, allowing more people to join in without needing expensive equipment.

Each fork had its drama, kind of like episodes in a soap opera, capturing the attention of users and investors alike. While purists argue that these forks dilute Bitcoin’s original vision, others see them as necessary steps toward a more versatile and user-friendly digital currency. These evolutionary steps have not only marked significant milestones in Bitcoin’s timeline but also motivated a broader discussion on what the future of digital currency should look like, sparking innovation and debate in the community.

Ethereum’s Path: Key Updates and Forks 🔗

Ethereum has always stood out for its ambitious approach to blockchain technology. Unlike Bitcoin, which is something like digital gold, Ethereum aims to be a platform where developers can build applications that run on a distributed network. This vision led to notable changes and improvements over the years, known as forks and updates. One of the most significant updates was called “Ethereum 2.0,” which is all about making Ethereum more scalable, secure, and sustainable. It’s a big deal because it promises to reduce energy consumption drastically, thanks to a shift from Proof of Work to Proof of Stake. But it’s not just about technical upgrades. Ethereum has also experienced its fair share of forks, both soft and hard, adapting and evolving in response to the community’s needs and challenges. For example, a major fork happened after the infamous DAO attack, leading to a split that created Ethereum Classic. These developments are not just about keeping the network up-to-date. They have real implications for users and investors, potentially affecting speed, costs, and even the overall security of the network. For those interested in how these changes compare to the world of traditional finance, the stance of central banks on bitcoin adoption versus ethereum offers some intriguing insights. As Ethereum continues to evolve, its journey is a testament to the vibrant and innovative spirit of the crypto community.

Impact on Users and Investors 💼

When these digital currencies go through changes, like forks and updates, it can really shake things up for those holding the coins in their digital wallets. Imagine you’re baking a cake (your investment), and suddenly, the recipe changes. You might end up with a completely different cake than you expected! This is what happens with forks and updates; they can change the rules of the game, sometimes splitting one currency into two (like Bitcoin Cash splitting from Bitcoin) or upgrading the system to make it faster or more secure. These changes can directly affect how much your digital ‘cake’ is worth, making it an exciting, yet unpredictable ride.

On the investor’s side, these changes are like the weather forecast for their portfolios. A sunny forecast (successful update or fork) could lead to a value increase, attracting more investors, and potentially leading to a price surge. However, stormy weather (controversial or poorly received updates) might push prices down, leading to a cautious approach. Navigating these events requires staying informed and sometimes even relying on expert predictions.

| Event | Impact on Investors | Impact on Users |

|---|---|---|

| Forks | Potential for new investment opportunities or risks | May need to adapt to new versions or networks |

| Updates | Opportunities for growth in value | Improved user experience or capabilities |

The Future: What’s Next for Bitcoin and Ethereum? 🔮

Peering into the crystal ball, we can only imagine the innovations that Bitcoin and Ethereum will bring to the table. Both cryptocurrencies are on a journey of constant evolution, aiming to make our digital and financial worlds more accessible, efficient, and secure. For Ethereum, the focus is on enhancing its platform to support more complex applications and making transactions faster and more energy-efficient. Bitcoin, on the other hand, seems to be concentrating on strengthening its role as digital gold, a secure and valuable store of wealth. As technology advances, we may see these two giants adopting and integrating breakthroughs like quantum resistance to stay ahead of potential threats. The impact of their developments will undoubtedly ripple through the world of cryptocurrency, influencing how we interact with the digital economy. One thing is for certain, the commitment of both Bitcoin and Ethereum to improving lives and fostering financial inclusion is evident through their support of various philanthropic initiatives. A shining example of this is bitcoin’s contribution to financial inclusion worldwide versus ethereum, showcasing how these digital currencies are not just about profits but also about empowering communities around the globe. As we move forward, the excitement lies not just in the technological advancements but in the potential for positive social change that these cryptocurrencies embody.