🌎 the Global Race: Ethereum Vs. Bitcoin for Remittances

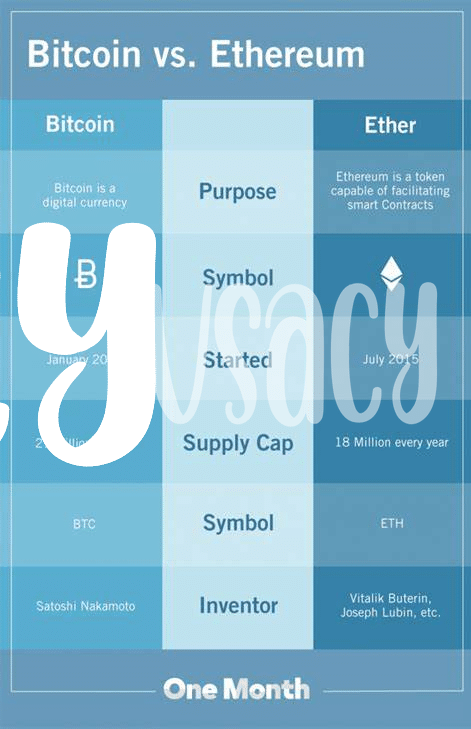

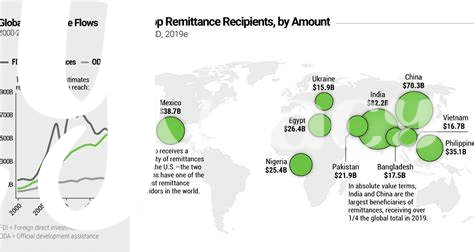

In the digital age, two giants stand tall in the race to change how we send money across borders: Ethereum and Bitcoin. Each has its fans cheering from the sidelines, but when it comes down to remittances—sending money home to families and friends—the real question is, which one takes the crown? On one side, Bitcoin, the first of its kind, offers the allure of stability and wide recognition. Across the ring, Ethereum steps in with its quicker transactions and innovative contracts, promising a smooth and efficient process. Yet, this competition isn’t just about speed and ease; it’s a battle that could redefine global money movement. As they vie for dominance, it’s clear that the victor could shape the future of remittances, making international money transfers faster, cheaper, and more accessible to everyone.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Transaction Speed | 10 minutes | Seconds to minutes |

| Transaction Cost | Variable | Generally lower |

| Global Recognition | High | Growing |

| Innovative Uses | Limited | Smart Contracts, DApps |

💸 Sending Money: Costs and Speed Compared

When we talk about sending money to friends or family around the world, two big names often come to mind: Ethereum and Bitcoin. These digital currencies have changed the game, allowing us to move money across borders without the usual wait or hefty fees. Imagine sending a gift to your cousin across the sea. With traditional banks, it might take days and cost more than you’d like. But with Ethereum or Bitcoin, it’s like sending an instant message – quick and often cheaper. This is because they cut out the middleman, making the whole process faster and more cost-effective.

But, it’s not just about speed and savings. Each of these digital currencies has its unique way of handling transactions, which can affect how much you pay and how long you wait. For example, Bitcoin is like the older, more established player, with a strong reputation for security. However, Ethereum is the newer kid on the block, offering some innovative features that can lead to lower costs and faster transactions in some cases. This battle for remittance dominance isn’t just about who’s faster or cheaper, though. It’s about finding the best fit for your needs, whether you’re prioritizing speed, cost, or something else entirely. And speaking of impact, don’t miss out on this fascinating read about the environmental impact: a Bitcoin vs. Ethereum analysis.

🛡️ Safety First: Which Is More Secure?

When it comes to keeping our digital dollars safe, Ethereum and Bitcoin both offer secure options, but they do have their unique angles. The safety of these cryptocurrencies hinges largely on blockchain technology, which is like a public ledger that is incredibly hard to tamper with. Bitcoin, being the first out of the gate, has a long-standing reputation for security. Its network security is backed by immense computing power, making it very resistant to attacks. On the other hand, Ethereum offers something a bit different. Its security not only involves transactions but also ‘smart contracts’ – think of these as self-executing agreements that live on the blockchain and work automatically when certain conditions are met. This adds an extra layer of utility and, potentially, security, but it also introduces more complexity, which could offer more angles for attack.

🌍 However, it’s important to remember that no system is entirely immune to risks. In the world of digital currency, the security of your investments also depends a lot on personal precautions. Both platforms continuously evolve, adopting new measures to enhance security. For instance, Ethereum is moving to a proof-of-stake model with its Ethereum 2.0 upgrade, which is expected to offer better security and lower the risk of attacks. 🛠️ At the end of the day, whether you lean towards the pioneering robustness of Bitcoin or the innovative approach of Ethereum, making sure you’re informed and cautious is key to keeping your digital treasures safe.

🌱 the Green Factor: Environmental Impact

In today’s world, where the digital horizon is expanding faster than ever, the way we think about the environment is changing too, especially when it comes to the giants of the crypto realm, Bitcoin and Ethereum. Both these platforms have a footprint on our planet, and it’s something we’re becoming increasingly aware of. Imagine a world where sending money doesn’t just mean a click but also planting a tree – that’s where the conversation on the environmental impact comes into play. Bitcoin, known for its strength and security, unfortunately, consumes a lot of energy, akin to the power usage of some countries! On the other hand, Ethereum is making moves towards a greener future by updating its technology to use much less energy. This shift matters because our planet matters. For those who are keen on diving deeper into how these platforms stack up and the move towards renewable energy solutions for bitcoin mining operations versus ethereum, it’s a discussion that goes beyond just technology or finances; it’s about ensuring a sustainable future for all. As we look ahead, the adoption of greener practices will not just be a bonus but a necessity, steering the digital currency world towards a more eco-friendly horizon.

📈 Future Predictions: Growth and Adoption Trends

Looking into the crystal ball of digital currency, both Ethereum and Bitcoin are on an exciting journey. Imagine a world where sending money is just as easy as sending a text message, and this is where we’re heading. With Ethereum’s continuous improvements and Bitcoin’s growing acceptance, their paths towards dominating the remittance market are becoming clearer. As we dive deeper, it’s like watching two giants gearing up for a friendly match, each with its strengths. Ethereum, with its smart contracts, is like a Swiss Army knife, adaptable and ready for complex transactions. Bitcoin, on the other hand, is like gold – trusted, stable, and everyone knows about it. The trend suggests a future where these giants could lead in different lanes; Ethereum, in the fast and multifaceted transactions avenue, and Bitcoin in the safe, slow, and steady road. The adoption curve is looking promising as more people and businesses get comfortable with digital currency, signaling a shift towards a more inclusive financial world. Here’s a simple view of what we might expect:

| Year | Ethereum Adoption Trends | Bitcoin Adoption Trends |

|---|---|---|

| 2023 | Growing interest in DeFi projects | Increasing use as digital gold |

| 2025 | Expansion in smart contract applications | Broader acceptance in retail |

| 2030 | Integration in mainstream banking | Widespread use in wealth preservation |

Both paths lead to a future where sending money across the world is faster, cheaper, and secure, making our lives a bit easier and the world a bit smaller.

💻 Technology Behind: Understanding the Basics

Imagine a world where sending and receiving money is as simple as sending a message on your phone. That’s the promise behind Bitcoin and Ethereum, two of the biggest names in the cryptocurrency world. At heart, they share a similar mission: to make transactions faster, cheaper, and borderless. Yet, the magic that makes them work is quite different. Bitcoin is like the granddaddy of digital money, focusing on being a stable way to send and receive value. Ethereum, on the other hand, is more like a Swiss Army knife, allowing not just for transactions but for complex agreements, known as smart contracts, to be coded right into the blockchain.

Now, if you’re curious about the heated debates or the unique features that set Bitcoin and Ethereum apart, we’ve got you covered. For a deep dive into the controversies and the special sauce behind each technology, check out educational resources for learning about bitcoin versus ethereum. Whether you’re intrigued by the tech or just want to keep up with the buzz, understanding these basics is like having a front-row seat to the future of money. From transaction times to the potential for world-changing applications, the journey of Bitcoin and Ethereum is just beginning.