The Birth of Bitcoin and Ethereum 🌱

Imagine a world where two superheroes emerged, not from the pages of a comic book, but from the minds of visionary tech enthusiasts. The first hero, Bitcoin, stepped into the light in 2009, crafted by the mysterious Satoshi Nakamoto. Its superpower? The ability to move money across the globe, swiftly and without the need for big, scary banks. Fast forward to 2015, and the stage welcomed Ethereum, envisioned by the young prodigy Vitalik Buterin. Ethereum went a step further, not just moving money with its digital magic but letting anyone build their mini-superpowers, called apps, on its platform. Together, these two have kick-started a revolution, the ripples of which are transforming our digital world in ways we’re just beginning to understand.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Birth Year | 2009 | 2015 |

| Founder | Satoshi Nakamoto | Vitalik Buterin |

| Primary Function | Digital Currency | Decentralized Platform |

Breaking down Their Core Technologies 🔍

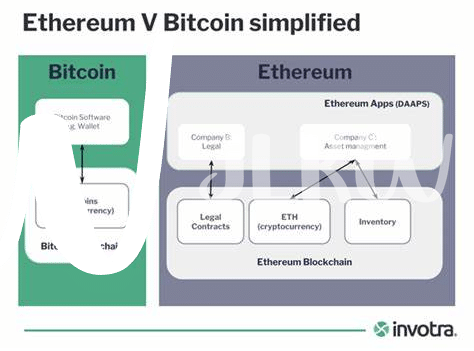

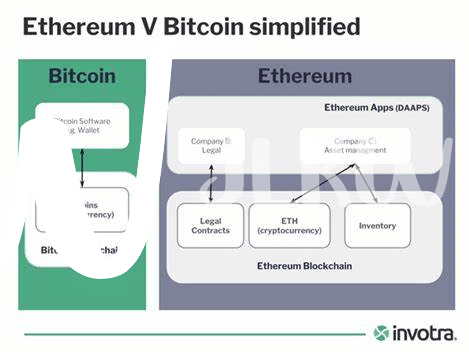

At the heart of every cryptocurrency lies its technology, a unique set of rules and processes that define its capabilities and potential. Imagine Bitcoin as the wise, older sibling who paved the way, built on a rock-solid foundation aiming for secure transactions without the need for a middleman. On the other side, Ethereum bursts onto the scene with a younger, more adaptable approach, not just focusing on transactions but also allowing for smart contracts—self-executing contracts with the terms of the agreement directly written into lines of code. This contrast sets the stage for a fascinating ecosystem where Bitcoin emphasizes security and reliability, likening it to digital gold. Meanwhile, Ethereum opts for flexibility and innovation, serving as a platform where developers can build decentralized applications, each with their own unique purpose and potential. For a deeper dive into how these two pioneers are reshaping the crypto landscape, consider exploring https://wikicrypto.news/overcoming-digital-fraud-ethereums-answer-to-identity-verification, where the future of digital transactions and identity verification is being pondered upon.

The Battle for Supremacy: Security Vs. Flexibility ⚔️

In the world of digital currencies, two giants stand tall: Bitcoin and Ethereum. While Bitcoin was conceived as a secure and decentralized form of money, Ethereum was built with a different vision in mind – flexibility and the ability to execute smart contracts. This difference sets the stage for an intriguing contrast. Bitcoin, as the first mover, has focused heavily on maintaining a fortress-like security, making it a trusted store of value. On the other hand, Ethereum’s approach is akin to a creative playroom, where developers are given the freedom to innovate and build varied applications, from games to financial instruments.

This dynamic has led to a vibrant debate within the crypto community 🏙️. Some argue that security should be the paramount concern, citing the value of having a digital gold that is unassailable. Others believe that the true revolutionary power of cryptocurrencies lies in their ability to offer unprecedented flexibility and to spawn new forms of applications that can change how we interact with the digital and financial worlds 🌐🚀. This debate is not just academic; it influences the evolution of these platforms and how they are perceived by investors, developers, and users around the globe.

How They’re Changing Money and Business 💼

In the world where digital currency is king, Bitcoin and Ethereum are like the infrastructure transforming how we think about money and business. Imagine having a wallet that’s not just for cash, but for smart contracts that could do anything from automatically leasing your car to paying royalties the moment your song is streamed. This is the world Ethereum is building – a place where agreements are as easy as sending an email. On the other hand, Bitcoin is reshaping the idea of money itself, providing a digital form of cash that isn’t tied to any country or bank. This means businesses can transfer funds faster and with lower fees, which is especially revolutionary for international transactions.

Understanding the shifts in bitcoin market trends and investment analysis for 2024 versus ethereum is essential for anyone looking to navigate the future of finance and tech. The communities and developers behind these projects are bustling cities of innovation, crafting new ways to interact with our assets and each other. As businesses begin to adopt these technologies, we’re moving towards a more decentralized world where the power is spread out instead of held by a few. It’s more than just tech; it’s a new era of accessibility and opportunity.

Community and Developer Ecosystem: a Tale of Two Cities 🏙️

Imagine a bustling city square, alive with the vibrant hustle of people. In the world of cryptocurrency, Bitcoin and Ethereum represent two such dynamic cities, each with its unique community and legion of developers. Picture this: on one side, we have Bitcoin, the granddaddy of them all, with a solid foundation of loyal followers and expert miners who ensure the city’s lights stay bright. Its community values stability and security above all, contributing to a traditional yet robust ecosystem. On the flip side, enter Ethereum – a younger, more flexible metropolis where innovation is the currency of choice. Here, developers are like urban planners, constantly building and improving, thanks to Ethereum’s welcoming of new ideas and applications with open arms.

Both communities are vital to the crypto world, yet they follow different maps to treasure. Through their unique approaches, they’re shaping the future of how we see and use money. Let’s take a look at how these two ecosystems compare:

| Aspect | Bitcoin | Ethereum |

|---|---|---|

| Focus | Security and reliability | Innovation and flexibility |

| Community | Experienced miners and investors | Developers and entrepreneurs |

| Development Style | Conservative, with gradual updates | Rapid, with frequent updates |

| Applications | Primarily for transactions and store of value | Wide range, including decentralized finance and smart contracts |

As the crypto landscape continues to evolve, these communities and ecosystems are excellent reminders of the power of collaboration and innovation. They may travel different paths, but both are heading towards a future where decentralized digital currency is a key player in the global economy.

Future Outlook: Predictions and Possibilities 🚀

In the ever-evolving world of cryptocurrencies, the roads leading to the future for Bitcoin and Ethereum are paved with innovation and potential breakthroughs. Imagine a world where paying for coffee or buying a house happens in seconds, with security and without borders – that’s the promise these technologies hold. To better understand how these digital giants might shape our financial universe, let’s dive into the possibilities. With Bitcoin, we see a continued focus on becoming digital gold, a safe haven in times of economic uncertainty. Ethereum, on the other hand, is set to further its mission of being the world’s computer, enabling not just transactions but also complex contracts and decentralized applications. As we look ahead, one must wonder how these platforms will revolutionize industries, from gaming to real estate, and redefine what we consider valuable. For those curious about navigating these waters, the future of digital identity verification with Bitcoin versus Ethereum offers a glimpse into the challenges and opportunities that lie ahead. Amidst this, the robust communities and developers backing each project will likely continue to be a driving force behind their growth, pushing the boundaries of what’s possible while ensuring the systems remain true to their decentralized roots. In this digital age, the only certainty is change, and in the case of Bitcoin and Ethereum, it promises to be a thrilling ride 🚀.