🌐 Why Defi Could Be the Future of Finance

Imagine a world where you’re in full control of your money, without needing to go through banks or other middlemen. That’s the heart of DeFi, or decentralized finance, where technology offers everyone the tools to manage and grow their wealth. It’s like having a tiny, powerful bank in your pocket, but without the usual fees, long waiting times, and red tape. What’s more, DeFi is built on blockchain technology, making it secure, transparent, and open to anyone with an internet connection. This might sound complex, but think of blockchain as a digital ledger that’s very hard to tamper with. Here’s a look at why so many believe DeFi could be a real game-changer in finance:

| Feature | Benefit |

|---|---|

| Accessibility | Makes financial services available to everyone |

| Transparency | Offers clear, open records of transactions |

| Security | Reduces risk with advanced encryption |

| Efficiency | Speeds up transactions while cutting costs |

As the globe becomes more connected and technology-savvy, DeFi stands out not just as an alternative to traditional finance, but as a potential leader, making financial empowerment not just a dream, but a reality for millions around the world.

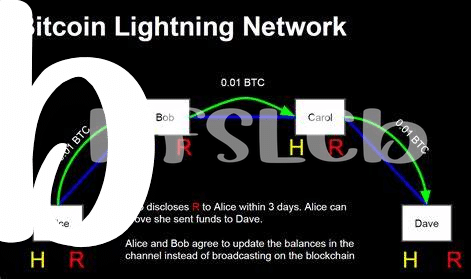

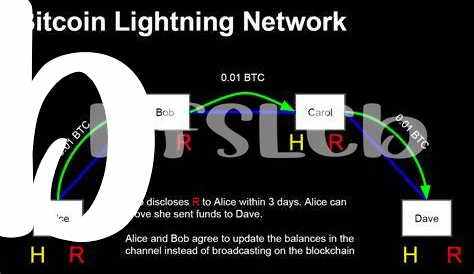

⚡ Understanding the Lightning Network’s Magic

Imagine you’re at a bustling market, but instead of waiting in long lines to pay, you zip through with instant, almost invisible transactions. That’s the essence of the Lightning Network, a layer on top of Bitcoin, making payments faster and cheaper. Picture this: right now, when you want to send Bitcoin to someone, it’s like sending a package through the post office, which can be slow and sometimes expensive. The Lightning Network, then, is like having a direct, lightning-fast delivery van for your transactions, bypassing the post office’s queues. This innovation is crucial for Bitcoin to become a daily payment method, not just a digital treasure chest. It’s designed to handle lots of tiny transactions quickly, like buying a coffee or paying back a friend for lunch, without clogging up the network. For a peek into how this is evolving and intertwining with other digital finance innovations, check out an enlightening read at https://wikicrypto.news/efficient-mining-techniques-bitcoin-and-ethereum-compared. This shift towards a nimbler, more efficient system is sparking conversations and excitement about the future of finance, as we inch closer to integrating such technologies into our everyday financial activities.

💵 Merging Defi and Lightning: a Dream Team?

Imagine a world where sending money is as easy as sending a text message, and earning on your savings happens almost like magic. That’s the promise when we think about bringing together Decentralized Finance (DeFi) and the Lightning Network. It’s like combining the power of the internet with the speed of a bolt of lightning. DeFi opens the door to a world where financial services operate without the need for traditional banks. Meanwhile, the Lightning Network makes using digital currencies super fast and cheap. By weaving these two innovations together, we’re looking at a potential dream team. This marriage could lead to faster, more accessible, and incredibly efficient financial services for everyone, everywhere. It’s not just about making transactions quicker or earning a bit more on savings; it’s about reimagining what the financial landscape looks like. 🚀🌍 This combo could democratize finance, making it fairer and more inclusive, setting the stage for a financial revolution as we head into 2024.

📈 Predictions: Where They Head in 2024

Looking into the crystal ball for 2024, the horizon for Decentralized Finance (DeFi) and the Lightning Network seems both thrilling and promising. Imagine these technologies as teammates, playing a significant role in reshaping how we handle money, making transactions faster and more accessible to everyone around the globe. Now, picture a world where sending money is as easy as sending a text message, thanks to the Lightning Network bridging gaps, and DeFi erasing the traditional boundaries set by banks and financial institutions. This duo is expected to break new ground, especially in areas previously untouched by modern banking, opening doors for everyone to participate in the global economy. However, it’s not just about making things faster or more inclusive. The union of DeFi and the Lightning Network could also lead to innovative financial products that we haven’t even thought of yet. As they grow closer, we may see solutions that protect against financial volatility or offer new ways to invest and save, revolutionizing our approach to personal finance. For those keen on exploring how this evolution might intersect with eco-friendly practices and the burgeoning world of digital art and collectibles, diving into navigating the world of bitcoin and nft collaborations in 2024 will offer a glimpse into a sustainable and artistic future powered by blockchain. Challenges remain, as integrating these technologies will require navigating regulatory landscapes and ensuring user safety. But the potential global impact is undeniable, showing a promising path toward democratizing finance on a scale never before seen.

🚀 Challenges Ahead for Defi and Lightning Integration

Combining Decentralized Finance (DeFi) with the Lightning Network is a bit like trying to mix oil and water at first glance. Both are revolutionary on their own, yet they operate on distinct principles. DeFi aims to make financial services open and accessible to anyone, anywhere, without the need for traditional banks. On the other hand, the Lightning Network seeks to speed up transaction times and reduce costs on the Bitcoin network. Marrying the two means addressing technical challenges, such as ensuring secure and seamless transactions across different blockchain platforms. Plus, there’s the human side of things – getting users to trust and adopt these new systems on a large scale.

Table: Major Challenges for DeFi and Lightning Integration

| Challenge | Description |

|———–|————-|

| Technical Integration | Creating seamless interoperability between different blockchains and protocols. |

| User Adoption | Encouraging widespread use and trust in these innovative systems. |

| Regulatory Hurdles | Navigating the complex landscape of global financial regulations. |

| Scalability | Ensuring the systems can handle large volumes of transactions without compromising speed or security. |

The road ahead isn’t an easy one. Beyond the technical hurdles lie regulatory dragons. The decentralized world operates in a realm still grey to lawmakers and regulators. Achieving global scale means not just building robust tech but also navigating the intricate web of regulations across different countries. Moreover, to truly revolutionize finance, these technologies have to prove they can handle massive amounts of transactions quickly and securely, making sure that as they grow, they don’t buckle under the pressure.

🌍 the Global Impact: Changing Everyday Finance

Imagine walking into a coffee shop in your neighborhood and paying for your latte with digital currency, no bank card in sight. This scene could become the norm rather than the exception as decentralized finance (DeFi) and technologies like the Lightning Network make their mark on everyday finance around the globe. These innovations aim to make transactions faster, less expensive, and accessible to everyone, breaking down the barriers that traditional banking systems often present.

For those looking to dive deeper into how this future is being built, a good starting point is understanding how new technologies are shaping sustainable finance. A valuable resource can be found in the step-by-step guide to bitcoin mining for newcomers versus ethereum, which navigates the complexities of mining digital currencies in an environmentally-conscious manner. As DeFi and the Lightning Network continue to develop, their integration could significantly alter how we interact with money, making financial independence and global participation possible for more people than ever before.