What Is Elliott Wave Theory? 🌊

Imagine you’re looking at the ocean. You see waves rise and fall in a sort of pattern, right? Now, think of this pattern happening in the world of finance, where prices go up and down. This idea inspired Ralph Nelson Elliott in the 1930s to create a theory that believes markets move in predictable waves or patterns. According to him, these ups and downs are not random chaos but follow a natural rhythm influenced by investor psychology and external events. Just like how surfers catch the best waves by understanding the sea, Elliott Wave Theory helps traders catch the best opportunities by reading market waves.

| Wave Type | Description |

|---|---|

| Impulse Wave | Moves in the direction of the main trend, consisting of five smaller waves 🌊 |

| Corrective Wave | Goes against the main trend, made up of three smaller waves 🌀 |

Elliott divided these market movements into two types: ‘Impulse Waves’ that push prices further in the trend direction and ‘Corrective Waves’ that move against it. By identifying these patterns, traders can make educated guesses about where the price might head next. It’s a bit like predicting the next big wave to ride, only with stocks, currencies, and yes, even Bitcoin! 📈🛸

The Basics of Bitcoin Trading 📈

Imagine stepping into a world where digital coins swirl around in a virtual marketplace, much like stars in the galaxy, each holding its unique value and story. This is the essence of Bitcoin trading, a voyage through the peaks and valleys of digital currency value on a platform where time never sleeps. With each tick of the clock, traders around the globe engage in a dance, buying low and selling high, all aimed at harnessing the power of volatility to their advantage. To embark on this journey, one must first comprehend the basics, such as setting up a digital wallet and understanding the seismic shifts of supply and demand that steer the Bitcoin ship. Moreover, it’s crucial to develop a keen eye for reading market trends and sentiments, often mirrored in the charts and graphs that paint the currency’s tumultuous journey. Amidst this adventure, staying updated with authoritative insights is key; consider reading more about how Bitcoin ties into the broader financial tactics for 2024 through https://wikicrypto.news/the-2024-financial-playbook-embracing-bitcoin-for-inflation-protection, a compass that guides through the tempest of digital currencies with precision.

Connecting Elliott Waves to Bitcoin 🤝

Imagine if you could predict the highs and lows of Bitcoin, just like a surfer catches the perfect wave. That’s where the magic of Elliott Wave Theory comes into play. This theory, much like the patterns in ocean waves, can help us spot trends in the Bitcoin market. By breaking down the price movements of Bitcoin into waves, we gain insight into where the market could head next. It’s like having a map in an ocean of uncertainty, showing us potential peaks (ups) and troughs (downs) in Bitcoin’s future.

Now, think of Bitcoin as a brave surfer navigating the vast sea. Each wave represents a shift in investor emotion and market momentum, swinging from optimism to pessimism and back again. 🌊↔️📈With Elliott Wave Theory, we’re not just guessing; we’re analyzing patterns to make educated forecasts. This doesn’t mean we can predict the future with 100% accuracy, but it’s like having a weather forecast before setting sail. By understanding these waves, traders can position themselves to ride the bullish trends up and prepare for the bearish ones, much like a seasoned surfer anticipates and reacts to the changing waves.

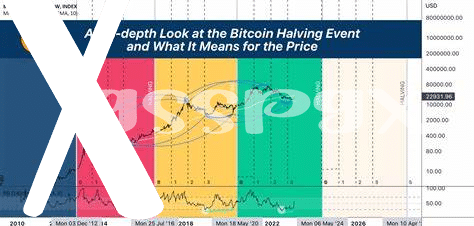

Predictions for 2024: Riding the Waves 🛸

As we look ahead to 2024, the ripples in Bitcoin’s value could turn into waves that savvy traders might ride to success. Imagine you’re at the beach, watching waves form and trying to pick the perfect one to surf. In the financial world, Elliott Wave Theory suggests that markets move in predictable waves – ups and downs that can help forecast future price movements. So, for Bitcoin enthusiasts and traders, understanding these patterns could mean the difference between wiping out and catching a monumental wave all the way to the shore. Just like in surfing, timing and experience matter.

For those ready to dive deeper and make waves in the Bitcoin space, joining a bitcoin developer community: how to contribute in 2024 can enhance your understanding and skills. Beyond just trading, it’s about becoming part of a community that’s at the forefront of digital currency innovation. As we navigate through the crests and troughs of Bitcoin’s market, equipping ourselves with the right knowledge and connections could set us up for a thrilling ride through 2024 and beyond. With careful analysis and strategic planning, traders might just find themselves on top of the wave, ready to ride the swell of Bitcoin’s potential highs.

Mitigating Risks in Wave Theory Trading 🛡️

When navigating the twists and turns of wave theory in the bustling world of Bitcoin, it’s important to wear a financial life jacket and have a keen eye on the weather ahead 🛡️. Think of it like planning a journey at sea; charting your course with care can make all the difference. Begin with diversifying your investment portfolio. Putting all your digital eggs in one Bitcoin basket might sound tempting when the tide is high, but waves can crash. Spreading investments across different assets could help steady your ship 🚢. Additionally, setting stop-loss orders is akin to installing a sturdy bilge pump; it might not stop the storm, but it can help keep your boat afloat by automatically selling at a predetermined price, minimizing potential losses. Lastly, persistent education and staying updated with market trends are your navigational stars, guiding you through dark waters. Here’s a quick glance at strategies to help keep your trading ship seaworthy:

| Strategy | Description |

|---|---|

| Diversification | Spread investments to reduce risk. |

| Stop-Loss Orders | Set automatic sell points to limit losses. |

| Education & Trends | Stay informed to navigate the market wisely. |

With these practices in place, you’re better equipped to ride the waves, making informed decisions that could lead to smoother sailing ahead 🌟.

Crafting Your 2024 Bitcoin Trading Strategy 🗺️

As we sail into 2024, having a well-thought-out Bitcoin trading strategy is like having a treasure map in the world of digital currency trading. 🗺️ Embracing the twists and turns of the market with the guidance of Elliott Wave Theory can be your compass, leading you through the highs and lows. It’s essential to keep an eye on the larger picture, staying alert to market trends and how they resonate with historical patterns. Diving into this adventure, one shouldn’t forget the role of Bitcoin as a digital gold, especially in times when the seas of the economy get a bit rough. For those looking to safeguard their treasure, understanding how bitcoin acts as a hedge against inflation in 2024 can be as crucial as having a map in uncharted waters. By considering these factors, you can craft a strategy that not only aims for the treasure chest but also prepares you for any storms ahead, ensuring a thrilling yet secure journey through the waves of 2024. 🌊🛡️