🌍 Global Economic Trends Impacting Bitcoin Prices

In the ever-changing world of money, where countries are moving pieces on a giant chessboard, Bitcoin dances to the rhythm of global economic shifts. Think of it as a sensitive scale, tipping with the tides of big countries’ financial decisions, trade agreements, or even the health of the economy. When a country’s economy is doing well, people might feel more adventurous, diving into Bitcoin. But if things look shaky, they might pull back, affecting Bitcoin’s price. It’s like a mirror reflecting the mood of economies around the globe.

| 📉 Economic Downturns | People often rush to safer investments, which can lead to decreases in Bitcoin prices. |

| 📈 Economic Booms | When confidence is high, investors might take bolder moves, potentially driving Bitcoin prices up. |

| 🌐 International Trade Deals | Big agreements can shift investor confidence, swaying Bitcoin prices in the process. |

So, while Bitcoin might seem like its own universe, it’s closely tied to the health and decisions of our global economy. Just as a gardener watches the weather, savvy Bitcoin enthusiasts keep an eye on these economic indicators, ready to predict the next big move.

🔒 Technology Advances in Blockchain and Security

Imagine flipping open your laptop or checking your phone to catch up on the latest in the world of digital money – a place where Bitcoin lives. With every tech upgrade, this digital currency seems to dance to a new beat. It’s like having the world’s most sophisticated lock, making it harder for the bad guys to get in. This ongoing improvement in technology not only keeps Bitcoin safe but also makes it easier for everyone to use. So, whether you’re buying your morning coffee or investing in your future, these advances make it all more reliable and smooth.

In a world where new gadgets and gizmos pop up almost every day, Bitcoin is riding the wave of innovation. From faster transactions to beefing up security, it’s all about making this digital currency ready for the future. For those keen to dive deeper, understanding these tech advancements is key. There’s a treasure trove of information out there, like on https://wikicrypto.news/simplifying-the-complex-blockchain-technology-explained-for-newbies, that breaks it all down in simple terms. So, as we zoom into the future, it’s these innovations that promise to keep Bitcoin in the spotlight, making it an exciting ride for everyone involved.

🏦 Central Banks’ Stance on Cryptocurrencies

Imagine a world where the traditional guardians of money, our central banks, start shaping the future of digital cash like Bitcoin. It’s not just a far-off dream. These financial giants are already making moves that could sway the ebbs and flows of Bitcoin’s sea. Central banks, historically known for their cautious approach, have begun to explore and sometimes embrace cryptocurrencies, influencing how people perceive and use Bitcoin. Their stance can either send Bitcoin’s value soaring or plunging, showing us that even in the digital realm, the old guardians still hold power.

As we dive deeper, it’s clear that their actions, from releasing official statements to potentially launching their own digital currencies, have a ripple effect. By either accepting or rejecting cryptocurrencies like Bitcoin, they guide the sentiments of millions, shaping the market. This dance between old money and new, between caution and innovation, is pivotal. It decides not just the stability of Bitcoin but also its acceptance and integration into our daily lives. The journey ahead is as thrilling as it is uncertain, with each move from our central banks writing a new chapter in Bitcoin’s storied history.

💹 Institutional Investors’ Influence on Bitcoin Value

Big players like investment funds and large companies are now stepping into the Bitcoin scene, making waves throughout the market. Their involvement has a significant impact; when they buy or sell Bitcoin in large amounts, the value can swing dramatically. Imagine a large ship making waves in a calm harbor – that’s what it’s like when these institutional investors move in the cryptocurrency world. Their actions can signal confidence or concern to smaller investors, often leading to a ripple effect throughout the market.

For those curious about how Bitcoin operates behind the scenes, there’s a useful resource to get started. Check out the step-by-step guide to bitcoin mining for newcomers in 2024. It offers insights not just into mining but also highlights Bitcoin’s potential for empowering social causes, offering a glimpse into the broader impacts of this digital currency. As technology evolves, so too does the landscape of investment, and understanding the fundamentals has never been more critical.

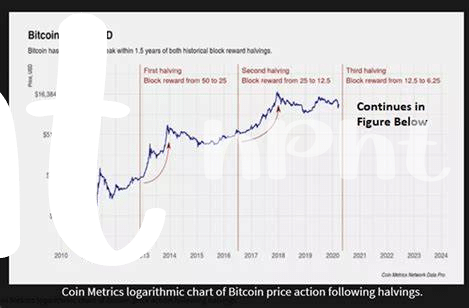

📈 Analyzing Bitcoin’s Historical Price Swings

Looking back, Bitcoin’s ride has been nothing short of a rollercoaster. From its infancy, it captured the curiosity of small-time traders and eventually garnered the attention of heavyweight investors. What makes this journey fascinating are the dramatic ups and downs in its value over time. These aren’t just random fluctuations; they’re lessons in supply and demand, investor sentiment, and even global events. For instance, when a big company announces support for Bitcoin, its value might soar. Or, if there’s a security breach at a major exchange, we might see a sudden dip. It’s like a living, breathing ecosystem, reacting to the world’s happenings. Here’s a quick snapshot of some key moments:

| Year | Significant Event | Impact on Bitcoin Value |

|---|---|---|

| 2017 | Cryptocurrency boom | Sharp increase |

| 2018 | Increased regulations | Significant drop |

| 2020 | Global pandemic begins | Volatility spikes |

These patterns not only highlight the sensitivity of Bitcoin to global cues but also underscore the evolving landscape in which it operates. Understanding this can help demystify many of the price movements we’ve witnessed, providing a foundation for what’s yet to come.

🚀 Future Tech Innovations and Bitcoin’s Journey

As we zoom into the future, technology not only evolves, it revolutionizes. The next wave of innovations may well redefine what we currently understand about the digital currency landscape. Imagine a world where buying your morning coffee with Bitcoin is as smooth as using traditional money, thanks to cutting-edge advancements in transaction speeds and security. These arenotypical scenes from a sci-fi movie; they’re the very real future we’re steering towards. And as these technologies make Bitcoin more accessible and reliable, they fuel its journey, potentially steering it into becoming a mainstream currency.

In the midst of this technological revolution, it’s essential to understand the backbone of Bitcoin – its blockchain technology. If you’re curious about how this pioneering technology works and the potential it holds for charitable endeavors, dive into bitcoin philanthropic initiatives suggestions. Here, you’ll find a treasure trove of information tailored for beginners in 2024, shedding light on how Bitcoin and its underlying tech could help shape a more inclusive and equitable world. Amidst the tech talk, it’s this human-centric potential of Bitcoin that stands out, hinting at a future where technology and philanthropy go hand in hand.