🌍 What Is Inflation and Why It Matters

Imagine going to the store with a list of things to buy, only to find out that prices have gone up, and you can’t afford as much as you could before. That’s inflation in action – it’s when the value of money goes down, so things cost more. It matters a lot because it can make life harder for people. If your money buys less today than it did yesterday, you’ve got to work harder and earn more just to keep up.

Inflation doesn’t affect everyone in the same way, though. For some, it’s just a minor inconvenience, but for others, it can mean choosing between essentials like food and rent. Countries try to keep inflation low and stable, but sometimes, things don’t go as planned, and prices rise quickly. This can happen for many reasons, like when there’s too much money in the system or when the costs of goods and services go up.

| Factor | Why It Matters |

|---|---|

| Rise in Prices | Makes everyday goods and services more expensive. |

| Decrease in Money Value | Means people need more money to buy the same things. |

| Impact on Savings | Reduces the value of money saved, affecting future plans. |

💰 Understanding Bitcoin Basics: the Digital Gold

Imagine a world where your money is digital, safely tucked away in your computer or smartphone, as easy to use as sending a text message but as valuable as gold. This is the essence of Bitcoin. Born from the digital age, it’s a kind of money that’s not governed by any single authority, such as a government or bank, making it quite unique. Think of it as digital gold, a form of value storage that you can keep without worrying about someone easily stealing it from you or it getting lost.

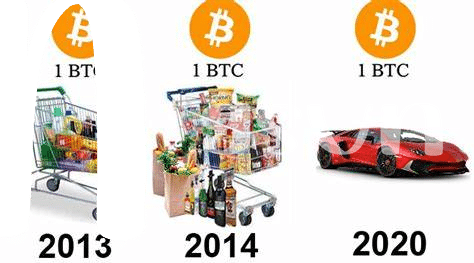

Diving into the digital realm, Bitcoin operates on a technology that ensures it remains scarce, much like gold. This scarcity is key because it means Bitcoin can maintain its value over time, unlike traditional money that can be printed without limit, leading to inflation. In this way, Bitcoin offers a pioneering approach to managing your money, ensuring that what you have today won’t be devalued tomorrow. For an in-depth look at how Bitcoin manages transaction fees, potentially making it an attractive option for small businesses, check out this resource.

📉 Bitcoin Vs Traditional Money: the Differences

When we look at Bitcoin and traditional money, it’s like comparing a bright, shiny spaceship with a reliable old car. The biggest difference lies in how they’re made and managed. Imagine traditional money as notes and coins you can hold, given out by banks and looked after by governments. These guys decide when to make more money, leading to the worry of inflation, where your money buys less over time. Now, enter Bitcoin — a digital currency that lives on computers. It’s not made by governments but by people using powerful computers, solving complex puzzles in a process called mining. There’s a set limit of Bitcoin that can ever exist, making it super rare, sort of like digital gold. What’s interesting is that Bitcoin operates on a system of trust, secured by technology that makes it almost impossible to cheat. Transactions with Bitcoin can happen from anywhere, to anywhere in the world, without the need for banks. This means lower fees and no waiting for days for international transfers. This digital approach aims to put the power back in the hands of the people, rather than leaving it all up to the big financial institutions.

🔒 How Bitcoin Battles Inflation: the Tech Behind It

Imagine you’ve got a magic purse that creates a limited number of magical coins each year, and no one, not even the magician, can suddenly decide to make more coins than what was originally planned. This is somewhat how Bitcoin works to fight against inflation. Unlike regular money that governments can print more of, causing each dollar or pound to lose value, Bitcoin’s secret sauce is its programming. Only 21 million Bitcoins can ever exist due to a rule written in its digital DNA, which means, just like the magical coins, they can’t just be made on a whim. This scarcity is what helps Bitcoin hold its value over time, making it a unique player in the battle against inflation.

Plus, everyone who uses Bitcoin follows a ledger, a kind of shared bookkeeping system that records every transaction. This ledger is guarded by complex puzzles that only powerful computers can solve, ensuring that not just anyone can mess with it. It’s like having an invincible guard that protects the magic purse from thieves and tricksters. If you’re intrigued by how this technology cuts through the confusion surrounding digital currencies and spins a web of security and trust, a deeper dive into bitcoin myths debunked explained will clear the fog around these digital treasures. Through this clever blend of scarcity and high-tech security, Bitcoin promises a financial haven from the silent thief that is inflation, but it’s not without its own set of challenges and adventures.

🌐 Real Stories: Bitcoin in Inflationary Economies

Imagine you’re in a country where the prices of everyday items keep climbing up, making life harder for you and your family. This is what happens when an economy faces high inflation, where the money in your pocket buys less than it did before. In these tough times, some folks have turned to Bitcoin, hoping it’ll be like a lifeboat in a stormy sea. They’ve seen it as a way to keep their savings from melting away like ice cream on a hot day.

Here’s a table that illustrates how Bitcoin has come into play in various countries experiencing high inflation:

| Country | Inflation Rate | Bitcoin Adoption |

|---|---|---|

| Venezuela | Over 10,000% | Widely used for remittances and preserving value |

| Argentina | Around 50% | Growing use for savings and everyday transactions |

| Zimbabwe | N/A (past hyperinflation) | Used as an alternative to unstable local currency |

| Turkey | Nearly 20% | Increasing interest for wealth preservation |

These aren’t just numbers on a page; they’re stories of people looking for a lifeline in choppy financial waters. By turning to Bitcoin, they’re hoping to find a bit of steadiness – a digital treasure chest that keeps their wealth safe from the storm of inflation. Whether they’re sending money to family without hefty fees or trying to keep their savings from shrinking, for many, Bitcoin has become a beacon of hope.

⚖️ Is Bitcoin the Ultimate Hedge? Pros and Cons

When considering Bitcoin as a safety net against inflation, it’s like looking at a coin with two sides. On one hand, Bitcoin has shown promise as a form of digital gold, a haven where you can place your trust during times when the value of paper money seems to be slipping through your fingers like sand. Its limited supply mimics the scarcity of real gold, potentially making it more resilient against the waves of inflation that erode the buying power of traditional currencies. This digital treasure has caught the eye of individuals living in countries where inflation runs rampant, offering a glimmer of hope and a new beginning to those whose local currencies have taken a plunge. However, it’s not all sunshine and rainbows. The rollercoaster ride of Bitcoin’s value can be a heart-stopping experience, with dramatic peaks and sharp valleys that could make anyone’s stomach churn. This volatility raises questions about its reliability as a true hedge against inflation. To understand more about how Bitcoin is shaping the future of transactions and value exchange, particularly for entrepreneurial ventures, discovering resources on bitcoin for small businesses explained could provide insightful perspectives. As we weigh the pros and cons, it becomes evident that while Bitcoin presents an innovative avenue to combat inflation, it also requires a sturdy heart and a spirit of adventure from those who wish to journey with it.