🌊 Understanding the Tides: What Is Bitcoin Lending?

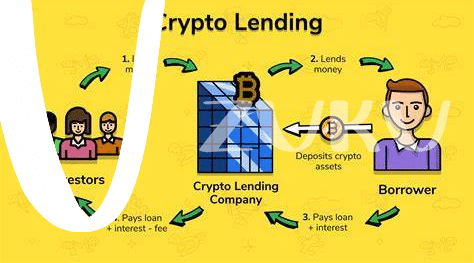

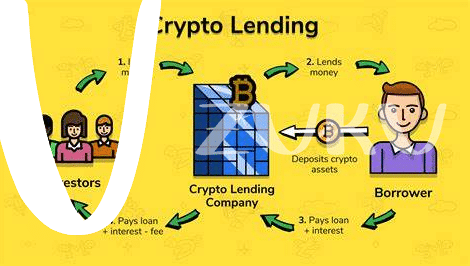

Imagine dipping your toes into the vast ocean, curious about what lies beneath the surface. That’s a bit like exploring Bitcoin lending, a fascinating way you can let your digital coins work for you instead of just sitting in a digital wallet. In essence, it involves lending your Bitcoin to others through a platform or arrangement, and in return, you get some interest, kind of like earning rent on a property. It’s a way to potentially grow your Bitcoin stash without having to sell any of it.

However, just like the ocean, Bitcoin lending comes with its currents and waves that you need to navigate carefully. The table below simplifies the basic components of Bitcoin lending:

| Aspect | Description |

|---|---|

| Lender | You, the person lending out your Bitcoin. |

| Borrower | The individual or entity looking to use your Bitcoin for a short period. |

| Interest | The reward you get for lending your Bitcoin, usually a percentage of the borrowed amount. |

| Platform | An online service that facilitates the lending and borrowing process. |

It’s thrilling and a bit adventurous, but like any adventure, it’s crucial to understand what you’re diving into. This beginning journey into Bitcoin lending can open up new opportunities, but grasping the basics is key to navigating its waters successfully.

🤝 Finding Your Match: Choosing the Right Platform

In the world of Bitcoin and cryptocurrency, finding a platform you trust to lend or borrow is a bit like choosing a partner for a dance. It’s not just about the rhythm but also feeling secure in their hold. Each platform offers its own tune—terms, interest rates, and security measures. Just as in dancing, it’s crucial to find one that matches your pace. Does the platform provide insurance on your loans? What’s their track record like? Delve into reviews and community feedback. Remember, a good partner doesn’t just lead well but listens, too.

As you sift through your options, think of your choice as laying the foundation of a house. It’s all about stability and trust. And while you’re exploring, don’t forget to check out https://wikicrypto.news/sound-wallets-innovative-approach-to-bitcoin-storage. This link taps into some excellent insights on managing your digital treasure chest with care. The goal is straightforward: ensure that when you commit, you’re stepping onto solid ground, ready to navigate the high seas of crypto lending with confidence.

⚖️ Weighing the Scales: Risk Vs Reward Analysis

When considering giving out your bitcoin in hopes of getting more back, it’s a bit like planting a seed and waiting for it to grow. But just like gardening, there’s a balance to strike between the sunshine that helps it grow (the rewards) and the storms that could wash it away (the risks). The key is understanding that not all soil is the same; in much the same way, all lending opportunities aren’t equal. Some might offer more sunshine with higher returns, but don’t forget, they may also expose you to bigger storms.

Navigating through these lending paths requires a keen eye to differentiate between a fertile field and a potential flood zone. Think of it as a teeter-totter, where on one side you have the potential gains, and on the other, the possible downfalls. Being aware of the weather forecast (market conditions) can help you decide if it’s the right time to plant your seed (lend your bitcoin) or if you should wait for a clearer sky. Remember, every gardener’s aim is to see their plant thrive, not just survive.

🔒 Lock It Up: Securing Your Bitcoin Loans

When venturing into the world of Bitcoin lending, think of your digital coins like a treasure chest that needs to be safeguarded. Just as a ship captain ensures the safety of his vessel against pirates, securing your Bitcoin loans is crucial. You wouldn’t sail without a map, and similarly, employing strategies to protect your cryptocurrency is essential for a smooth journey. It’s about creating a foolproof plan that shields your assets from potential threats such as hackers or sudden market downturns. A great first step is to understand why Bitcoin, much like gold, holds its value over time, an insight you can gain from bitcoin as a store of value explained. Moreover, using reputable lending platforms that offer robust security measures and insurance can be like having a seasoned crew aboard your ship, ensuring you navigate through turbulent waters with confidence. Remember, in the vast sea of cryptocurrency, being proactive about safeguarding your investment is your best bet against unforeseen storms.

📈 Reading the Tea Leaves: Market Trends & Timing

Understanding when to dive into the waters of bitcoin lending is a bit like reading a secret map where X marks the spot, but the X keeps moving. Picture yourself as a captain of a ship, navigating through calm and stormy seas, always keeping an eye on the horizon for what’s coming. The crypto market, much like the ocean, is constantly changing, with waves of highs and lows. Timing your entry or exit in bitcoin lending is crucial, just as a surfer waits for the perfect wave. By keeping a close eye on market trends, you can anticipate when to lend your bitcoins for the best return or when to hold off due to an impending storm. This doesn’t require a crystal ball but paying attention to the economy, regulatory news, and tech developments in the crypto world. Here’s a simple guide to help you understand market trends:

| Trend | What It Means | Action |

|---|---|---|

| Rising Prices | The value of Bitcoin is going up. | Consider lending, as borrowers are likely enthusiastic. |

| Falling Prices | The value of Bitcoin is on a decline. | May be wise to wait before lending, to avoid loss. |

| Stable Prices | Bitcoin’s value isn’t changing much. | A stable market might be a good time to lend, as risks are lower. |

Always remember, while the journey of bitcoin lending can be rewarding, it’s essential to navigate carefully, keeping an eye on both the skies and the sea of market trends, ensuring you sail smoothly towards your financial goals.

🚀 Beyond Bitcoin: Exploring Other Cryptocurrency Lending Options

Once you’ve dipped your toes into the world of Bitcoin lending, it might be time to explore the colorful ocean of other cryptocurrencies out there. Just like visiting different cities gives you new experiences, diving into alternative coin loans can unlock new opportunities and maybe even better rewards. This isn’t just a one-flavor world; from Ethereum’s smart contracts to Litecoin’s faster transactions, each crypto brings something unique to the table. But, with new chances come new challenges. It’s like playing a new level in a game; you need to understand the rules and risks. To keep your digital coins safe, you might want to learn about bitcoin and dive into the vibrant DeFi ecosystems that fuel these alternatives. Both of these are treasure maps that guide you through the risks and rewards of crypto lending beyond Bitcoin. Remember, each cryptocurrency has its own weather system – market trends, transaction speeds, and community trust. So, put on your explorer’s hat and chart your course carefully. Whether it’s the speedy rapids of Litecoin or the intricate caves of Ethereum, there’s an adventure waiting with each one.