Bitcoin Basics: Understanding the Digital Gold 🌐

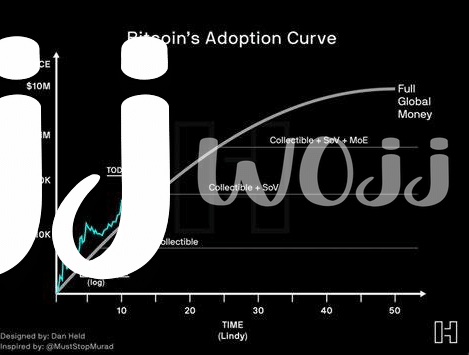

Imagine finding a treasure chest, not buried under the ocean, but in the digital world. That’s what Bitcoin is like! Created in 2009, think of it as digital money or “digital gold” that you can send to anyone around the globe without needing a bank to do it for you. What makes it gold-like is its rarity and value; just as there’s a limited amount of gold on Earth, there are only 21 million Bitcoins that can ever exist. This scarcity is part of what gives Bitcoin its value.

| Year | Bitcoin’s Key Features |

|———–|——————————-|

| 2009 | Creation and launch |

| 2010 | First real-world transaction |

| 2021 | Hits an all-time high value |

Unlike traditional money, where governments can print more when needed, Bitcoin’s supply is fixed. This is done through a process called mining, which involves powerful computers solving complex puzzles. It’s this blend of technology and finiteness that has caught the attention of the world. From individuals to big corporations, many see it as not just a form of money, but also an investment, somewhat akin to buying gold. However, unlike gold which you can physically hold, Bitcoin lives entirely online, secured by cryptography, making it both exciting and a bit mysterious.

Diversifying Portfolios: Not All Eggs in One Basket 🥚

Imagine you’re making a big, tasty breakfast, and you’ve got all your eggs in one basket. If you trip on your way to the table, there goes your breakfast, right out the window. In the world of investing, that basket is your portfolio, and the eggs are your investments. Now, what if I told you there’s a way to protect your breakfast, or better yet, your financial future, from such mishaps? Enter Bitcoin, the digital gold, offering a new, shiny kind of egg. By including Bitcoin in your investment basket, you’re not just adding a different flavor, you’re introducing an asset that dances to its own beat, often moving differently from stocks, bonds, and gold. This can be like having an invisible safety net under your basket, helping you balance if traditional markets take a tumble. If you’re curious about adding this digital gold to your basket but aren’t sure where to start, explore more about navigating through the Bitcoin universe with this insightful guide, https://wikicrypto.news/navigating-bitcoin-exchanges-a-comprehensive-tutorial, where you can learn the ropes and potentially weave a stronger, more diverse financial safety net for yourself.

Risk Management: the Safety Net of Bitcoin 🛡

When we talk about keeping your money safe and sound, Bitcoin is like having a high-tech safety net. Just like in a circus, where a safety net catches acrobats if they fall, Bitcoin can catch a company if its other investments start to stumble. It’s a bit different from the usual stocks and bonds because it dances to its own tune. While other parts of the market might zig, Bitcoin often zags, helping smooth out those bumpy financial rides. It’s a bit like adding a pinch of salt to your hot chocolate – unexpected, but it can make the whole thing taste better. 🛡☕

By sprinkling a little Bitcoin into a company’s financial mix, they’re not just sticking to one flavor. Think of it as adding an extra card to your deck, giving you more options to play in the game of finance. With its ability to stand strong even when other investments are shaking, Bitcoin offers a way to keep the boat steady in rough waters. 🃏🌊 It’s not about putting all your trust into Bitcoin, but rather about having it there as a reliable friend that can help out when things get tough. Plus, being a part of the Bitcoin club might also open up new doors and bring exciting opportunities right to your doorstep.

Bitcoin’s Influence on Corporate Strategy 🔄

Imagine a world where companies mix up their strategies like a master chef experimenting with new recipes; this is what Bitcoin has brought to the corporate table. By stepping into the digital currency space, businesses are now embracing a level of flexibility that was unheard of before. In a way, Bitcoin acts like a Swiss Army knife, offering multiple tools in one. It’s not just about having another asset in the portfolio; it’s about embracing change, innovating, and preparing for a future that’s increasingly digital. Moreover, by incorporating Bitcoin, companies signal to the market and their customers that they are ahead of the curve, willing to adopt cutting-edge technologies. This strategic move can enhance a company’s brand, making it more attractive not only to investors but also to a new generation of tech-savvy customers. Additionally, for those interested in the practicalities of integrating Bitcoin into their operations, resources like bitcoin paper wallets explained offer valuable insights, ensuring that even newcomers can navigate the complexities of digital currencies. In essence, Bitcoin is redefining how businesses think about money, investment, and growth, charting a course toward a more diversified and resilient future.

Real-world Success Stories of Bitcoin Diversification 📈

In the world of business, where certainty is as rare as a diamond, some companies have turned to Bitcoin as their knight in digital armor. Take, for example, a tech giant that made headlines for converting a portion of its cash reserves into Bitcoin. This move was not just a bold statement in favor of the digital currency, but also a strategic one, aimed at protecting the company against the devaluation of traditional money. Their success story not only showcased the potential of Bitcoin to act as a hedge against economic downturns but also highlighted its ability to contribute positively to a company’s bottom line. 📈

Other corporations have followed suit, integrating Bitcoin into their financial strategies to diversify their investment portfolios. One much-discussed case is an electric car company that acquired $1.5 billion worth of Bitcoin. This decision was influenced by the desire to maximize returns on cash that was otherwise sitting idle. The gamble paid off, with the company reporting a significant profit from this investment alone. These examples demonstrate how Bitcoin can serve as a viable tool for corporate diversification and risk management, opening new avenues for companies willing to embrace innovative financial strategies. 🚗🔌

| Company | Investment in Bitcoin | Outcome |

|---|---|---|

| Tech Giant | Diversified cash reserves into Bitcoin | Protected against currency devaluation, positive impact on bottom line |

| Electric Car Company | Acquired $1.5 billion worth of Bitcoin | Reported significant profit from the investment |

Future Predictions: Bitcoin in Corporate Finance 🔮

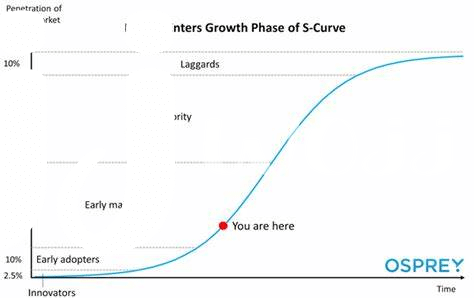

Looking ahead, it’s clear that Bitcoin is setting the stage for a significant transformation in corporate finance. Imagine a future where businesses lean heavily on this digital asset, not just as an investment but as a core part of their financial strategy. With its ability to facilitate easy, secure, and fast transactions across borders, Bitcoin could streamline international trade 🌍. Companies might begin to keep a larger portion of their reserves in Bitcoin, using it as a hedge against currency devaluation and as a means to swiftly mobilize funds when opportunities or needs arise. The trend towards decentralization and digital currencies is likely to grow, and with it, we could see Bitcoin becoming a staple in corporate treasuries. For those looking to dive deeper into how Bitcoin is making inroads into the financial systems and its potential to empower those without traditional bank accounts, consider exploring bitcoin educational courses explained. This shift could redefine risk management, offer unprecedented diversification opportunities, and even spur innovative financial products and services geared towards leveraging Bitcoin’s unique properties 🔐🔍. The stories of early adopters today might just be the standard operating procedure tomorrow, signaling a promising horizon for Bitcoin in corporate finance.