🌍 Remittances Today: How the World Sends Money

When people move to different countries for work, they often send money back home to their families. This process, known as sending remittances, is a lifeline for many households around the globe. It might sound simple, but there’s a lot that goes into getting that hard-earned cash from one country to another. Imagine you’re sending money from the US to your family in the Philippines. Traditionally, you’d go to a bank or a specialized company, fill out some forms, and pay a fee. Then, your money starts its journey, hopping through various banks and sometimes taking days to arrive. It’s not just slow; it can be pretty expensive because of the fees charged at every step. This process, while reliable, can eat into the amount that finally reaches your family. It’s a big deal, considering that for many, this money pays for essential things like food, education, and healthcare.

| Step | Action | Notes |

|---|---|---|

| 1 | Choose a service | Bank or specialized company |

| 2 | Fill out forms | May require personal and recipient information |

| 3 | Pay fees and send | Fees vary by service and amount sent |

| 4 | Money travels | Can take several days |

| 5 | Recipient collects | Often needs to visit a local branch |

Despite the hassles and costs, people continue to navigate this cumbersome process, relying on it to support their loved ones. As the world becomes more connected and demands more efficient services, the traditional way of sending remittances is ripe for innovation, sparking interest in the potential for new technologies like Bitcoin to revolutionize this age-old process.

📉 Understanding the High Costs of Traditional Remittances

Sending money across borders isn’t always a breeze, especially considering the pockets it has to go through. Imagine you’re trying to send a portion of your hard-earned cash to your family living miles away; not only does it have to hop through several banks, but each jump often nibbles away a bit more of your money. This is due to a variety of fees and exchange rates that seem to favor the house more than the player. It’s like trying to pass a message in a game of telephone, but every person you pass it through demands a slice of your snack.

And it’s not just the money disappearing into thin air. The time it takes for your cash to make its grand entrance can stretch from a few days to a whole week. In a world where we can chat with someone across the globe in milliseconds, why should sending money be any different? This sluggish pace and high cost are exactly why people started looking for alternatives, paving the way for innovations like Bitcoin to make a grand entrance. For a deeper dive into how Bitcoin and its underlying technology, blockchain, are revolutionizing the way we think about and handle remittances, check out https://wikicrypto.news/decoding-cryptography-the-science-behind-bitcoin-recovery-tools. This exploration might just shine a light on why many are turning to digital currencies to bypass these financial hurdles.

💡 Bitcoin Emerges: a New Hope for Lower Costs

Imagine sending money across the globe as easily as sending a message on your phone. 🌍✨ With the arrival of Bitcoin, a spark of hope flickers for everyone looking for a way to reduce the hefty fees attached to sending money home to loved ones. Unlike traditional methods that often involve long waiting times and a maze of fees, Bitcoin shines as a beacon of low-cost transactions. This digital form of money uses the internet to move funds fast and without the need for middlemen, making it a wallet-friendly option for people worldwide. By tapping into the power of Bitcoin, individuals can bypass the usual hurdles and keep more of their hard-earned money, providing a lifeline to families and friends who rely on these crucial financial lifelines. 🌟🚀 As we navigate through the evolving landscape of money transfer, Bitcoin stands out not just as an alternative, but as a beacon of hope for making remittances more affordable for everyone, anywhere.

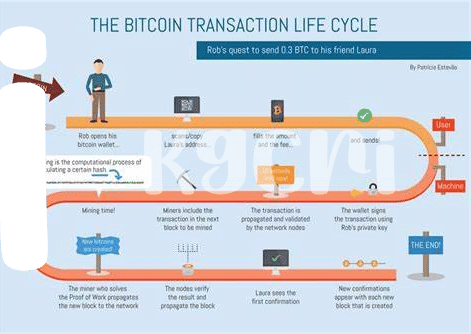

🌐 the Blockchain Advantage: Fast, Secure, and Global

Imagine a world where sending money across borders is as easy as sending a text message, and just as quick. This isn’t a far-off dream but a reality made possible by blockchain, the tech behind Bitcoin. By sidestepping the traditional hurdles of international transactions—like lengthy processing times, hefty fees, and the risk of information theft—blockchain presents a streamlined, safer, and more affordable way to move money globally. Its foundation is a decentralized network, meaning that it doesn’t rely on one single point of control. This not only speeds things up but also adds a layer of security, as there’s no central database for hackers to target. What’s more, this technology paves the way for transparency, allowing users to track their transactions in real-time. For those eager to dive deeper and understand more about how Bitcoin is making waves in real transactional scenarios, tapping into bitcoin educational resources explained can be a great start. Here, the complexity of blockchain is unraveled, showcasing why it’s not just a buzzword but a revolutionary approach to financial transactions across the globe.

🚀 Real-life Success Stories: Bitcoin in Action

Imagine a world where sending money to your family halfway across the globe is as easy as sending a text message. This isn’t a far-off dream but a reality for many, thanks to Bitcoin. One heartwarming story comes from a worker in the U.S. who sends part of his earnings back to his family in the Philippines. Traditional methods would eat into his hard-earned money with high fees and long waiting times. However, by choosing Bitcoin, he not only slashes the transaction costs but also ensures that his family receives the money within minutes. This is life-changing for many, allowing for more frequent and efficient support of loved ones.

| Country | Traditional Method Cost (%) | Bitcoin Transaction Cost (%) |

|---|---|---|

| Philippines | 7.2 | 2.5 |

| Nigeria | 8.9 | 2.7 |

| India | 5.9 | 2.9 |

Another tale unfolds in Venezuela, where hyperinflation has rendered the local currency almost useless. Here, Bitcoin isn’t just a financial choice but a lifeline. Families use it to preserve their savings’ value and conduct day-to-day transactions securely. These stories underscore Bitcoin’s role not just as an investment vehicle, but as a practical financial tool transforming lives worldwide, offering a glimpse into a future where money moves freely and efficiently, unrestrained by geographic or economic boundaries.

🧐 Navigating Challenges: Overcoming Bitcoin’s Limitations

Bitcoin stands tall as a beacon of hope for making money transfers around the globe easier, cheaper, and faster. But, like any hero of a story, it faces its own set of dragons to slay. The quest is fraught with hurdles like fluctuating values and regulatory mazes that can make anyone’s head spin. Yet, the community around Bitcoin isn’t standing by idly. Ingenious minds are at work, crafting tools and strategies to smooth out these bumps in the road. For instance, imagine being able to fix a mistake in a transaction or recover lost digital treasure. Sounds like a plot twist, right? Well, it’s becoming reality with tools designed for these very purposes. They’re like the fairy godmothers of the Bitcoin world, and you can dive deeper into this magic with bitcoin philanthropy explained, where mysteries of Bitcoin recovery tools are unraveled, showing everyone that with the right knowledge and tools, navigating Bitcoin’s world becomes less of a wild ride and more of a calculated adventure.

Beyond technology, the community also plays a pivotal role. By sharing knowledge, experiences, and supporting each other, overcoming Bitcoin’s limitations feels less like a solo expedition and more like a journey undertaken with a formidable fellowship. Education and awareness are spreading, shining a light on the paths through Bitcoin’s dense forest of challenges. From workshops to online forums, the collective wisdom of the Bitcoin community is a powerful force pushing forward, making the vision of a global, accessible, and equitable financial system not just a hopeful dream but a tangible future. This vibrant ecosystem, bursting with collaboration and innovation, shows us that while Bitcoin may have its limitations, our collective potential to adapt and overcome is limitless.