What Is Bitcoin Anyway? 🤔

Imagine having a type of money that’s not made of paper or metal, doesn’t live in a conventional bank, and can be sent across the globe in minutes without hefty fees. That’s Bitcoin for you 🌍💡! Born from the digital world in 2009, Bitcoin is a form of money known as cryptocurrency. Unlike traditional money, it operates on a technology called blockchain, which keeps a secure and public record of all transactions. Think of it as a digital ledger that’s maintained by a network of computers (called nodes), ensuring that every bitcoin exchanged casts a permanent footprint in the world of digital currency.

What sets Bitcoin apart is its unique feature of being decentralized. This means no single power, like a government or bank, has control over it. Everything about Bitcoin – from owning, trading, to exchanging it for goods and services – happens online 🖥️📲. With an internet connection and a digital wallet, anyone, anywhere, can become a part of Bitcoin’s ever-growing community. Its independence from the traditional financial system not only fascinates tech enthusiasts but also appeals to those seeking alternatives to conventional banking methods.

The Basics of Supply and Demand 📉📈

Imagine you’re at the market looking to buy some apples. There are only a few apples left, but many people want them. This scarcity makes those apples more desirable, so their price goes up. That’s supply and demand in a nutshell – it’s about how much of something is available (supply) and how much people want it (demand). When supply is low and demand is high, prices climb. Conversely, if there’s a ton of something but no one really wants it, the price drops. This concept isn’t just for apples; it applies to everything, including digital currencies like Bitcoin.

Bitcoin works on the same principles, but with a twist – its supply is limited. There can ever only be 21 million Bitcoins. This limit is like having only so many apples in the world and no way to grow more. When more people learn about Bitcoin and want to buy in, but the number of Bitcoins doesn’t increase, the demand against a limited supply drives the price up. For a deeper dive into how specific Bitcoin mechanisms like ‘the halving’ influence its supply and demand dynamics, check out this article. It illustrates how intricate the balance of availability and desire is, moving Bitcoin’s price in fascinating ways.

How Bitcoin’s Supply Limit Fuels Demand 🚀

Imagine a world where gold is so rare that finding even a tiny piece makes you the talk of the town. That’s sort of what Bitcoin is like in the digital realm. 🌐🚀 Its creators set a max limit of 21 million coins, making it a digital treasure hunt that has everyone buzzing. This scarcity is a big deal because, just like with anything rare, people tend to want it more – kind of like vintage comic books or limited edition sneakers. As more folks learn about Bitcoin and join the chase, the demand goes up, but since there’s a cap on how many bitcoins can ever exist, there’s not enough for everyone. This mix of super high demand and a limited supply makes the price of Bitcoin soar, much like a rare piece of art’s value skyrockets when collectors are clamoring for it. Every time you hear about Bitcoin hitting new heights, it’s this unique supply-and-demand dance playing out in the digital marketplace. So, in a way, Bitcoin’s built-in scarcity acts as its superpower, making it more desirable and valuable as time goes on.

Major Events Impacting Bitcoin’s Price Movements 🌎

Just like a whirlwind can change the landscape, certain big events can really stir things up in the world of Bitcoin. Imagine one day you’re sipping your coffee, and the next, news breaks that a large country has decided either to embrace or shun Bitcoin. Such announcements can send Bitcoin’s price on a rollercoaster ride, either soaring to the skies or diving deep. It’s not just about governments getting involved. Big companies saying “yes” to Bitcoin can also make waves. For example, when a tech giant announces they’re now accepting Bitcoin, it can spark excitement and drive more people to hop onto the Bitcoin bandwagon, pushing the price up.

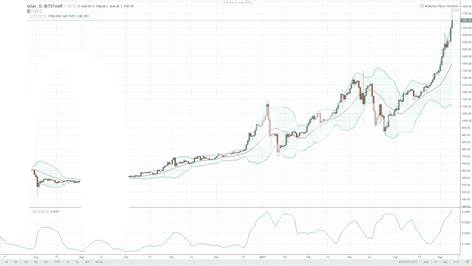

But there’s more to it than just headlines. Real, tangible events, like updates to the technology behind Bitcoin, can also play a massive role. It’s all connected, like pieces of a giant puzzle. If you’re keen to see how past events have shaped Bitcoin’s journey, take a peek at bitcoin historical price trends explained. Whether it’s a new feature that makes transactions faster or a security update, each of these milestones can entice more users and investors, influencing the delicate balance of supply and demand. So, keeping an eye on these developments isn’t just interesting—it can give you insights into where Bitcoin might be headed next. 📈🌎💡

Cryptocurrency Markets Vs. Traditional Markets 🏦

Imagine stepping into a bustling market where you can buy and sell fruits anytime versus a traditional store that opens and closes at set times – this is somewhat similar to how crypto markets and traditional financial markets operate. With crypto, like Bitcoin, the market never sleeps; it’s a 24/7 affair 🌙☀️, contrasting starkly with the stock market, which sticks to business hours. Another key difference is how these markets react to news. In the crypto world, a tweet can send prices skyrocketing or plummeting within minutes 🚀💔, whereas traditional markets often have more time to digest news before it reflects in stock prices. This means crypto traders need to always be on their toes, ready for sudden shifts. Adding to the unique nature of cryptocurrency markets is the level of access. Anyone with an internet connection can start trading crypto, making it a playground not just for seasoned investors but also for novices eager to try their luck 🎲🌐.

| Feature | Cryptocurrency Markets | Traditional Markets |

|————————|————————|———————|

| Market Hours | 24/7 | Limited (e.g., 9-5) |

| Reaction to News | Immediate | Delayed |

| Access for Individuals | High | Moderate |

| Volatility | High | Lower |

Real-life Factors Influencing Bitcoin Buyers 🛒

Imagine walking into a mall with a list of things you want to buy. Now, if everyone else also wants the same items, prices might go up, right? That’s a bit like what happens with Bitcoin. People’s daily lives play a big role in deciding if they want to buy or not. Think about when you hear on the news that Bitcoin’s price has skyrocketed 🚀 or when a famous person says they’ve bought a lot of it. These bits of news can make more people want to buy Bitcoin, pushing the price up.

But there’s more to it. Sometimes, things happening in the world can make people look for safe places to keep their money, like when banks seem risky or when the prices of regular things we buy go up a lot (inflation). Bitcoin has become one of those safe places for some. Also, knowing that Bitcoin is trying to make sure it can handle more transactions, especially in places where not everyone can get to a bank easily, makes it even more attractive. This idea is unpacked further in this insightful read: find out more about how Bitcoin is gearing up to become more accessible in different parts of the world bitcoin in emerging markets explained.