What Is Bitcoin Halving? a Simple Explanation 🚀

Imagine Bitcoin as a gold mine. In this digital mine, instead of gold, miners are after Bitcoin. But there’s a catch! Every four years, the amount of Bitcoin they find for their effort gets cut in half. This event is known as Bitcoin Halving. It’s like if the amount of gold you could dig up in a mine was suddenly reduced by half, making it rarer and potentially more valuable over time.

This process is put into place to control how many new bitcoins are created. Think of it as a clever magic trick that helps keep Bitcoin scarce. When something is rare, it often becomes more desirable. 📉➡️📈 Below is a simple overview of how this magic trick has been performed in the past:

| Halving Event | Year | New Bitcoins per Block |

|---|---|---|

| 1st Halving | 2012 | 25 |

| 2nd Halving | 2016 | 12.5 |

| 3rd Halving | 2020 | 6.25 |

By making new bitcoins harder to come by, each halving event adds a bit of mystery and excitement around what will happen next, keeping everyone on their toes and buzzing about Bitcoin’s future.

Why Halving Happens Every Four Years ⏳

Imagine Bitcoin as a giant puzzle where miners compete to solve complex problems to win a prize: newly minted bitcoins. These puzzles are designed to get harder over time, limiting how quickly new bitcoins are created. This is where the halving steps in, a rule written into Bitcoin’s DNA, ensuring that every four years, the prize for solving these puzzles is cut in half. It’s like a beat that keeps the pace, ensuring Bitcoin doesn’t rush its growth and maintains scarcity, kind of like gold. This brilliant mechanism ensures that Bitcoin remains rare and desirable, aiming for a future where it becomes even more valuable. While it might seem a tad complex, the essence is quite simple: halving helps control the supply, making sure Bitcoin doesn’t lose its charm by becoming too common too quickly. If you’re curious about how Bitcoin continues to empower individuals and transform economies worldwide, especially in developing countries, you might find this read enlightening: https://wikicrypto.news/how-bitcoin-empowers-entrepreneurs-in-developing-countries.

The Magic Behind Reducing New Bitcoins 💫

Imagine you’re playing a video game where gold becomes scarcer and more valuable as you progress, making every piece of gold you find even more special. This is similar to what happens with Bitcoin. Every four years, the amount of new Bitcoin created and earned by the people who help keep the Bitcoin network running, known as miners, gets cut in half. This event is Bitcoin’s way of making sure that not too much of it comes out too quickly. If new Bitcoins kept being made at a fast pace, there would be so many that they wouldn’t be worth much—kind of like if someone kept printing loads of money. But by making new Bitcoins less common, they stay more valuable. It’s a clever trick to help Bitcoin maintain its worth over time, making it an intriguing aspect of the digital currency world. 🌍✨🚀

How Halving Influences Bitcoin’s Value 📈

Imagine you have a pie, and every four years, the slices you give out get smaller. This is a bit like what happens with Bitcoin during a halving event. As fewer new Bitcoins are produced, they become scarcer. Now, in many cases when something is harder to find, it often becomes more valuable. People might start thinking, “If there are going to be fewer Bitcoins available, I’d better grab some now before they’re even harder to get!” This idea can drive up demand, while the supply is going slower, pushing up Bitcoin’s value. It’s a bit like suddenly finding out there’s only a limited number of your favorite collector’s item available; suddenly, everyone wants one!

Moreover, as Bitcoin’s value increases, it could encourage more businesses to start accepting it as a form of payment. This boost in adoption further solidifies its worth and utility. For more insights on integrating Bitcoin into business practices, a great place to start is with this article on bitcoin scalability solutions explained. It’s not just about keeping Bitcoin scarce; it’s about building its reputation as a dependable, valuable digital asset that’s here to stay. Each halving event writes a new chapter in Bitcoin’s story, one where its value might just hit the next milestone.

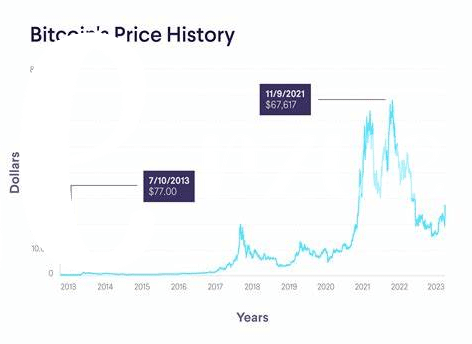

Past Halvings and Their Impact on Price 📊

When the halving event waved its magic wand over Bitcoin, a curious thing happened; the price started climbing up the ladder. It’s like throwing a big, rare party that happens only once every four years, making everyone pay attention. The first spectacle took place in 2012, and since then, each event has been like a step on a staircase leading up into the sky. Imagine it as a surprise box that every time it’s opened, the gift inside becomes a bit more special, catching more eyes and upping the anticipation for the next one.

| Halving Event | Year | Approximate Pre-Halving Price | Approximate Post-Halving Price |

|---|---|---|---|

| 1st Sparkle ✨ | 2012 | $11 | $1,100 |

| 2nd Celebration 🎉 | 2016 | $650 | $2,500 |

| 3rd Festival 🎊 | 2020 | $8,787 | $30,000 |

The pattern in the table isn’t hard to spot. Each halving has historically led to astonishing climbs in Bitcoin’s price, igniting discussions and dreams about the heights the next celebration will reach. This unique dance of supply and excitement makes Bitcoin more than just digital money; it’s a growing legend in the world of finance.

Predictions: the Future after the Next Halving 🔮

Peering into the crystal ball 🌐🔮 to predict what lies ahead post-halving is like trying to crack a secret code—exciting yet uncertain. The halving serves as a catapult, launching Bitcoin’s scarcity into the spotlight, which historically has sweetened its appeal to investors. Imagine supply shrinking while demand stays the same or even grows; it’s a recipe for value increase. Experts think this scarcity tactic may continue to push Bitcoin’s price skyward, using patterns from the past as a map. Yet, as with any prediction, there’s a dose of unpredictability. Factors like global economic conditions, tech advancements, or changes in regulation could all twist the outcome in unforeseen ways.

Looking around the corner, there’s buzz about how this scarcity-induced interest could spur Bitcoin’s integration into bitcoin in e-commerce explained, branching out from an investable asset to a staple in digital transactions. This would not just impact those holding Bitcoin but could reshape how the digital marketplace operates, making Bitcoin a linchpin in e-commerce. Enthusiasts and analysts alike are keen to see if the post-halving world will usher in an era where Bitcoin isn’t just stored but actively used, signaling a shift towards widespread digital currency adoption.