What Is Bitcoin Mining? 🤔

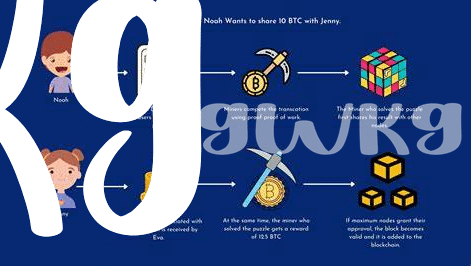

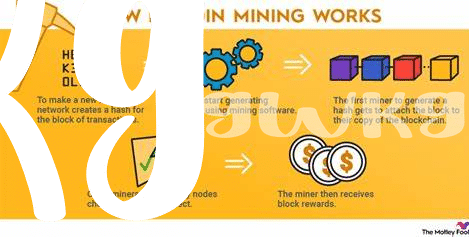

Imagine a world where digital gold can be mined, not with pickaxes and shovels, but with computers and cleverness. That’s the essence of Bitcoin mining. It’s a process where people use specialized computers to solve complex puzzles. Making it through these puzzles means helping to secure the Bitcoin network, and as a reward, miners receive Bitcoin. It’s like a high-tech treasure hunt where the prize is a piece of the digital future.

This digital digging does more than just print new Bitcoin out of thin air; it validates transactions on the blockchain, keeping the system honest and trustworthy. Miners are the backbone of the Bitcoin ecosystem, ensuring its integrity and functioning. Without miners, Bitcoin could not exist as we know it today. They are the guardians of the decentralized ledger, making every transaction count.

| Feature | Description |

|---|---|

| Specialized Computers | Devices designed specifically for solving complex computational puzzles |

| Blockchain | A decentralized ledger recording all transactions securely |

| Digital Gold | A term often used to describe Bitcoin due to its value and rarity |

| Validation | Process of confirming transactions to maintain the network’s integrity |

The Cost of Mining Equipment 🖥️

When diving into the world of bitcoin mining, one cannot overlook the cost of the gear needed to join the race. Think of it as gearing up for a digital gold rush, where your shovel and pickaxe are specialized computers designed to solve complex puzzles. These machines don’t come cheap, with prices that can make your wallet wince. High-end equipment is crucial because the faster you can mine, the more bitcoin you can potentially earn. But here’s the catch—this tech quickly becomes outdated, making it a constant race to stay ahead. This cycle of upgrading gear adds an extra layer to your investment, beyond just the initial purchase. It’s not just about buying the equipment; it’s about continuously investing in order to remain competitive in a constantly evolving field. Remember, in this digital quest for gold, your tools of the trade play a pivotal role in how much treasure you can unearth. To navigate these and other complexities of the cryptocurrency world, including how to handle the digital identity associated with your investments, clicking through to https://wikicrypto.news/navigating-digital-identity-in-the-blockchain-era can provide valuable insights.

Electricity: the Silent Expense ⚡

When we dive into the world of bitcoin mining, it’s easy to get caught up in the excitement of technology and potential earnings. However, a quiet yet significant factor often goes unnoticed until it’s too late: the cost of electricity. This invisible expense can sneak up on miners, as it requires a lot of power to solve those complex puzzles that secure the blockchain and earn bitcoins. Imagine your computer working overtime, around the clock, and then visualize your electric meter spinning just as fast. That’s the reality of bitcoin mining. In some places, the cost of electricity is low enough to make mining profitable, but in others, the high cost of power can eat into earnings, turning what seemed like a gold rush into a losing venture. It’s like watering a garden; the more you water (or mine), the higher your bill at the end of the month. This makes it crucial for prospective miners to crunch the numbers on their energy consumption before diving in, ensuring their venture won’t be dimmed by the silent expense of electricity.

Mining Pools Vs. Solo Mining 🏊

Venturing into the crypto mining arena, individuals are often faced with a choice: joining a group effort or going solo. When you mine in a pool, imagine you’re part of a team working together to solve a puzzle. Each member contributes their computing power, and if the team solves the puzzle, the reward is split amongst the group based on how much power each person contributed. This can mean more consistent, albeit smaller, payouts. It’s like opting for regular paychecks instead of holding out for a lottery win.

On the flip side, solo mining is akin to being a lone wolf, relying solely on one’s own equipment and skills to tackle the challenges. The potential reward is alluring – if you solve the puzzle on your own, you keep the entire prize. However, this is a much tougher route with the odds of winning akin to hitting a jackpot. Given the increasing complexity and the competitive nature of mining, the chances of striking gold alone have become slimmer. Moreover, with the landscape of digital currency ever-evolving, staying informed is crucial. For those keen on navigating the intricate world of crypto and its implications, including an understanding of bitcoin taxation guidelines explained can shed light on the often-overlooked facets of crypto earnings and investments.

Bitcoin Price Fluctuations and Profitability 💸

Imagine if you had a magic plant that grew gold bars, but the size and value of the gold it produced changed every day. That’s a bit like trying to make money through digging up virtual gold, also known as mining for cryptocurrency. The price of this digital treasure can swing up and down wildly, affecting whether miners hit a jackpot or barely scrape by. When prices soar, the mining rush begins, with miners hoping to sell their finds at peak values. But when prices drop, the once bustling mines can quickly turn silent, with the cost of running the mining equipment sometimes more than the value of the gold dug up.

| Price Level | Profitability Impact |

|---|---|

| High | Increased earnings, higher interest in mining |

| Low | Reduced earnings, potential operational losses |

This rollercoaster ride doesn’t just affect miners’ wallets. It also influences the mining landscape, pushing miners towards joining pools to share resources and rewards, or pushing the bravest to mine solo, hoping for a big score. Keeping a close eye on market trends becomes a form of treasure hunt itself, where understanding the waves can mean the difference between striking rich or hitting rock bottom.

Future Trends in Bitcoin Mining Technology 🚀

In the world of Bitcoin mining, we’re standing on the cusp of a technological revolution 🚀. Imagine miners not struggling with the high costs of electricity or the constant need to upgrade hardware. The future might just hold solutions to these challenges, as researchers and engineers are tirelessly working to make mining more energy-efficient and accessible. Solar-powered mining farms and quantum computing are no longer just pie-in-the-sky ideas; they’re becoming real possibilities. This means that, soon, mining could leave a smaller carbon footprint and become profitable for a wider range of participants.

Now, picture a world where your digital identity enhances the security of your Bitcoin transactions, making everything you do with your digital coins safer and more private. Innovations like these are not just about making mining more profitable; they’re about protecting the entire blockchain ecosystem. For more insights on how Bitcoin and digital identity intertwine, especially in enhancing security and supporting philanthropic initiatives, take a dive into bitcoin philanthropic initiatives security concerns. These advancements promise a future where Bitcoin mining is not only more sustainable but also a critical player in the global push for better, more secure digital transactions.