Understanding Basics of Crypto Taxation 🧐

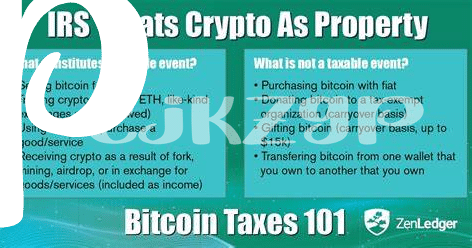

Imagine this: you find a shiny digital coin in the vast online world, and just like magic, it grows in value! But hold on, just like uncovering a treasure, you’ve got to share a piece with the guardians of the land, also known as the tax folks. When you make money from your digital coins – maybe you sold them for more than you bought them, swapped them, or even bought a coffee with them – the tax guardians want to know because they see it as income. And just like your paycheck, a portion of your crypto gains needs to be shared with them.

So, how do you figure out how much to share? Well, it starts with keeping track of your treasure map, marking every spot you’ve bought, swapped, or spent your digital coins. But it gets a bit tricky because the value of your digital coins can change faster than the weather. Just remember, every time you make a move with your cryptocurrency, it’s like telling a new part of your treasure story to the tax guardians. And at the end of the year, you sum up all these stories to find out how much of your treasure needs to be shared. Here’s a simple table to help you keep track:

| Date | Transaction Type | Crypto Amount | USD Value at Transaction | Gain/Loss |

|---|---|---|---|---|

| Jan 1, 2023 | Bought Bitcoin | 1 BTC | $30,000 | – |

| Mar 15, 2023 | Sold Bitcoin | 1 BTC | $45,000 | + $15,000 |

| Apr 10, 2023 | Swapped Bitcoin for Ethereum | 0.5 BTC | $25,000 (Equivalent in ETH) | – |

Welcome to your first steps into the world of crypto taxation, a necessary part of your adventure with digital coins!

Record-keeping: Your Crypto Transaction Diary 📓

Imagine having a diary that could help you save money on taxes. That’s exactly what keeping a meticulous record of your crypto transactions can do for you. It’s like having a detailed map that guides you through the complex world of digital finance, ensuring you don’t pay more than you need to come tax season. Every buy, sell, trade, or earnings from cryptocurrencies should be noted down with the date, amount, and type of transaction. This isn’t just a good habit; it’s a powerful tool in the realm of crypto taxation. As digital currencies like Bitcoin become more integrated into our financial system, understanding and leveraging the nuances of tax obligations is crucial. This practice helps in painting a clear picture of your financial activities throughout the year, making tax filing less of a headache and more of a breeze. It’s also a lifesaver if the tax authorities have questions about your returns. Keeping a thorough record is your first step toward smart tax planning in the digital age, ensuring you’re armed and ready for the tax season without breaking a sweat. And remember, for insights into navigating the complex digital identity landscape in the blockchain era, don’t miss out on exploring https://wikicrypto.news/the-future-of-philanthropy-blockchain-for-good.

Loss Harvesting: Turn Losses into Tax Wins 🔄

Imagine you’re playing a video game, and you’ve stumbled a few times, losing some of your digital gold. Now, instead of feeling down, what if the game offered you a power-up for every stumble, turning your losses into a special kind of win? This is similar to what you can do with your crypto investments through a smart move called loss harvesting. It’s like finding a silver lining on a cloudy day. When the value of your crypto takes a dip, and you decide to sell it, you’re not just stopping the loss. You’re also creating an opportunity to reduce how much tax you owe on other wins you’ve made. By documenting these sales carefully, you can tell the tax folks, “Hey, I didn’t win all around this year,” which can lower your tax bill. Think of it as making your mishaps work for you, turning what seems like a setback into a strategy for your wallet. 🔄🔍💡

Long-term Vs Short-term: Timing Matters ⏳

When it comes to investing in cryptocurrencies like Bitcoin, timing can play a huge role in your tax obligations. Believe it or not, the length of time you hold onto your digital assets can significantly affect how much tax you’ll have to pay. Here’s a nifty thing to know: if you keep your crypto for more than a year before selling, any profit you make is considered a long-term gain. The cool part? These gains are taxed at a lower rate than your regular income, which means you could save a tidy sum. On the flip side, if you decide to sell your crypto within a year of buying it, any profit falls into the short-term gains category. These gains get taxed just like your regular income, often at a higher rate. So, timing your crypto sales can be a smart way to manage your taxes. Yet, it’s not just about watching the clock. Understanding the intricate dance between market trends, investment goals, and tax implications is crucial. With the ever-evolving nature of cryptocurrency regulations, it’s like playing a complex, yet rewarding game. For those seeking to navigate these waters with a bit more background knowledge, checking out bitcoin and digital identity explained can offer valuable insights into the broader implications of blockchain technology and its impact on financial systems. By playing it smart and staying informed, investors can make timing work to their advantage, opening up opportunities for tax-efficient cryptocurrency trading that balances risk with potential reward. 🚀📊

Legal Tax Shelters: Iras and Crypto 💼

Think of saving for your future while investing in crypto, like keeping your cake and eating it too. It sounds pretty sweet, right? This is where Individual Retirement Accounts (IRAs) that accommodate cryptocurrencies step into the picture. Essentially, these IRAs work just like any traditional retirement account but with a cool twist: you can include Bitcoin or other cryptocurrencies in your retirement portfolio. What makes this strategy a game-changer is how it combines the tax advantages of an IRA with the potential high returns of crypto investments. 💼🚀 Imagine this: normally, when you sell your crypto and make a profit, the taxman comes knocking for his share. However, by using a crypto-friendly IRA, these gains can grow tax-deferred or even tax-free, in the case of a Roth IRA. It means more of your money stays yours and gets to multiply over the years until it’s time to retire and enjoy the rewards. 🎉💰

| Account Type | Tax Benefit |

|---|---|

| Traditional IRA | Tax-deferred growth |

| Roth IRA | Tax-free growth |

Just remember, diving into the world of IRAs with crypto requires a bit of homework and potentially some professional guidance to navigate the rules and maximize your benefits. It’s a bit like setting out on an adventure: a bit daunting at first, but with the right map and tools, you’re set for an exciting journey. 🗺️🧭

Seeking Professional Help: When to Call in Experts 📞

Venturing into the world of cryptocurrency can sometimes feel like navigating a maze without a map. As your digital wallet grows and the complexity of transactions increases, the notion of tax may become overwhelming. This is where a guiding hand can be invaluable. There’s a point in every investor’s journey when googling answers or seeking advice from online forums is no longer enough. The tax laws surrounding cryptocurrencies are evolving, and what worked yesterday might not be applicable today. The necessity of staying compliant with the IRS while optimizing tax liabilities calls for expertise beyond the amateur level. At such a crossroads, consulting a tax professional who is well-versed in crypto can be a game-changer. They possess the tools and knowledge to navigate the intricate tax implications of your investments, ensuring you’re not only compliant but also maximizing your benefits.

Moreover, with the growing concern over bitcoin philanthropic initiatives security concerns, having an expert to rely on for the best practices in safeguarding your investments becomes crucial. The relationship between the evolving digital currency landscape and economic theories presents unique challenges and opportunities for investors. A skilled tax consultant can provide tailored advice, taking into account your specific situation and goals. They can help in demystifying the complexities of crypto taxes, from understanding the importance of detailed record-keeping to implementing strategies like loss harvesting. In essence, seeking professional guidance isn’t just about solving problems—it’s about unlocking potential gains and securing your investment’s future. 📞💡🔍