Demystifying Bitcoin: What Makes Its Price Tick? 🕵️♂️

Imagine if we could peek behind the curtains and uncover the secrets of Bitcoin’s ever-changing price. Much like a heartbeat, the price of Bitcoin reacts to a multitude of factors, creating a fascinating puzzle for us to solve. At its core, Bitcoin’s price is influenced by supply and demand, news, and global economic sentiments, acting as the pulse of the cryptocurrency world. When more people want to buy Bitcoin than sell it, the price goes up. Conversely, when more folks are selling than buying, the price takes a dip. But that’s just the tip of the iceberg.

Let’s dive a little deeper with a simple table to illustrate these influences:

| Influence | Effect on Bitcoin’s Price |

|---|---|

| Supply and Demand | 📈 Increases with more buyers, 📉 Decreases with more sellers |

| Major News | 🚀 Can cause spikes or drops depending on the nature |

| Global Economy | 🌍 Economic uncertainty can lead to increased investment in Bitcoin |

Through this lens, it’s clear that Bitcoin acts as a mirror, reflecting the sentiments and actions of its global audience. Just like the weather, predicting its next move can be complex but deeply intriguing, offering a glimpse into the interplay of technology and human behavior.

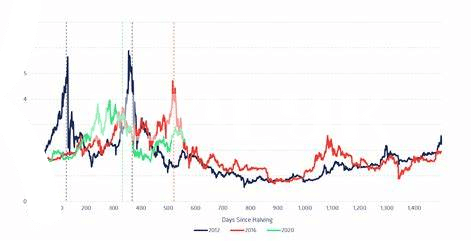

Chart Basics: Reading Bitcoin’s Mood Swings 📊

Imagine Bitcoin as a rollercoaster with its ups, downs, and sometimes, scary loops. That’s what its price feels like over time. Visualizing this ride, we use charts – these are like maps that guide us through Bitcoin’s mood swings. They show us the history of Bitcoin’s price, how it winks at highs, sulks at lows, and sometimes just hums along. By learning to read these charts, we’re trying to understand the language of Bitcoin, to foresee if it’s gearing up for a thrilling climb or bracing for a dip.

Charts can tell stories, tales of battles between those wanting to push the price up and those pulling it down. It’s like watching a game where each team has its strategy, but the scoreboard is the price chart. Spotting patterns on these charts can sometimes feel like predicting the weather by looking at clouds. Will it rain or shine? Similarly, we use this info to guess Bitcoin’s next move. Whether you’re a seasoned trader or a curious newcomer, getting to grips with chart basics can demystify the world of Bitcoin and perhaps, even make it a tad less daunting.

For those looking to delve deeper into the world of Bitcoin, understanding its intricacies like enhancing privacy on the Lightning Network is crucial. You can explore more at https://wikicrypto.news/navigating-bitcoin-paper-wallets-pros-and-cons, where advanced topics are broken down, making the complex world of cryptocurrency a little easier to navigate.

Trend Lines: Bitcoin’s Path Unraveled 🔍

Imagine drawing a line that traces Bitcoin’s journey across a chart, like a treasure map guiding us through peaks and valleys. This line, better known as a trend line, unlocks secrets to understanding where Bitcoin might head next. It’s like following the bread crumbs in a vast digital forest. When prices consistently fall, the line slopes downwards, whispering tales of caution 📉. Conversely, an upwards path signals eagerness in the market, with traders and investors joining the rally like bees to honey 📈. But here’s where the magic happens: these lines aren’t just for show. They act as invisible hands, directing Bitcoin’s journey, signaling when it might be time to hold tight or brace for a new adventure. With a bit of practice, anyone can learn to interpret these lines, turning complex market movements into understandable narratives. And just like that, the market’s chaotic dance begins to make sense, helping to illuminate the way forward.

Support and Resistance: Bitcoin’s Invisible Barriers 🚧

Imagine Bitcoin as a daring explorer venturing through a jungle of numbers and charts, facing invisible walls that shape its journey. These walls, known as support and resistance levels, are like hidden forces that can either prop Bitcoin up when it stumbles or keep it from soaring too high, too fast. Support is the floor where Bitcoin’s price finds a soft landing, preventing it from falling further. Resistance, on the other hand, is the ceiling that caps its ascent, like an invisible barrier. Navigating through these levels requires a keen eye, as they often indicate where the price might bounce back or break through, leading to new adventures.

Understanding these invisible barriers becomes crucial, especially when considering factors like bitcoin lightning network security concerns, which add another layer of complexity to Bitcoin’s price movements. As traders, grasping the concept of support and resistance helps in making better predictions and decisions. Whether Bitcoin’s price will hurdle over these barriers or take a step back depends on a myriad of factors, but one thing is sure – these levels are key to unlocking Bitcoin’s price mystery. Just like explorers rely on maps, traders use these indicators to chart a course through the volatile world of cryptocurrency, hoping to predict Bitcoin’s next big move. 🗺️💡🔑

Popular Patterns: Predicting Bitcoin’s Next Move 🔮

Imagine Bitcoin as a storybook character, going on adventures across digital landscapes. Like any good tale, it leaves behind clues in patterns that can seem like magic spells to predict its next leap or tumble. Think of “head and shoulders,” not the shampoo, but a pattern resembling a person’s silhouette hinting a price drop. Then there’s the “double bottom,” sounding like pirate treasure, signaling a rally cry for prices to climb. These patterns, seen in the scribbles and lines on charts, are like secret handshakes among traders, helping them guess where Bitcoin might travel next. It’s not about crystal balls but understanding the footprints left behind, allowing those ready to dive into the story to possibly foresee the next chapter. Here’s a quick look at how these patterns can signal different market moves:

| Pattern | Description | Possible Signal |

|---|---|---|

| Head and Shoulders | Resembles a silhouette with two smaller peaks around a larger central peak. | A potential downturn in Bitcoin’s price. |

| Double Bottom | Looks like the letter “W”. It indicates a drop, a rise, another drop, and a final rally. | An upward trajectory in Bitcoin’s price. |

By piecing together these clues, enthusiasts and investors alike can become more adept at navigating the high seas of cryptocurrency markets, making informed decisions rather than relying on mere chance.

Indicators and Oscillators: Bitcoin’s Heartbeat 💓

Imagine Bitcoin as a living, breathing thing, its pulse racing with every buy and sell. That pulse can be understood through special tools known as indicators and oscillators. These tools help us feel Bitcoin’s heartbeat, figuring out when it might take off running or when it might take a breather. For instance, imagine indicators as signposts, guiding us through Bitcoin’s energetic landscape, while oscillators are like Bitcoin’s mood swings, swinging between excitement (buying) and nervousness (selling). It’s a bit like figuring out when to join a party or take a quiet exit, all by reading the room’s vibe.

To truly grasp Bitcoin’s shifts, one must also comprehend the underlying tech, like understanding the different types of Bitcoin wallets which play a crucial role in the ecosystem. For a deeper dive into this fascinating world, check out bitcoin blockchain technology explained. It’s about seeing beyond the surface, discovering patterns and rhythms in what may seem like chaos, and making informed decisions, whether you’re just starting out or you’ve been navigating these waters for a while. 🚀💡