🌱 the Early Days of Bitcoin and Paper Wallets

Back in the early days, when Bitcoin was a new star in the digital sky, people were exploring ways to safely keep their shiny new coins. Enter paper wallets, an innovative method that felt like holding a treasure map. In this simpler time, you could quite literally print your Bitcoin ownership proof on a piece of paper. This method involved printing out your private and public keys (think of them as the secret code to access your digital treasure chest) and saying “Voila!” You just created a physical bank in your drawer. This was a game-changer because it meant that as long as you kept that piece of paper safe, your bitcoins were secure from online thieves eagerly prying into software wallets. Picture it: a world where your digital wealth could sit snugly inside your sock drawer! It was a perfect solution for early adopters who reveled in the novelty of turning virtual coins into something you could hold. But like all treasures, protecting it became the next big adventure.

| Year | Event |

|---|---|

| 2009 | Bitcoin’s Creation |

| 2011 | Introduction of Paper Wallets |

🔐 How Paper Wallets Work: a Simple Explanation

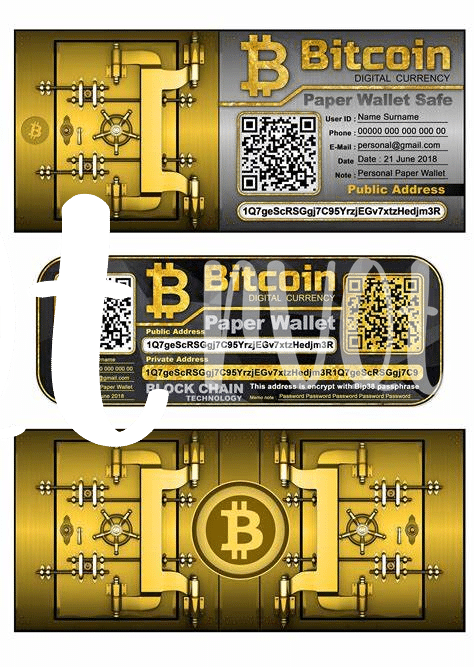

Imagine you’ve decided to keep a secret note where you jot down a special code that unlocks a treasure chest. In the world of Bitcoin, this secret note can be similar to what we call a paper wallet. A paper wallet is quite simple; it’s a physical piece of paper where your private and public keys to accessing your Bitcoin are printed. Think of your public key as the location of your treasure chest on a vast digital map, visible to anyone, but they can’t open it. Your private key, however, is the secret code that unlocks the chest. Only you should know this code. By writing these keys down on paper, you create a “backup” of your treasure chest’s lock and location that isn’t connected to the internet. This means no hacker can digitally sneak in and steal your treasure. It’s just like hiding your note in a secret drawer. Your treasure—your Bitcoin—is safe as long as you keep this piece of paper secure and private. To ensure your note’s safekeeping, learning more about enhancing security measures is crucial, just like in the case of maximizing security for your Bitcoin interest account, as detailed at https://wikicrypto.news/maximizing-security-for-your-bitcoin-interest-account.

🛡️ the Security Benefits of Using Paper Wallets

Imagine having a secret code that only you know, safely written down on a piece of paper. That’s the beauty of using paper to store your Bitcoin information. It’s like an old-school, ultra-secure treasure map, away from the prying eyes of internet pirates. This method is particularly comforting because it’s immune to cyber-attacks. No hacker can remotely access your precious Bitcoin if it’s not stored on a computer but rather on a simple piece of paper in your personal safe or a secret hiding spot. It’s direct and straightforward, with your Bitcoin literally in your hands, untouchable by the digital thieves lurking in the shadows of the internet.

Moreover, this approach puts the power of privacy back into your hands. In a world where digital footprints are constantly being tracked and privacy is becoming scarce, keeping your Bitcoin on paper means you’re not leaving a trail of breadcrumbs for someone to follow. You don’t have to worry about a software bug or a failing hard drive wiping out your digital treasure. It’s a peace of mind that, in today’s digital age, is becoming more and more valuable. So, while it may seem a bit old-fashioned, the security of a paper wallet lies in its simplicity and physicality, offering a fortress for your digital gold.

🚨 Common Risks and How to Avoid Them

While paper wallets provide a unique form of keeping your digital coins safe, carrying their own charm, they are not without their shadows that lurk in the form of risks. Imagine, for a moment, that you’ve carefully locked your digital treasure on a piece of paper. Sounds secure, right? Yet, water damage, fire, or simply losing that precious paper can make your digital wealth vanish into thin air. Then there’s the threat of someone sneakily copying your private key when you’re not looking, rendering the concept of ‘security’ a bit ironic. To shield against these risks, it’s crucial to laminate your paper wallet, keeping water and wear away. Storing it in a fireproof safe adds another layer of protection. Moreover, for those wary of prying eyes, splitting the key across several locations can be a clever way of safeguarding your assets. As we march forward into an era of advanced threats, understanding bitcoin lending platforms security concerns becomes vital. This knowledge helps arm against not just physical threats but sophisticated digital ones too, ensuring your treasure remains firmly in your hands.

🔄 Moving from Paper to Digital: a Trend Analysis

In the world of Bitcoin, we’ve seen things evolve pretty fast, and nowhere is this clearer than in how we keep our Bitcoins safe. Picture this: a while back, keeping your Bitcoin safe meant writing down your keys on a piece of paper, known as a paper wallet. It was like having a secret code that only you knew, tucked away in a drawer or a safe. Super simple, right? But then, as more people started using Bitcoin, smarter and more convenient ways of storing these digital coins came into play. Enter digital wallets – think of them as upgraded, high-tech versions of your old piggy bank, but for Bitcoin. They’re apps or software where you can safely keep your Bitcoin, accessible with just a few taps on your phone or clicks on your computer.

Now, switching from paper to digital wasn’t just a fad. It marked a massive shift in how we think about and handle digital currency security. But why did people start favoring digital over paper? Check out this quick breakdown:

| Feature | Paper Wallet | Digital Wallet |

|---|---|---|

| Accessibility | You have to physically manage and store it. | Access your coins anywhere, anytime. |

| Security | High if stored correctly but can be lost or damaged. | Strong security measures but requires trust in technology. |

| Convenience | Not so handy for daily use. | Easy transactions and tracking. |

This shift to digital doesn’t mean paper wallets don’t have their place anymore. For some, they’re like a trusty old lockbox, especially for those who prefer the tangible assurance of holding their investment in their hands. But as we move further into the digital age, the trend is clear: digital wallets are becoming the go-to, offering a blend of convenience, accessibility, and security that’s hard to beat. The evolution from paper to digital reflects our broader move towards a more connected and digital-first world, where ease of use and security go hand in hand.

🤔 Is the Paper Wallet Era Over?

In the world of Bitcoin, the transition from paper to digital wallets has sparked much debate. Initially hailed for their simplicity and security, paper wallets have gradually seen a decline in popularity. This shift is primarily driven by the evolution of digital wallets that offer enhanced security features, ease of use, and seamless transactions. However, it’s important to note that paper wallets haven’t vanished entirely. They still hold value for those seeking a physical backup or less tech-savvy users. The question now isn’t so much about their extinction, but rather how they fit into the broader ecosystem of Bitcoin security. As we navigate this digital terrain, understanding the security concerns tied to both forms of wallets becomes crucial. For insights into these concerns, particularly in the realm of Bitcoin interest accounts and payment channels, bitcoin and payment channels security concerns offer comprehensive analysis. Nonetheless, with technological advancements, the community continues to weigh the pros and cons, evidencing a trend towards digital solutions while acknowledging the foundational role paper wallets played in the cryptocurrency saga.